Glory Detailed Income Statement Companies House Micro Entity Balance Sheet Example

In this case the company will use 912 x 632000 to determine whether the entity qualifies as a micro-entity.

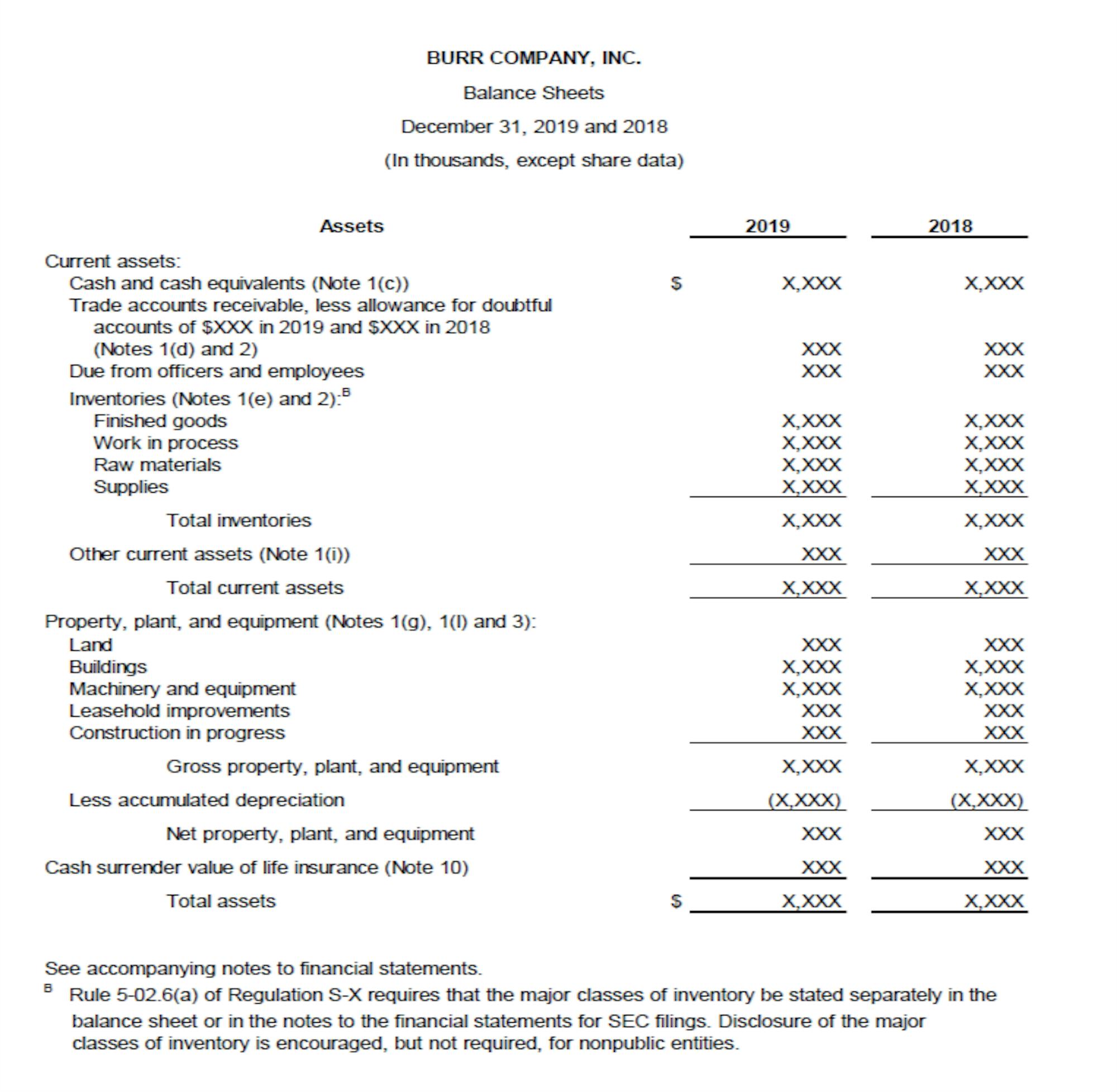

Detailed income statement companies house micro entity balance sheet example. Signature of a director and their name printed on the balance sheet. Approval the financial statements of Demo Micro-entity FRS 105 Limited for the year ended 31 December 2016 which comprise the income statement and statement of financial position from the companys accounting records and from information and explanations you have given me. 12460 held in the bank at the end of the year.

Statements on the balance sheet All four statements must be accepted before the accounts are submitted to Companies House. Prepayments and accrued income. Indeed as mentioned above disclosures over and above those.

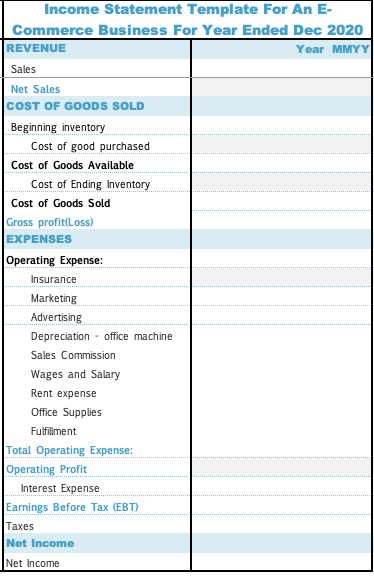

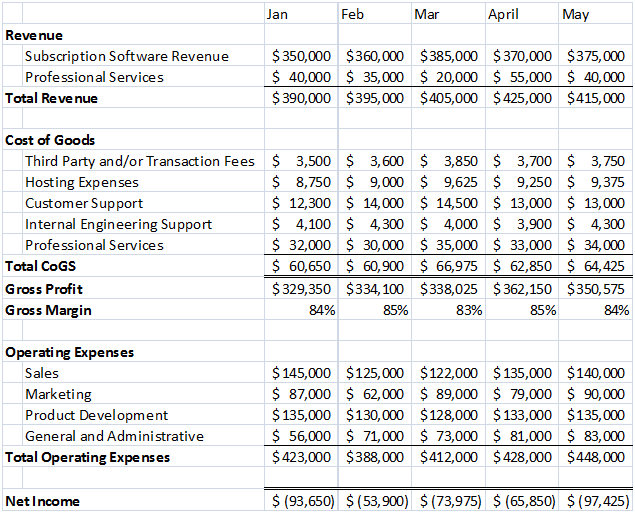

Your income statement and balance sheet are two of the most important documents you will create as a business owner. Detailed Income Statement Template - Free Excel Download. We have been able to file dormant accounts up until now but in 2017 received 6000 for extending a.

They may prepare micro-entity accounts if theyre within the threshold they may prepare abridged accounts or they may prepare a full accounts. This Detailed Income Statement Template was created for a Landscaping Irrigation Lighting Company but can easily be adapted to a variety of businesses. Every time a company records a sale or an expense for bookkeeping purposes both the balance sheet and the income statement are.

We tried to get some great references about rental property income statement and balance sheet sample for you. Statement on the balance sheet above the directors signature that the accounts have been prepared in accordance with the micro-entity provisions. Rental property income statement and balance sheet sample.

On the other hand while an audited micro-entity that chooses not to file its profit and loss account is similarly not required to file the audit report at Companies House unlike an entity in the small companies regime the micro-entity is not required to include a note to the balance sheet regarding the audit. 316000 or less on its balance sheet. Amounts falling due with one year.