Neat Withholding Tax Payable In Balance Sheet

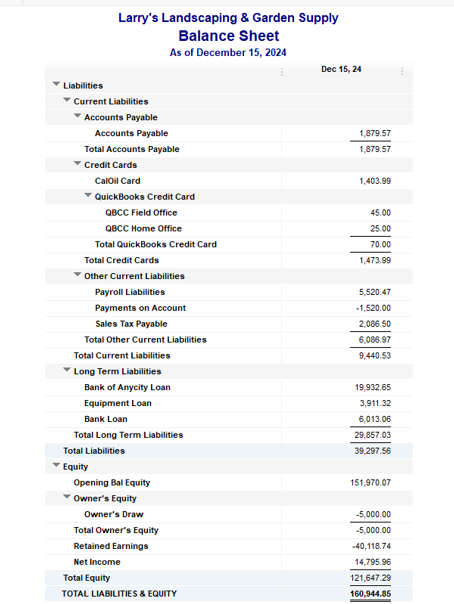

Withholding accounts -- as liability and not expense accounts -- figure into total liabilities which appear on the companys balance sheet one of several financial statements generated each month.

Withholding tax payable in balance sheet. Payroll liabilities include taxes and other amounts withheld from employees paychecks and taxes paid by employers. 2-1998 as amended RR 2-98 every payor required to deduct and withhold taxes under the regulations shall furnish each payee with a withholding tax statement using BIR Form No. For this transaction the Accounting equation is shown in the following table.

Employers normally withhold amounts from employees paychecks for federal income taxes. The payroll taxes withheld from employees wages and salaries are not company expenses. The withholding entity records the amount of this tax in its balance sheet as a liability as soon as it is withheld and clears the liability when it is paid to the government.

FICA social security taxes. To add to what Linda has already stated if you run accrual accounting the balances should generally only be out by a few cents. If running cash accounting it will likely never be close particularly if you have issued invoices with GST included and these havent been paid within the same GST period or you use Accounts Payable and have unpaid bills at the end of the tax period.

After declared dividends are paid the dividend payable is reversed and no longer appears on the liability side of the balance sheet. They are also combined into the amount of the liabilities listed on the shareholders equity financial statement. Government as of the balance sheet date for the federal income taxes withheld from its employees salaries and wages.

Federal income tax withholdings payable definition This current liability account reports the amount a company owes the US. Withholding tax payable P10000. The employers matching portion of the Social Security and Medicare taxes FICA and the federal and state unemployment taxes.

The various taxes payable accounts may be aggregated into a single taxes payable line item in the balance sheet for presentation purposes. Payment of expense subject to withholding. Notes payable payable beyond 1 year Loans payable Mortgage payable Relationship of Balance Sheet Elements The relationship of the elements of balance sheet must be accounted in a manner that will reflect the changes in the economic resources and obligations of the business.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)