Out Of This World Cash Flow From Financing Can Be Generated By

In actively growing and expanding companies positive cash flow is required to maintain business growth.

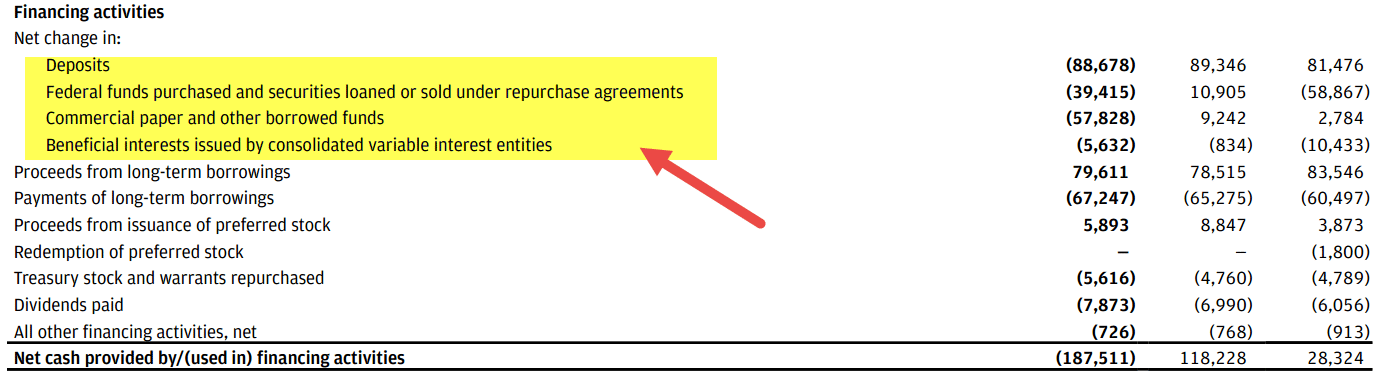

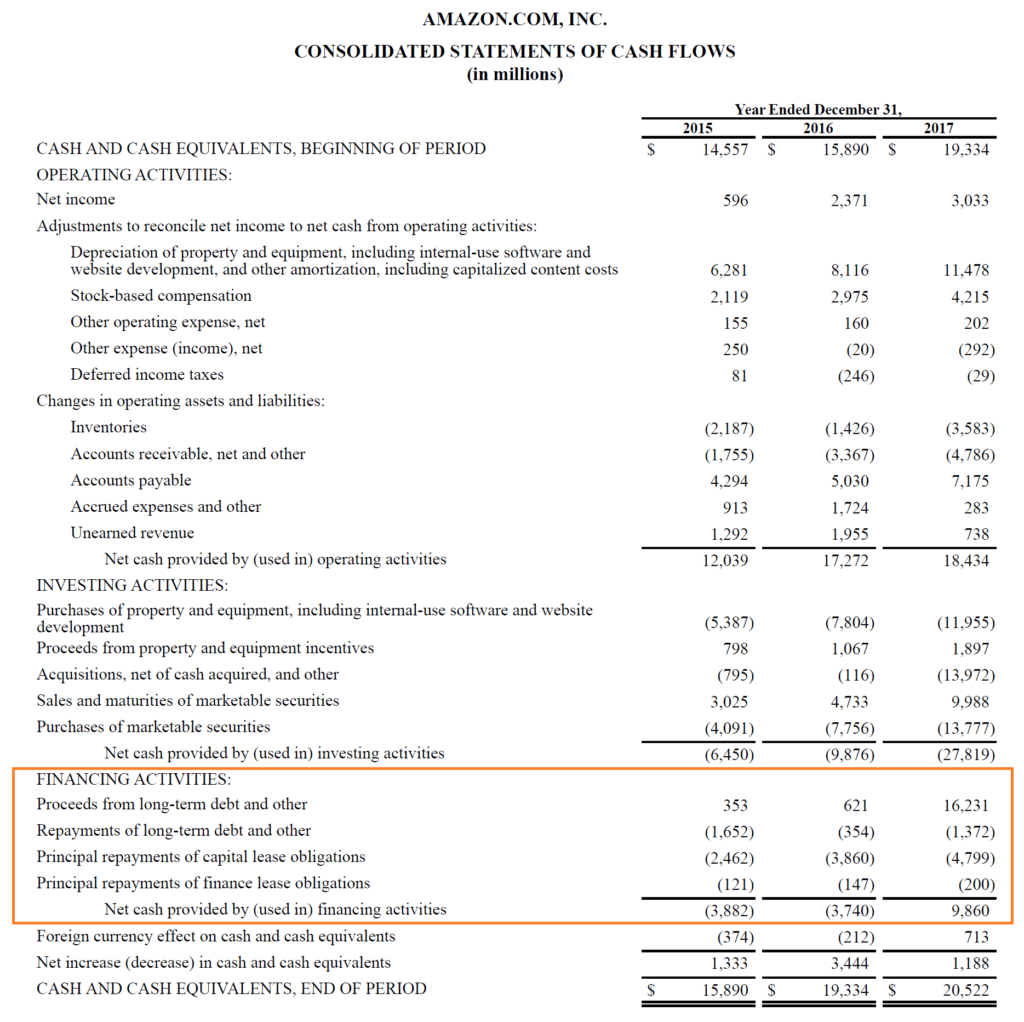

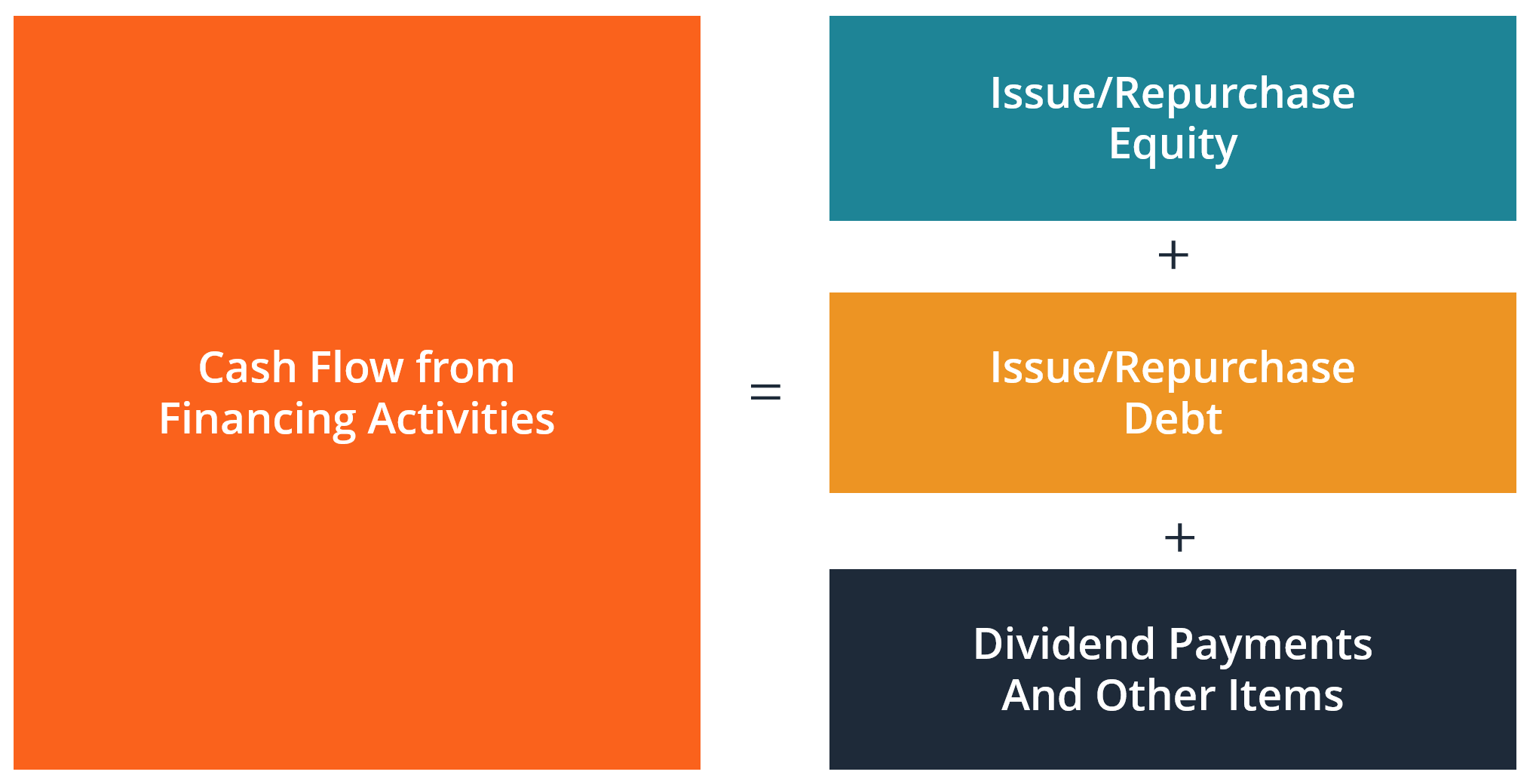

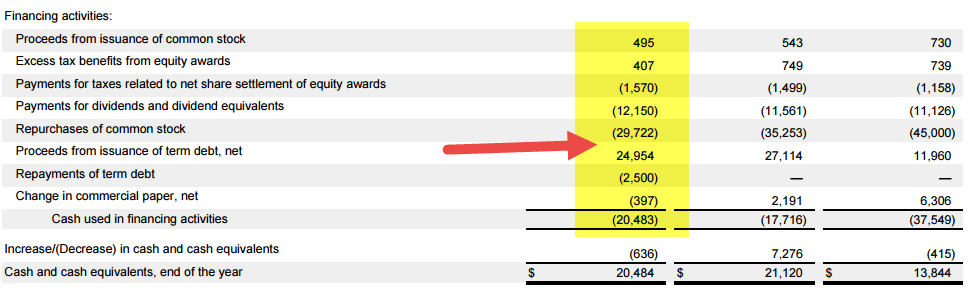

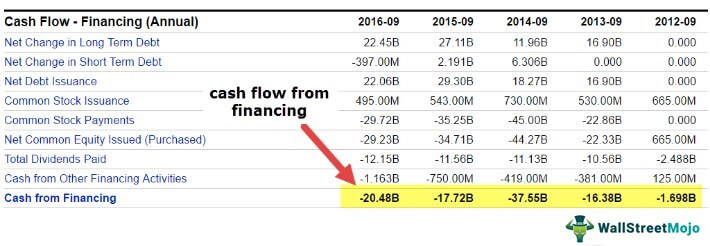

Cash flow from financing can be generated by. The phase in the product life cycle when I company is purchasing fixed assets and beginning to produce. Cash Flow from Financing is money moving in and out of the business due to financing such as loans or lines of credit. Cash flow from financing activities is a section of a companys cash flow statement which shows the net flows of cash that are used to fund the company.

Tap card to see definition. Click again to see term. Tap again to see term.

Cash flow obtained from equity financing as well as debt including company loans. This refers to the net cash generated from a companys normal business operations. Cash flow generated by delivering goods and services including revenue and expenses.

Each of these categories contains different accounts. And cash outflows that are incurred while repaying such funds such as redemption of securities payment of. In later-stage companies it is normal to see positive operating cash flows neutral investing cash flows and negative financing cash flows.

Financing activities include transactions. Cash flow is the money that flows in and out of the firm from operations financing and investing activities. Think of them as envelopes into which your cash is organized.

In other words financing cash flow includes obtaining or repaying capital be it equity or long term debt. Cash used in operations will exceed cash generated by operations in the inreoduxtory phase. Cash flow can be further broken into three major categories.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)