Matchless Coca Cola Ratio Analysis

Net Profit Ratio.

Coca cola ratio analysis. Coca-Cola Cos quick ratio deteriorated from 2018 to 2019 but then improved from 2019 to 2020 exceeding 2018 level. To obtain help in the analysis a time series analysis is carried out in which most recent ratios are compared with previous years ratios. Coca-Cola financial Ratio analysis Students name.

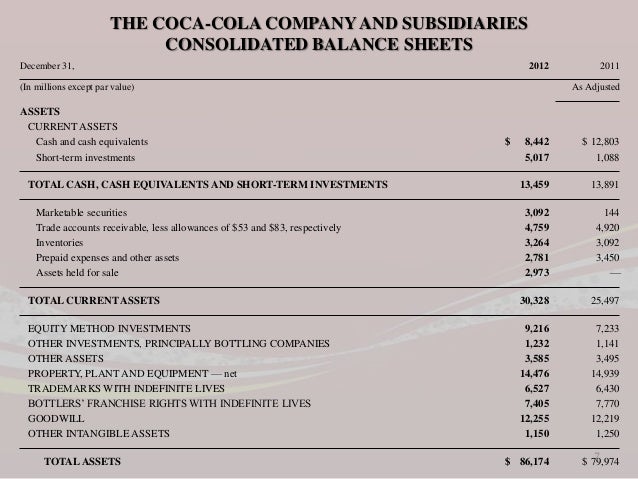

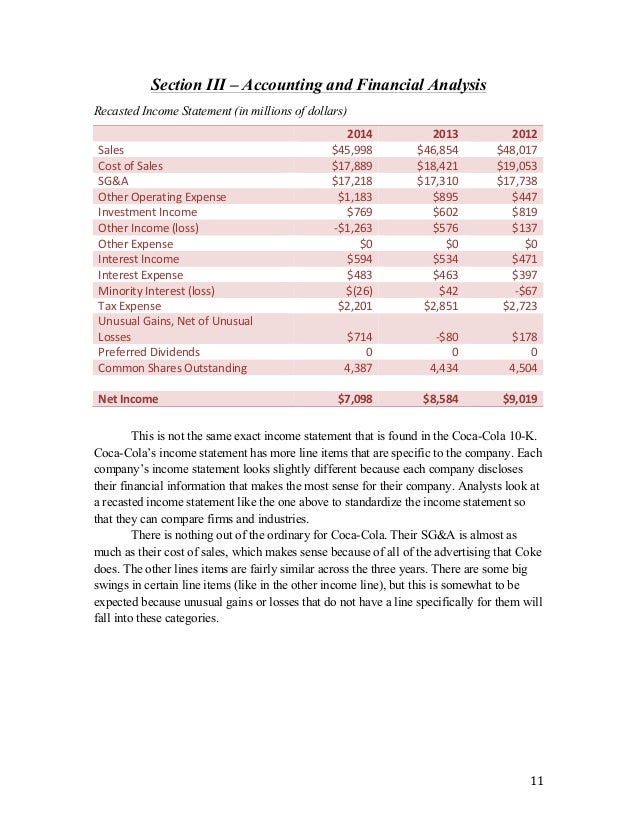

Ratio Analysis Of Coca-Cola. CurrentQuick ration Receivable Current Liability Cash Marketable Securities. Looking into Coca Cola Co growth rates revenue grew by 487 in I.

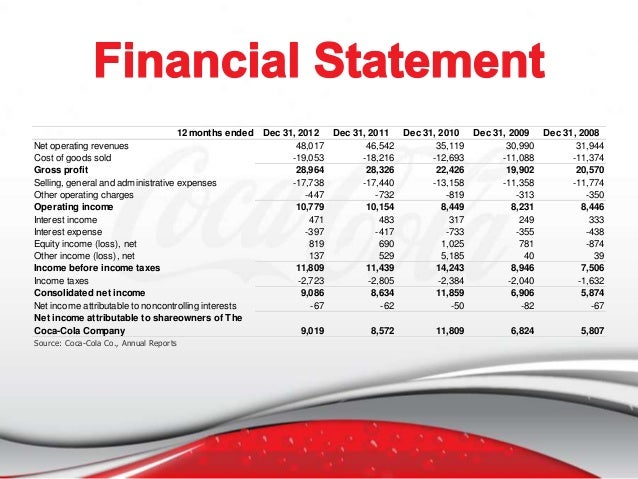

2293 Nonalcoholic Beverages industry recorded growth of revenues by 81 Coca Cola Cos net profit deacreased by -1932 in. In general the basic concept behind it is that the higher the liquidity ratio the bigger the safer a company is in paying its bills. The best technique to accomplish this is the analysis of financial ratios.

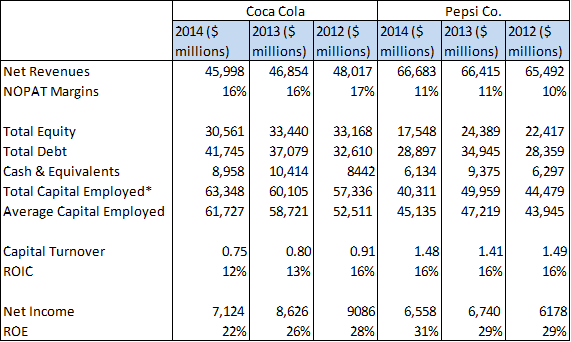

Coca Colas return on assets for year 2002 is 12 and 16 in 2003 as illustrated in Figure 1. In the next year the organizations current ratio would slightly increase to 134. The drop in the ratio.

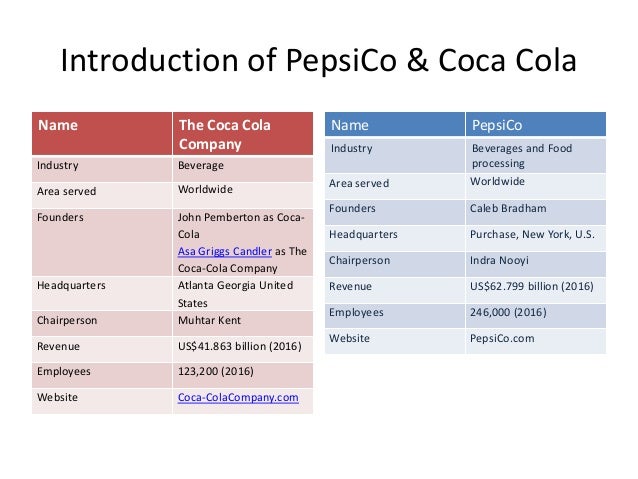

His idea was centered on making a great and refreshing drink to be sold at different locations. The company makes more than 500 nonalcoholic beverages brands which are congregated into diverse categories such as sparkling soft beverages H2O and sports beverages plat based beverages and energy drinks. Ratio Analysis Of Coca-Cola.

Coca Cola Debt ratio increased by 5 from 73 in 2016 to 78 in 2017 due to increase in. Quarter 2021 from the same quarter a year ago. -1 between the first and the second quartile.