Top Notch Gearing Ratio Analysis

Market value ratios.

Gearing ratio analysis. Capital gearing ratio Posted in. But if its main competitor shows a 70 gearing ratio against an industry average of 80 the company with a 60 ratio is by comparison performing optimally. For example a company with a gearing ratio of 60 may be perceived as high risk.

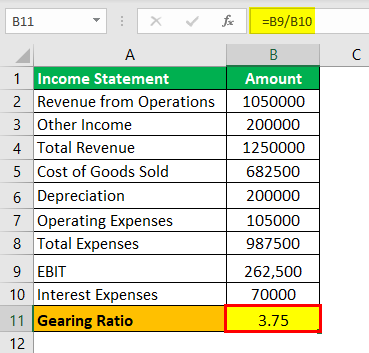

Gearing focuses on the capital structure of the business that means the proportion of finance that is provided by debt relative to the finance provided by equity or shareholders. Determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. Comparing gearing ratios of similar companies in the same industry provides more meaningful data.

The gearing ratio measures the proportion of a companys borrowed funds to its equity. However it focuses on the long-term financial stability of a business. Gearing is a measurement of a.

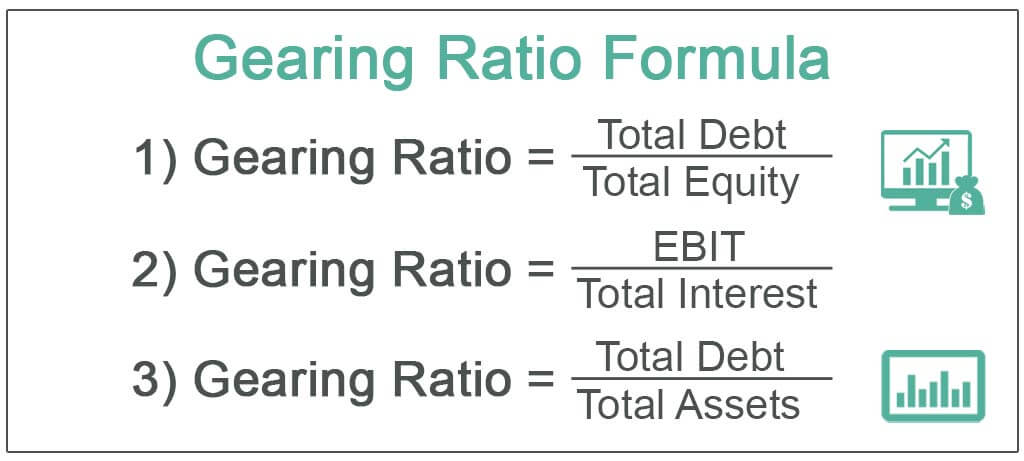

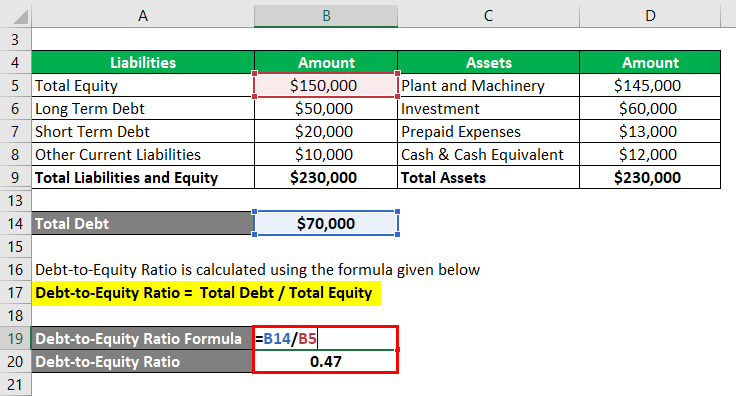

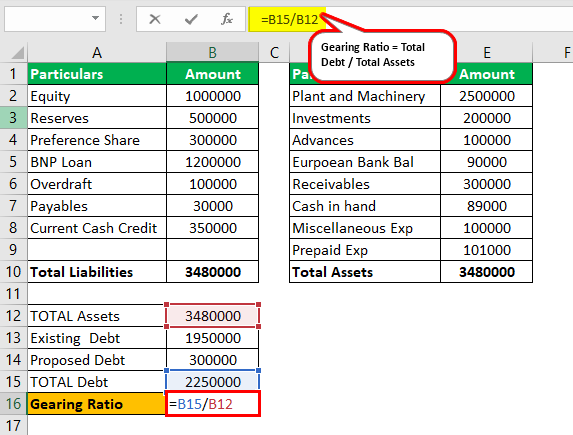

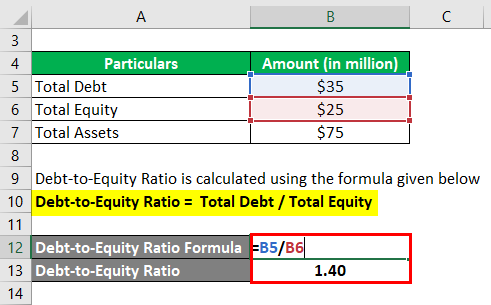

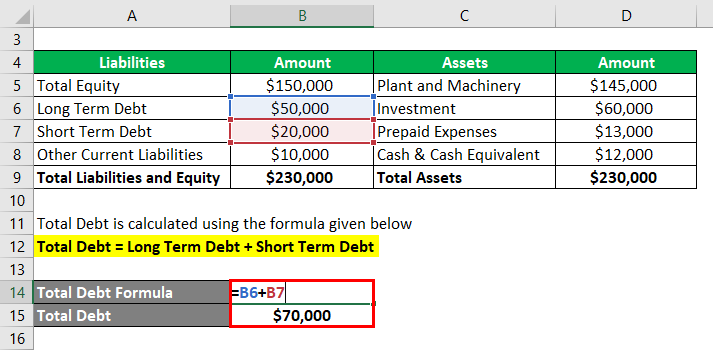

There are a number of gearing ratios including the debt equity ratio and the debt ratio. Gearing is a measurement of the entitys financial leverage. Capital gearing ratio is the ratio between total equity and total debt.

Investors lenders and analysts sometimes use these types of ratios to assess how a company structures itself. As stated by Investopedia the higher degree of a companys leverage indicates the company to be more risky. So the first formula for the gearing ratio is.

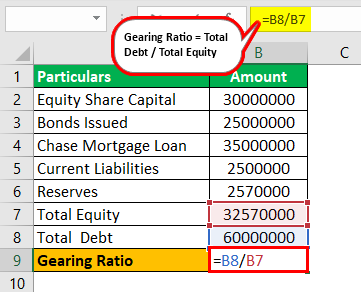

The Capital Gearing Ratio of. A business needs to be performing well in areas of. In doing industry analysis most business use benchmark companies.