Breathtaking Drafting Financial Statements

Finally prepare a cover letter that explains key points in the financial statements.

Drafting financial statements. This document outlines risks and controls common to the Drafting and Reporting Financial Statements process in a risk control matrix RCM format. Financial statements are not filed timely. The Draft Audited Financial Statements need not include footnote disclosure or any opinion of PWC or any other audit or accounting firm.

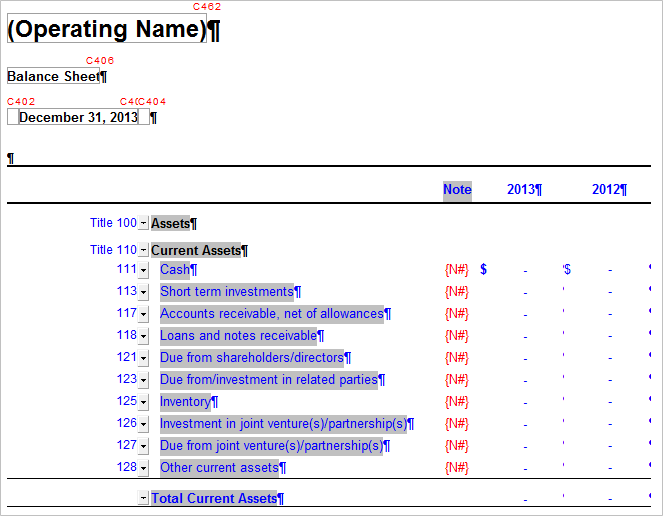

The Stockholders will cause the Draft Audited Financial Statements to be delivered in audited form accompanied by the reports thereon of the Companys accountants by December 27 1996. Income statements balance sheets cash flow statements and key ratios. The videos in this learning journey are very useful to firms who normally use CaseWare Working Papers for preparing financial statements.

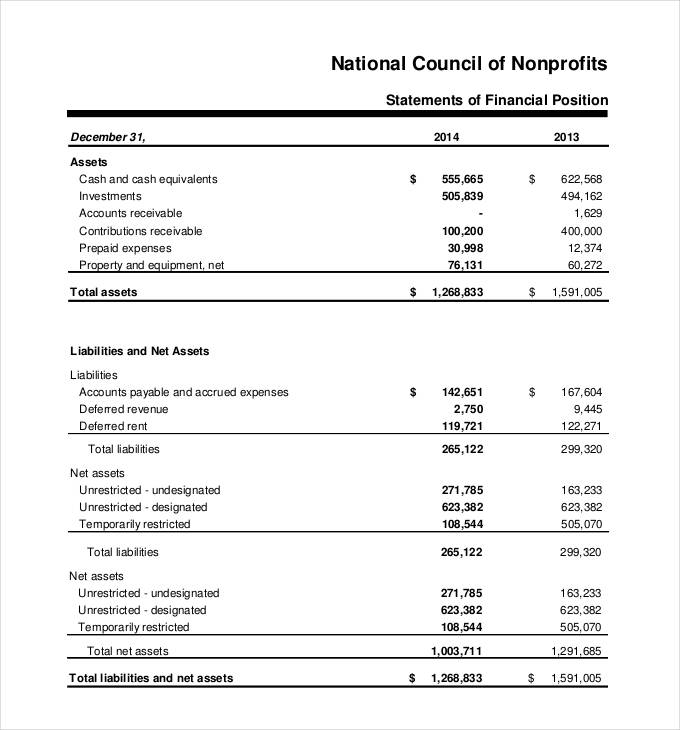

Draft financial statements FSP FA5 Draft financial statements 1 Overview This unit is about drafting the financial statements of incorporated organisations following the preparation of an initial trial balance. Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Draft Financial Statements means the draft audited financial statements of Holdings and its Subsidiaries dated as of March 15 2007 for Fiscal Year 2006 consisting of balance sheets and the related consolidated statements of income stockholders equity and cash flows for such Fiscal Year.

I a statement of comprehensive income for the year ended 31 May 2011. Then assemble this information into packets and. I All inter-company balances should be eliminated.

You can use your own accounts structure and just link your accounts to our reporting classes to. Financial statements are not complete. Ad See detailed company financials including revenue and EBITDA estimates and statements.

01 Financial Statements - Company Template. Use this annual financial statements template to prepare comprehensive company financials in Excel based on International Financial Reporting Standards for small medium enterprises IFRS for SMEs. Financial statement not correct due to changes in regulations and accounting rules.