Glory Companies With Great Balance Sheets

Out of the two Chevron offers a larger dividend.

Companies with great balance sheets. Instead I think it be a good idea we all share stocks of companies with GREAT balance sheets who CAN survive a possible depression. Nicholas Johnson analyst. Have done a good job conserving their cash.

Exxon Mobil is one of the largest oil and gas companies in the world and has one of the best balance sheets in the business. Chevron like XOM is an oil company with a particularly strong balance sheet. ALU remains profitable and financially very strong with a robust balance sheet and a current cash balance of more than US77 million according to the Company announcement dated 12 th May 2020.

Hess is a good example. No debt and are still considered a. The Equity market clearly overreacts to companies with bad balance sheets which provides opportunity to nab good businesses that can support higher leverage Patience is rewarded.

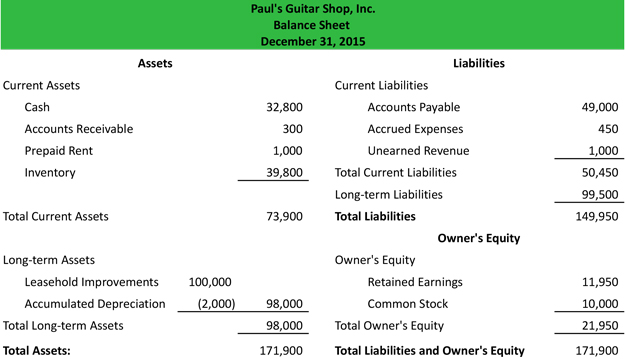

Current Ratio Current Assets Current Liabilities. With a market capitalization of approximately 350 billion the company is absolutely massive. Companies are also issuing equity to ensure they have strong balance sheets.

I think how people measure bad balance sheets is too simplistic. Oracles solid earnings growth supports the shares good near-term prospects says Charles Clark tech analyst at Value Line. 3 Dividend Stocks With Rock-Solid Balance Sheets Johnson Johnson is on this list of attractive investments.

A liquidity ratio that measures a companys ability to pay short-term and long-term debts. Several companies around the world have strong balance sheets but only a select few make this list. Anshul Saigal Portfolio Manager Head PMS Kotak Mahindra Asset Management Company spoke with ET Now earlier today about the investment process of his Sp.