Unique Project P&l How To Figure Out Retained Earnings On A Balance Sheet

If youre looking for your retained earnings balance you can find it under the shareholders equity section of your balance sheet.

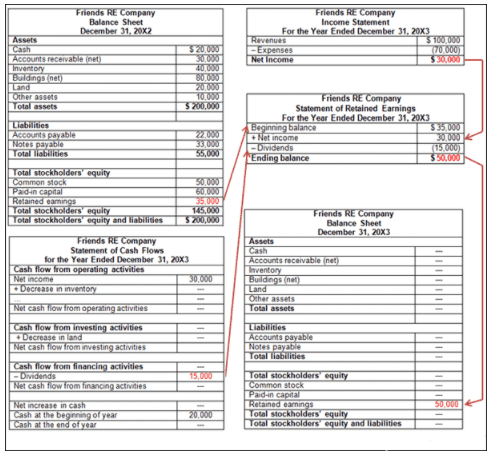

Project p&l how to figure out retained earnings on a balance sheet. Current Retained Earnings ProfitLoss Dividends Retained Earnings. They are the last item to be calculated on a pro forma balance sheet. Beginning retained earnings comes from the balance of last years balance sheet of 400000.

It is the sum of profits and losses at the end of the accounting period after deducting the amount of dividends. Retained Earnings Assets - Liabilities Tips on how to calculate retained earnings on balance sheet The retained earnings formula adds net profit to the previous year retained earnings then subtracts net dividends paid to the shareholders from the current term. To forecast your businesss equity you can use this formula.

The retained earnings formula is fairly straightforward. My suggestion dont waste another minute trying to figure out how to balance your balance sheet. Projected Equity Equity Last Year Net Income - Dividends Change in Equity.

Retained earnings on the balance sheet can be calculated with the formula below. Retained earnings can be tricky at times. If your balance sheet isnt balanced then you want to look in particular areas for inconsistenciesSome of these areas include retained earnings loan amortization issues paid in capital and inventory changes.

Pro forma retained earnings can be tricky to determine. Retained Earnings also called accumulated earnings retained capital or earned surplus appears in the shareholder equity section of the statement of financial position more commonly known as Balance Sheet. Wire the balance sheet so that it always balances by making Retained Earnings equal to Total Assets less Total Liabilities less all other equity accounts.

Net Income comes from the budgeted income statement for the year of. Next on your balance sheet forecast is your projected equity position. Plug the balance sheet ie.