Casual Historical Financial Ratios

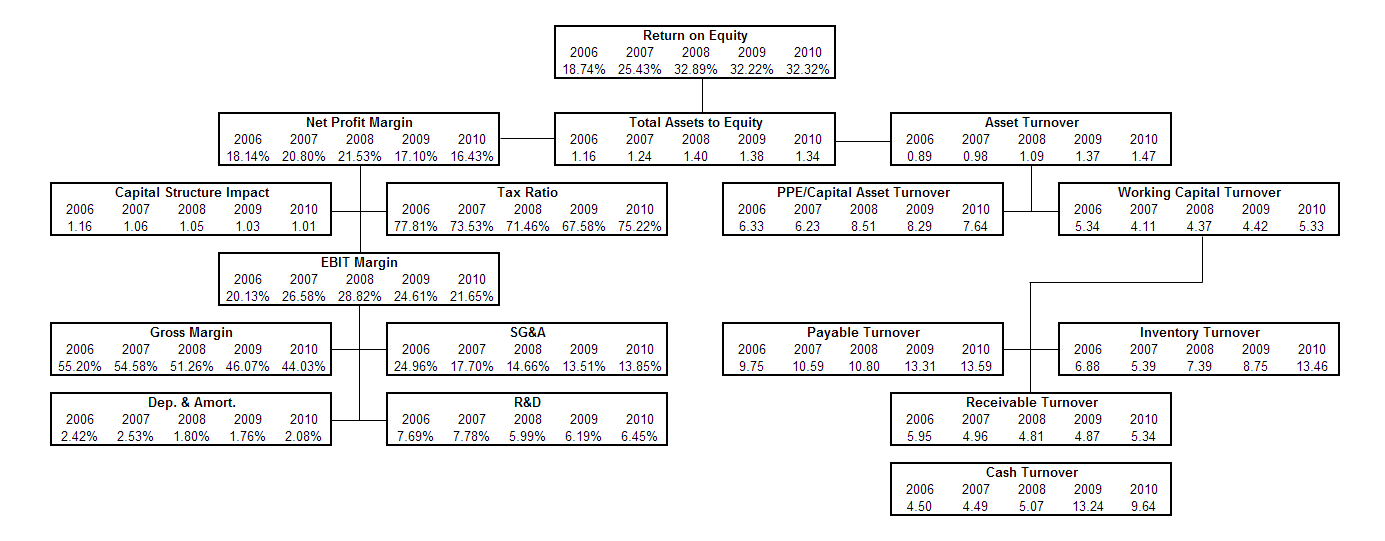

Ten years of annual and quarterly financial ratios and margins for analysis of Disney DIS.

Historical financial ratios. Average industry financial ratios for US. Jesse M Jesse M. Ten years of annual and quarterly financial ratios and margins for analysis of Apple AAPL.

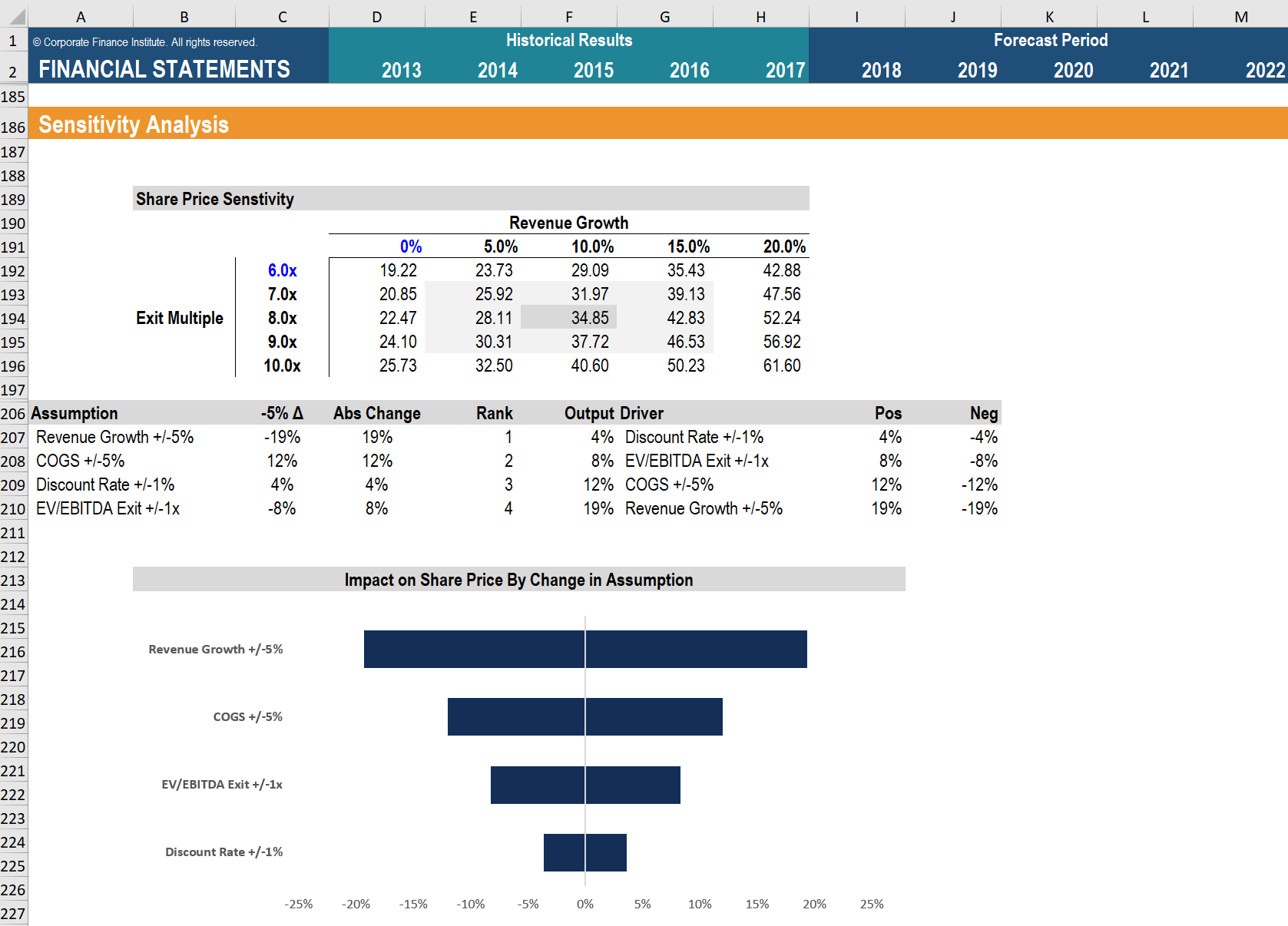

In college projects they were very useful for getting benchmark data to compare an individual business against an industry as a whole. Unfortunately all the public finance sites only offer the current financial ratios for the company. One needs to divide the historical price of the stock by the corresponding historical EPS epsActual taken from the Earnings section of the Fundamentals.

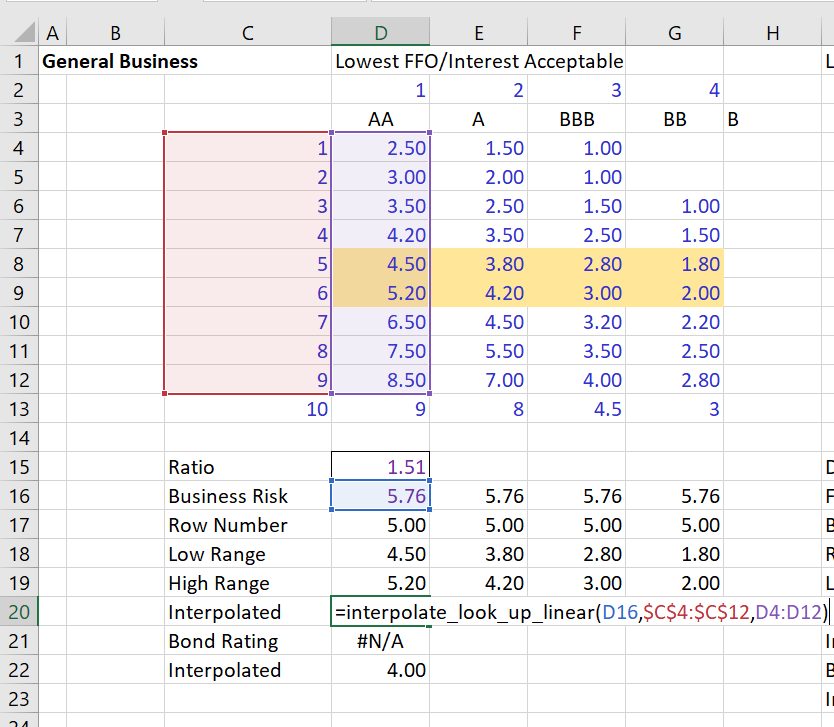

Im trying to make a report that analyzes how the financial ratios current quick inventory turnover etc for Gazprom Russia and its competitors has evolved over time. Professionally I have access to a few tools paid subscritpions. 220 rows IRS financial ratios is the only source of financial ratio benchmarks.

Financial ratios are useful tools that help investors analyze and compare relationships between different pieces of financial. Accessing Historical Financial Ratios for a company. IFRS financial reporting.

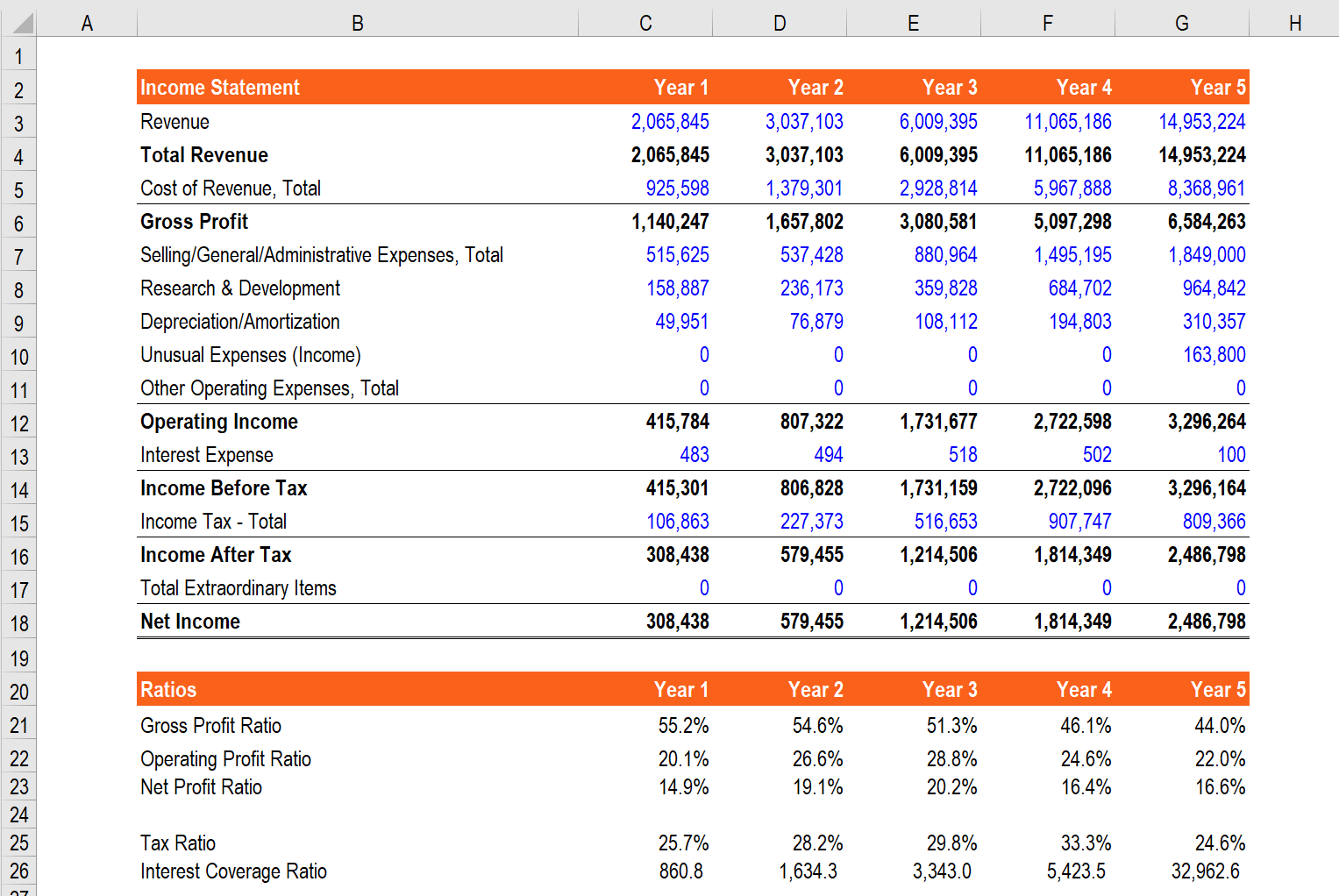

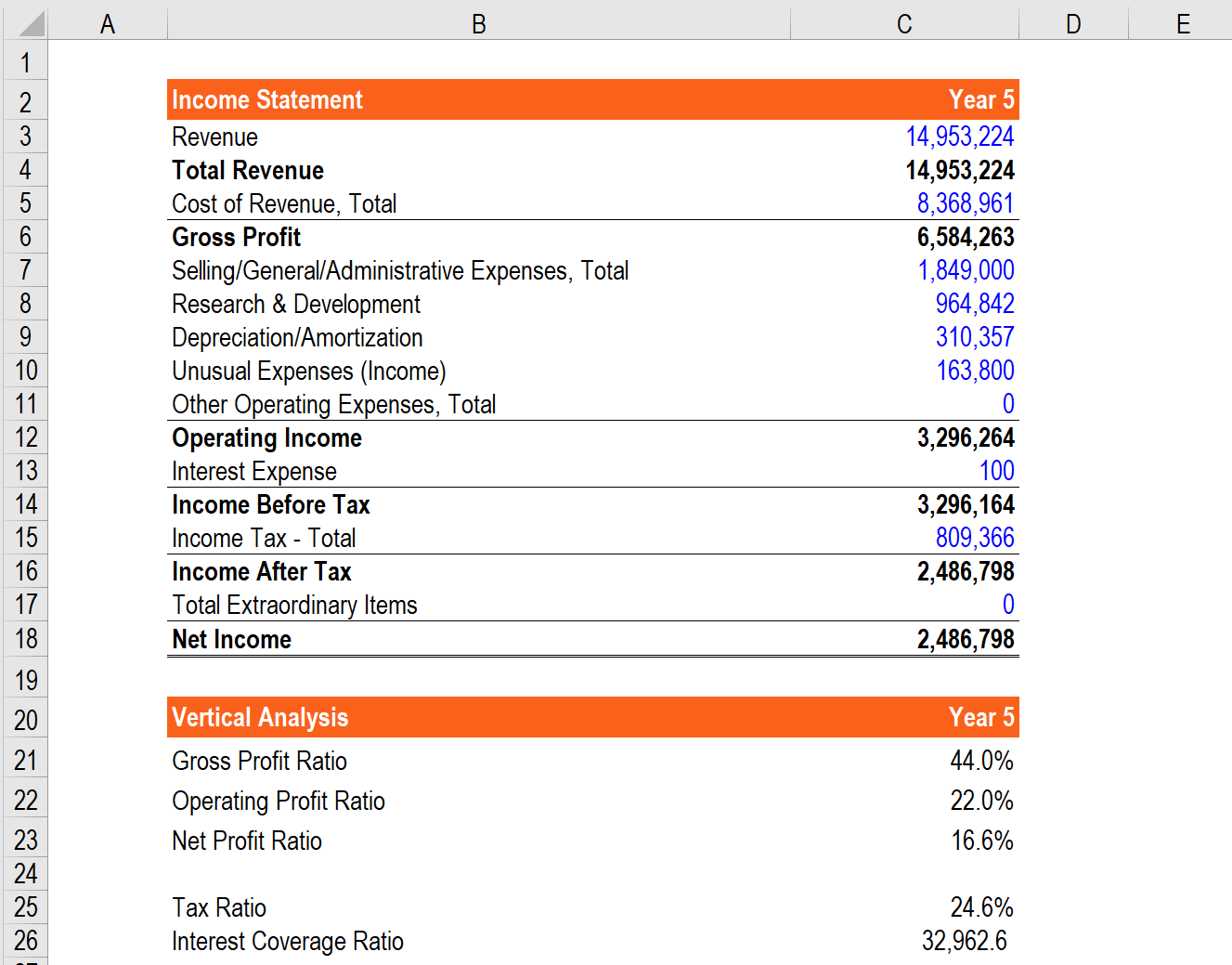

PE ratio Market Price per Share Earnings per Share. They are currently covering around 25k companies. Financial ratio analysis can also be defined as the process of presenting financial ratios which are mathematical indicators calculated by comparing key financial information appearing on Microsoft financial statements.

2020 2019 2018 2017 2016 2015. Sorry I am not sure I know a single website. Most financial ratios help to conduct quantitative analysis to assess vital information about the companys valuation as well as profitability and liquidity indicators such as leverage growth profit margins and different types of rates of return.