Formidable Earning Assets Bank Balance Sheet

Click to see full answer.

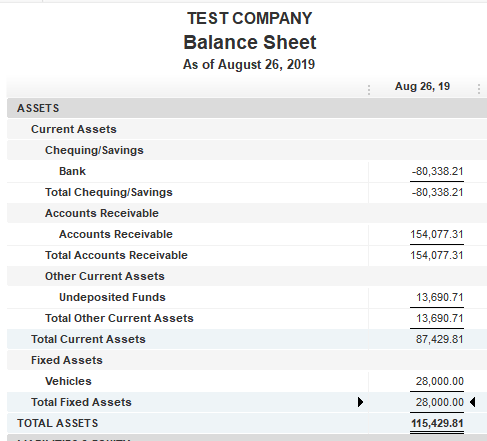

Earning assets bank balance sheet. Cash Due from Banks. Earning assets include stocks bonds income from rental property certificates of deposit CDs and other interest or dividend earning accounts or instruments. Use the balance sheets from the current year and previous year to find the average earnings assets and the average total assets.

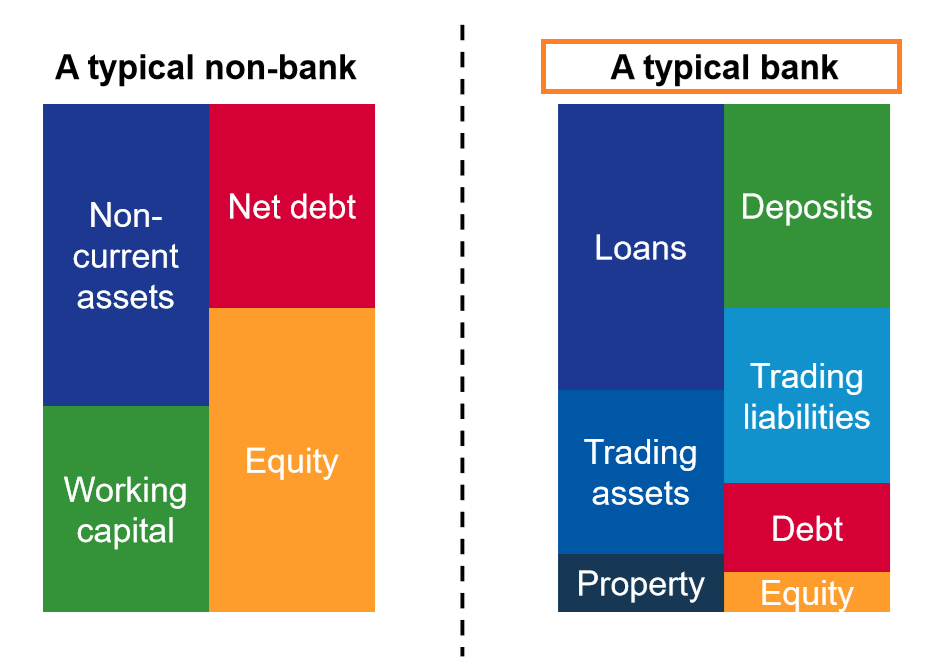

They can provide a steady income. A balance sheet aka statement of condition statement of financial position is a financial report that shows the value of a companys assets liabilities and owners equity on a specific date usually at the end of an accounting period such as a quarter or a year. The balance sheet of the bank is different from the balance sheet of the company and it is prepared only by the banks according to the mandate by the Banks Regulatory Authorities in order to reflect the tradeoff between the profit of the bank and its risk and its financial health.

Assets Liabilities and Bank Capital. Instead the corporation likely used the cash to acquire additional assets in. Bank Balance Sheet Other Earning Assets Relate Posts.

Bank Balance Sheet Other Earning Assets. Deutsche Bank AG Annual balance sheet by MarketWatch. View all DB assets cash debt liabilities shareholder equity and investments.

Like any other company a banks balance sheet consists of three parts. This is also called as the book value of a bank. Are Retained Earnings an Asset.

Their main function is to attract funds from savers and lend them to those applying for a credit or loan. Other Earning Assets Total. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets loans and their cost of funds customer deposits.