Matchless Calculate Income Tax Paid Cash Flow Statement

Module 2 Learning Task Statement of cash flows.

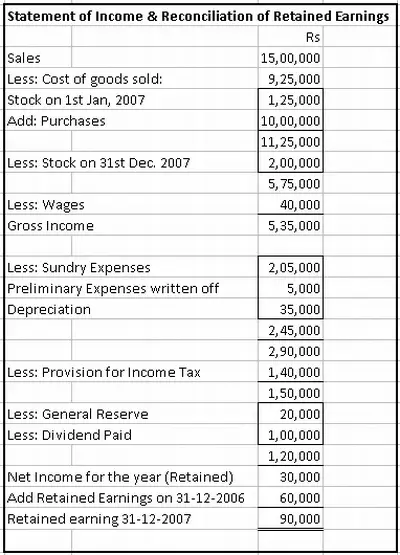

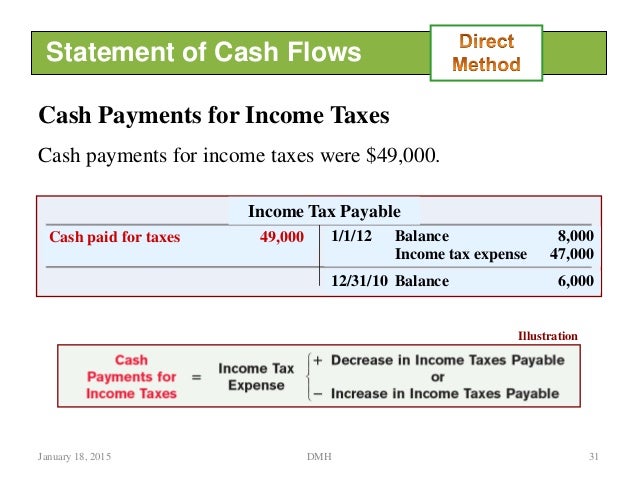

Calculate income tax paid cash flow statement. Income tax paid section. Income Tax Paid. The Direct Method or the Indirect Method only apply to the Cash Flow from Operations and do not effect the Cash Flow from Investing or Cash Flow from Financing sections of the Cash Flow Statement.

Opening Income tax liability Income tax expense incurred in 2018 Closing income tax liability. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. The standard-setting bodies encourage the use of the direct method but it is rarely used for the excellent reason that the information in it is difficult to assemble.

This is referred to as the indirect method. Proposed presentation tax allocation. The current portion of income tax expense for XYZ Limited can be calculated as follows.

Lets take a look at an example of that formula in the real world. Using the direct method the 92000 total tax payment is allocated 80000 to operating activities and 12000 to investing activities. By allocating income taxes in the cash flow statement NCFO becomes 120000 and NCFI becomes 62000.

A month a quarter or year which is arrived at by. Income taxes paid The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. There are two ways to calculate the Cash Flow from Operations which are the Direct Method and the Indirect Method.

The cash flow direct method formula is as follows. It represents the net cash flow cash generated less cash spent of an entity during a specific period ie. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how money moved in and out of the business.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)