Outrageous Treatment Of Extraordinary Items In Cash Flow Statement

To ascertain how much cash or cash equivalents have been generated or used in different activities ie operatinginvestingfinancing activity.

Treatment of extraordinary items in cash flow statement. GAAP no longer requires the reporting of extraordinary items separately from irregular items only as nonrecurring items. Objectives of Cash Flow Statement. Present it separately means that the gain or loss from extraordinary items should be segregated from the profitloss from ordinary operations and should be shown as a separate line item in the income statement after considering the tax effect.

Treatment of tax Cash flow for tax payments refund should be classified as cash flow from operating activities. If its a movement in a provision for for example warranties then yes it will appear in. The cash flows associated with extraordinary items are disclosed separately as arising from operating investing or financing activities in the cash flow statement to enable users to understand their nature and effect on the present and future cash flows of the enterprise.

All extraordinary items are to be presented separately in the financial statements. In late 2015 the Income statement treatment of non-recurring items began to change under International Financial Reporting Standards IFRS and under country-specific GAAP. These tax treatments have vanished for.

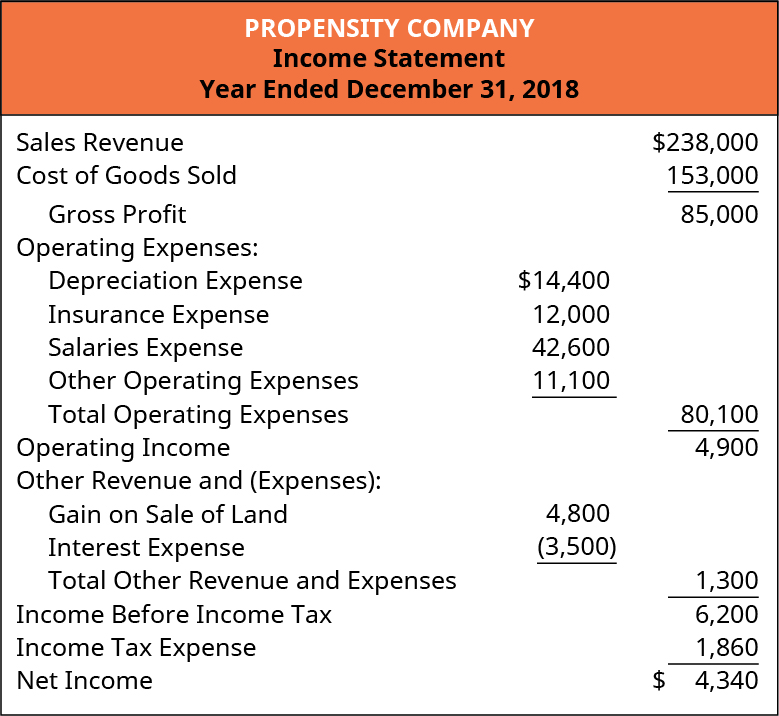

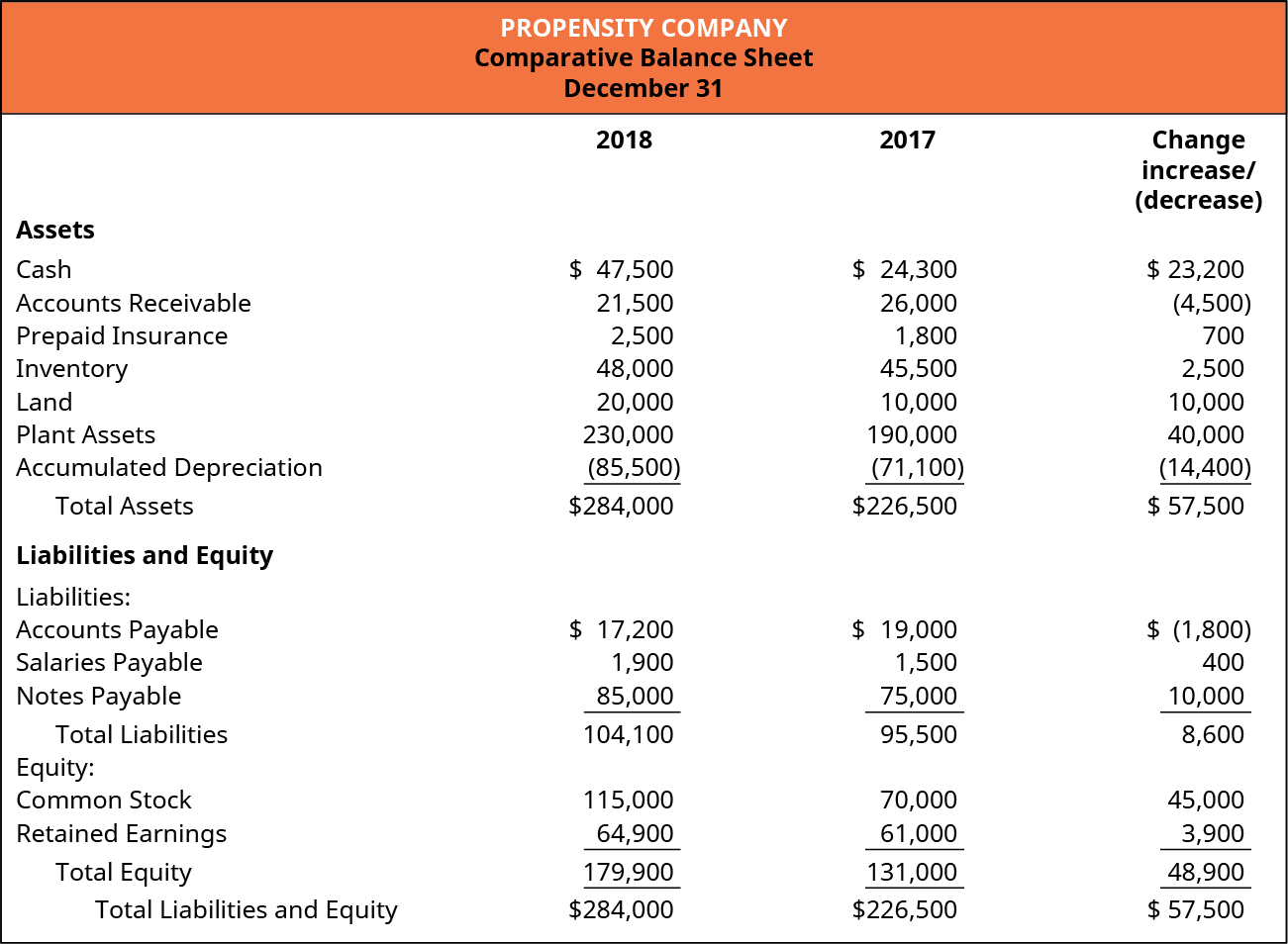

If its a provision for doubtful debts or for depreciation then no they wont appear as line items in the statement of cash flows. GAAP in order to reduce the cost and complexity of. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in.

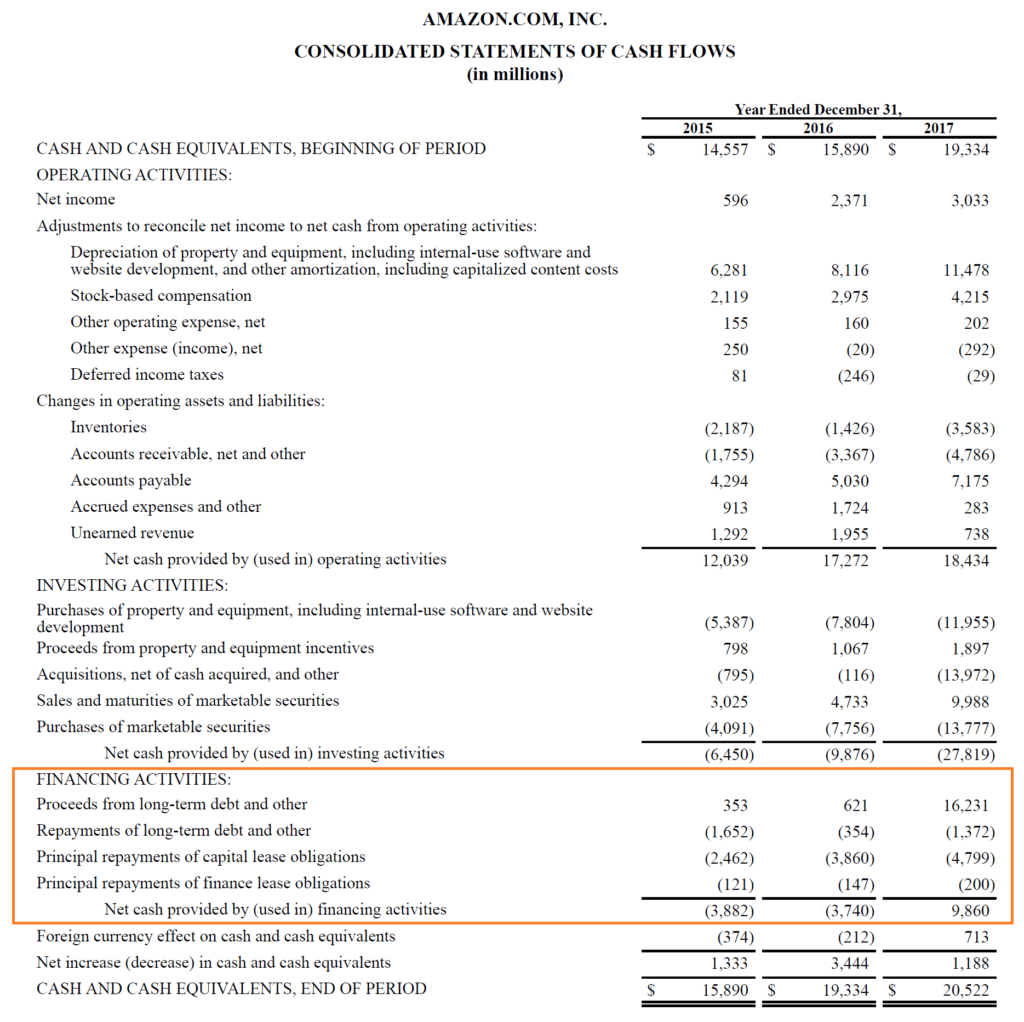

Extraordinary Items - Any cash flows arising from extraordinary items are disclosed separately as arising from operating financing or investing activity as the case may be under the appropriate head. GAAP For GAAP unusual or infrequent items appear on an income statement gross of any tax implications. Insurance claim received against loss of fixed assets is extraordinary investing cash inflow.

Extraordinary Items under US. Read this article to learn about the five special items in cash flow statement and their treatment. My queries are relating to CFS.