Simple Common Size Statement Format

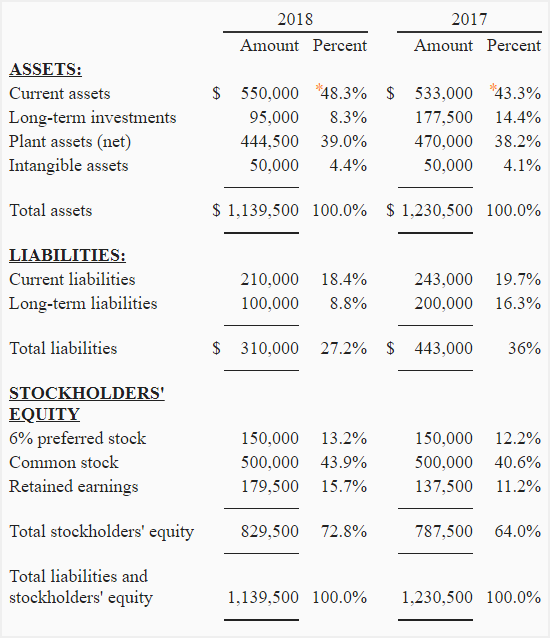

It evaluates financial statements by expressing each line item as a percentage of the base amount for that period.

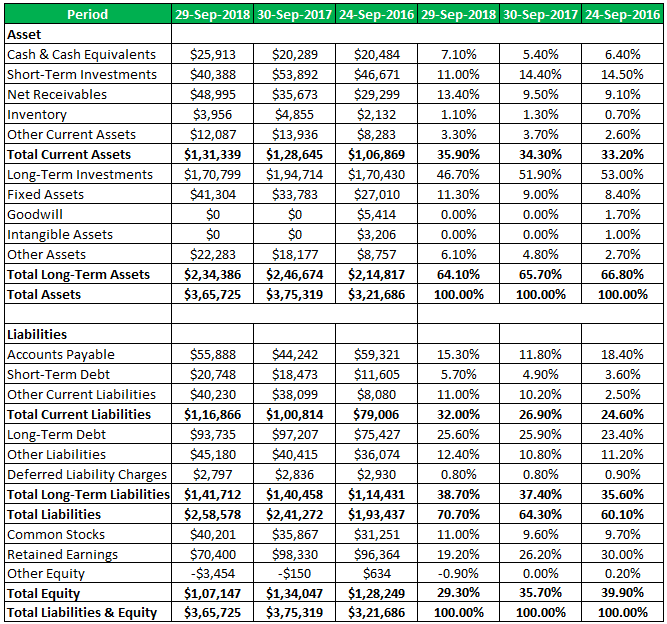

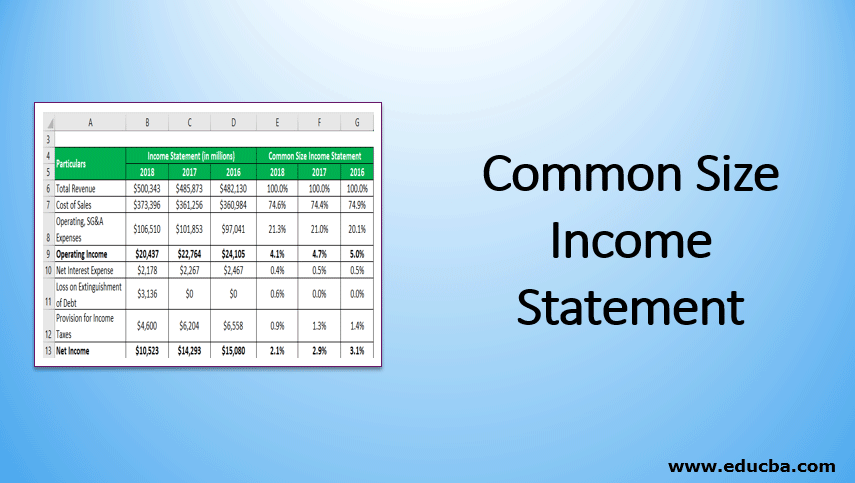

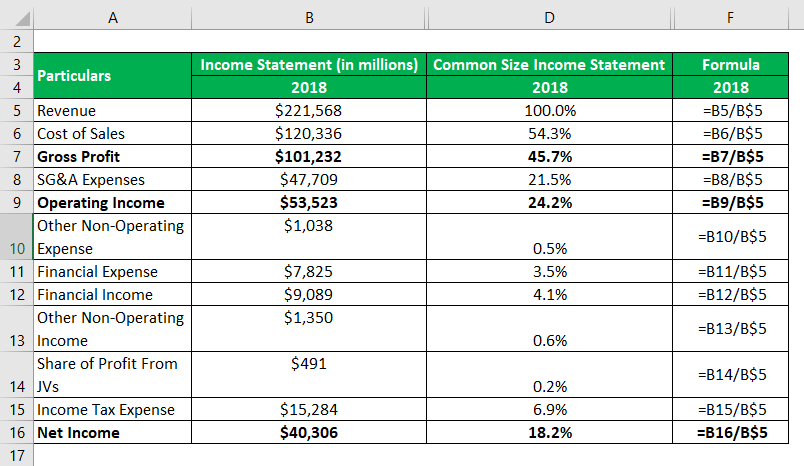

Common size statement format. Operating income dropped significantly in 2015. The below table provides a brief illustration. Common size analysis also referred as vertical analysis is a tool that financial managers use to analyse financial statements.

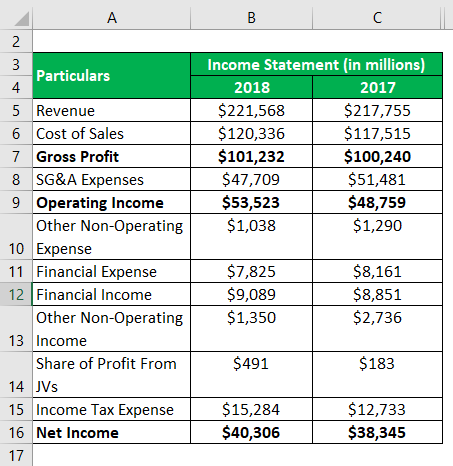

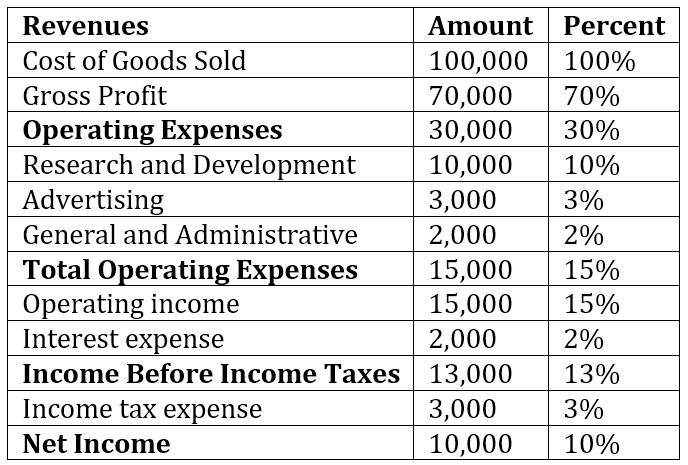

COGS divided by 100000 is 50 operating profit divided by. There are two approaches to the common-size analysis of a cash flow statement. The base item in the income statement is usually the total sales or total revenues.

Effective Tax rates increased to 44 in 2015 as compared to an average of 32-33 in earlier years. Simply insert columns set up some division and let excel work its magic. Common size analysis is used to calculate net profit margin as well as gross and operating margins.

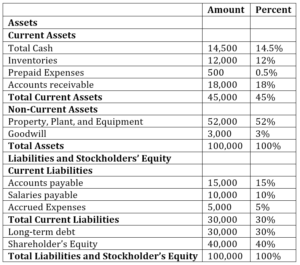

Common Size Analysis Template This common size analysis template allows you to compare the financial performance of companies in different sizes on the same scale. A common size balance sheet displays the numeric and relative values of all presented asset liability and equity line items. Revenue divided by 100000 is 100.

COMMON-SIZE INCOME STATEMENT OR COMMON-SIZE STATEMENT OF PROFIT AND LOSS Common-size Income Statement is the vertical analysis of Income Statement in which value of Revenue from Operations is taken as 100 and values of other items of Statement of Profit and Loss are expressed as percentage of Revenue from Operations. Download the Free Template. For example gross margin is calculated by dividing gross profit by sales.

There are two reasons to use common-size analysis. SGA expense had decreased from 361 in 2007 to 341 in 2005. How to Common Size an Income Statement To common size an income statement analysts divide each line item eg.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)