Divine Example Of Going Concern Note In Financial Statements

Neither IAS 1 nor IAS 10 provide any details however of any alternative basis and how it might differ from the going concern.

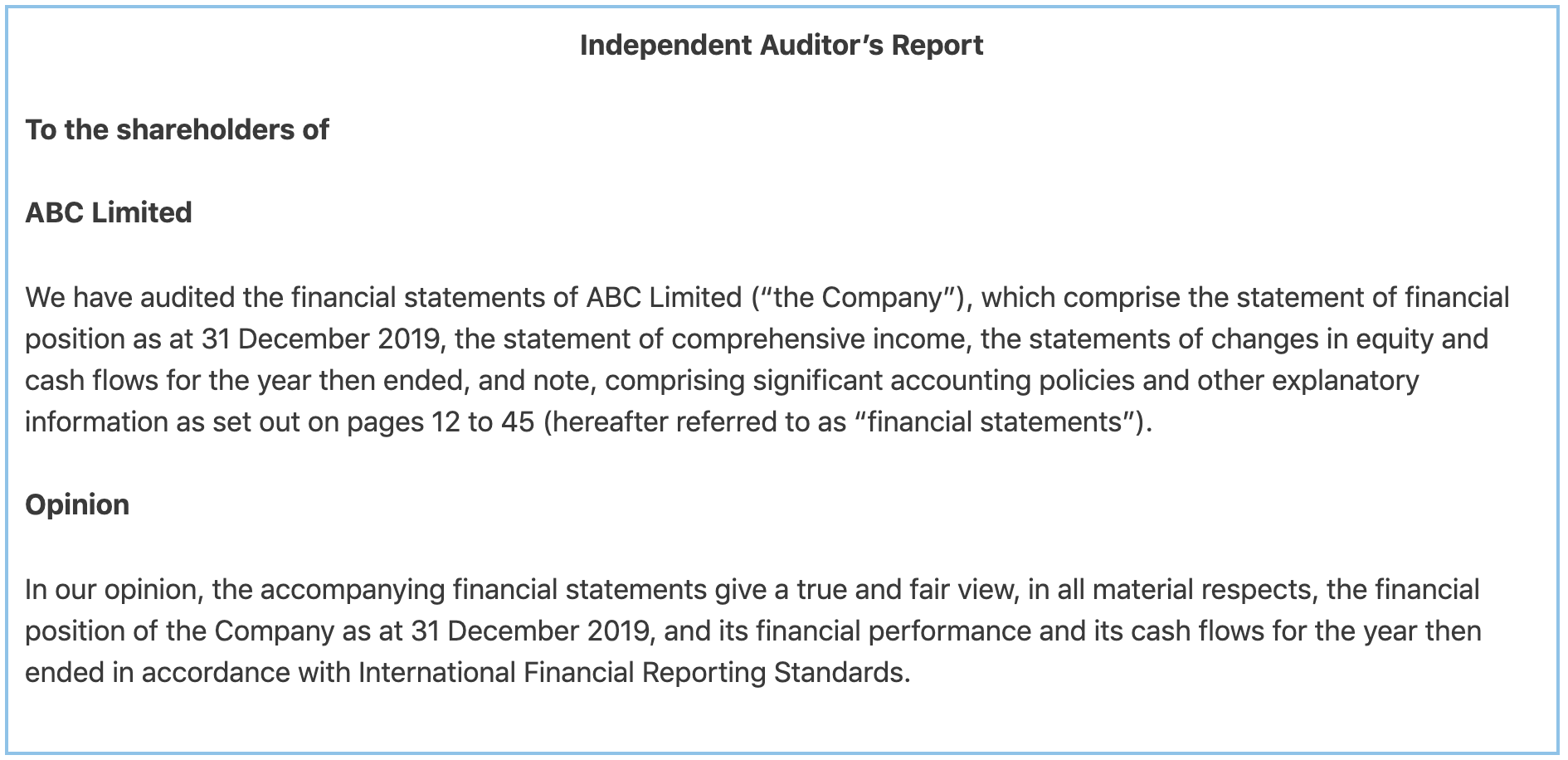

Example of going concern note in financial statements. Report on the Financial Statements We have audited the accompanying financial statements of ABC Pte. A company is a going concern if no evidence is available to believe that it will or will have to cease its operations in foreseeable future. I plan to put the following in the accounting policy.

The Company which comprise the statement of financial position of the Company as at 31 December 2014 the statement of profit or loss and other comprehensive income statement of changes in equity and statement of cash. Under IFRS financial statements are prepared on a going concern basis unless management either intends to liquidate the entity or to cease trading operations or has no realistic alternative but to do so paragraph 25 of IAS 1 Presentation of Financial Statements. IAS 12526 Insights 128010.

I have a client or a number at the moment who have made losses and have net liabilities in the balance sheets. Example 1 Going concern - Loss of major customer Going concern. Example scenario 1 - Material uncertainty about the entitys ability to continue as a going concern PwC 14.

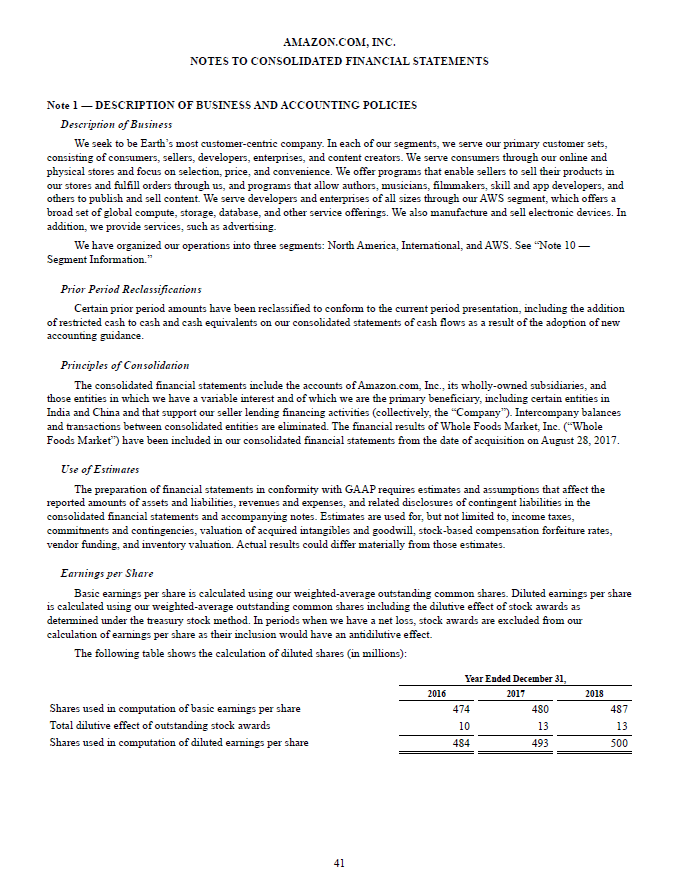

Notes to financial statements 44 Appendices to illustrative financial statements Appendix A Guidance on financial statements disclosures. One disclosure example is These financial statements are prepared on a going concern basis because the holding company has undertaken to provide continuing financialsupport so that the Company is able to pay its debts as and when they fall due. These accounts have been prepared on the going concern basis on the understanding that the directors and shareholders will continue to.

The example wording in this Guide has been adapted from the company examples in the FRCs. Going concern basis of accounting. The examples of the disclosure are consistent in each standard and will usually be included in the accounting policies.

Auditors report on the financial statements. So if you apply the break-up basis then the objective of financial statements is not to assess the financial performance of. It is not defined in IFRS thats true but it is defined in the legislation of some jurisdictions.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)