Looking Good Trade Debts In Balance Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

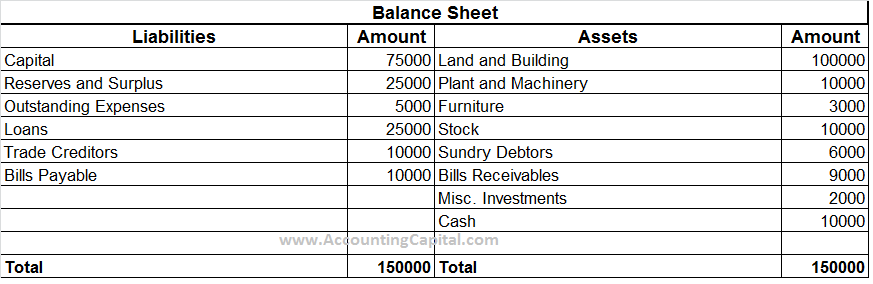

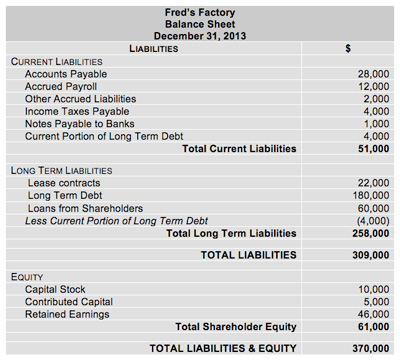

These are the amounts that are expected to be settled in less than 12 months.

Trade debts in balance sheet. These obligations are usually paid between 10 and 90 days and in accounting are considered current liabilities for the purchasing company. Definition of Trade Debts. The allowance for doubtful debts the allowance for bad debts or the allowance for doubtful accounts Hope those explanations helped.

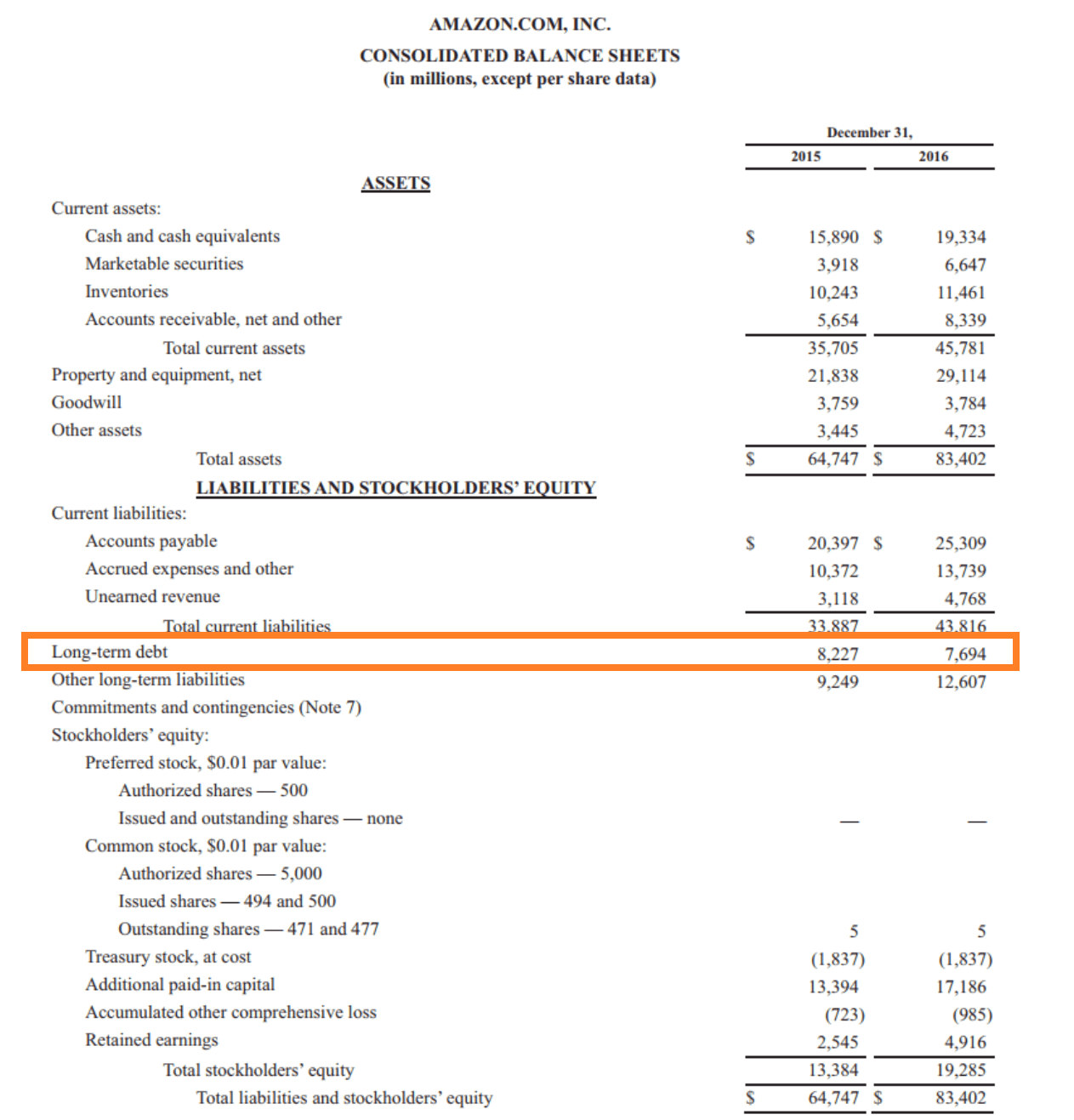

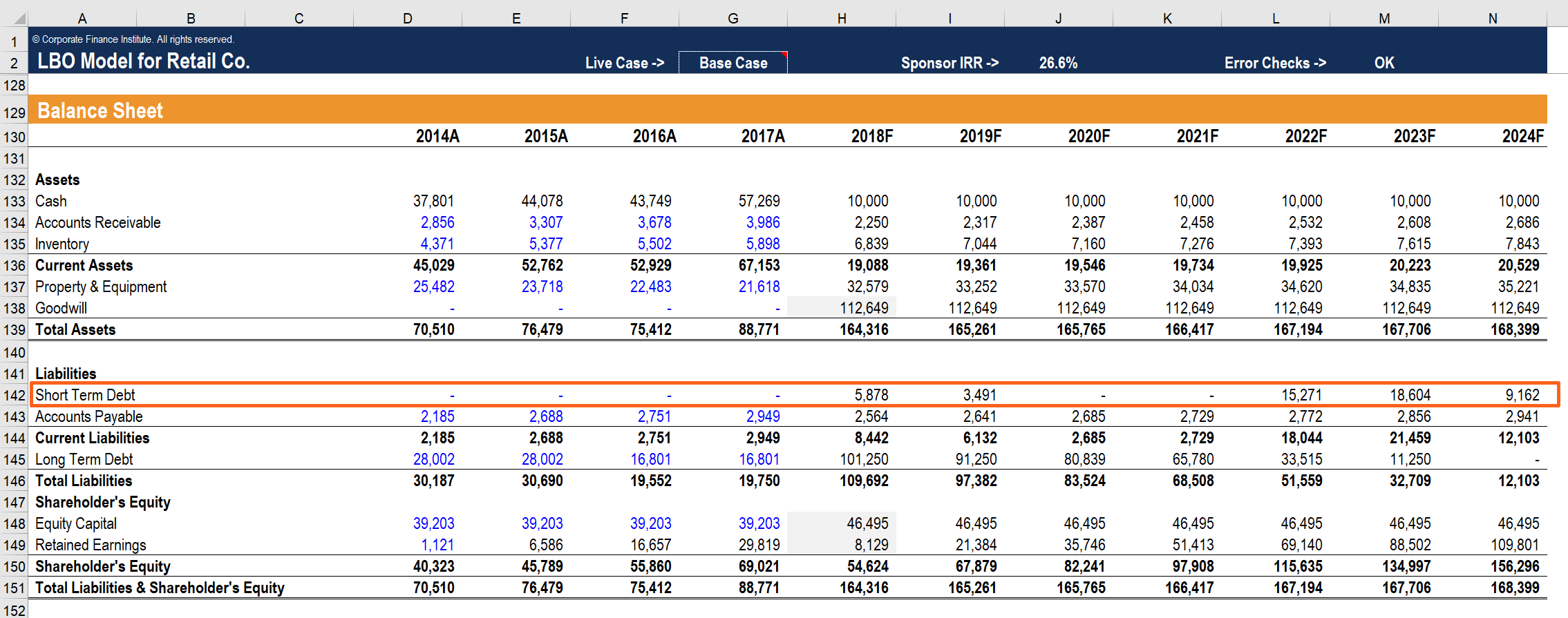

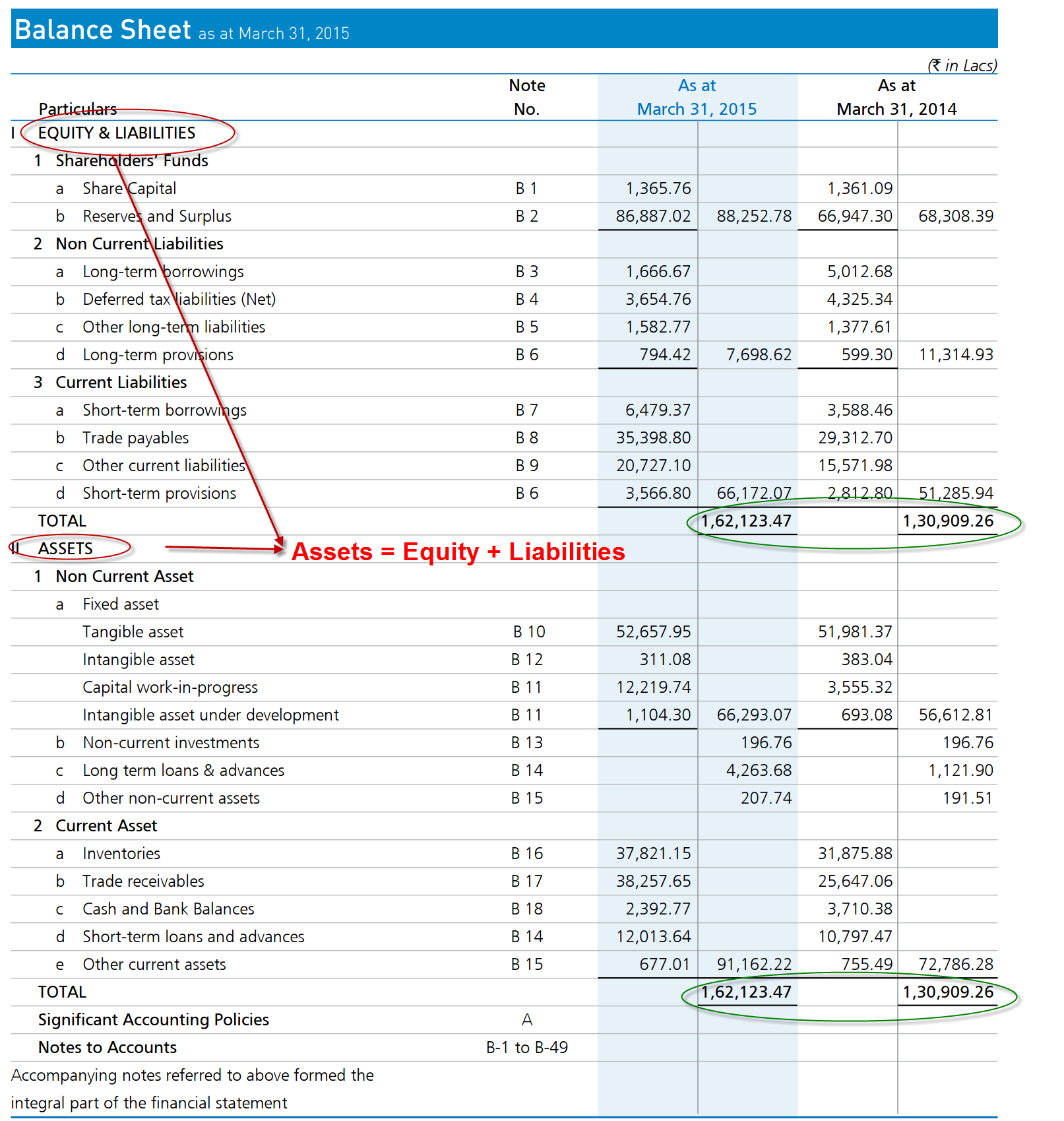

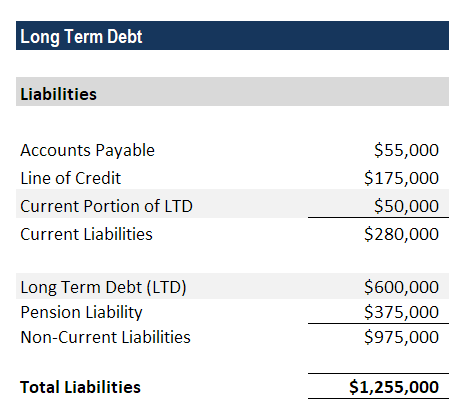

All you need to do is to add the values of long-term liabilities loans and current liabilities. The classification is based on the intent of the company as to the length of time it will. Note that the provision for bad debts is also known by a few other names such as.

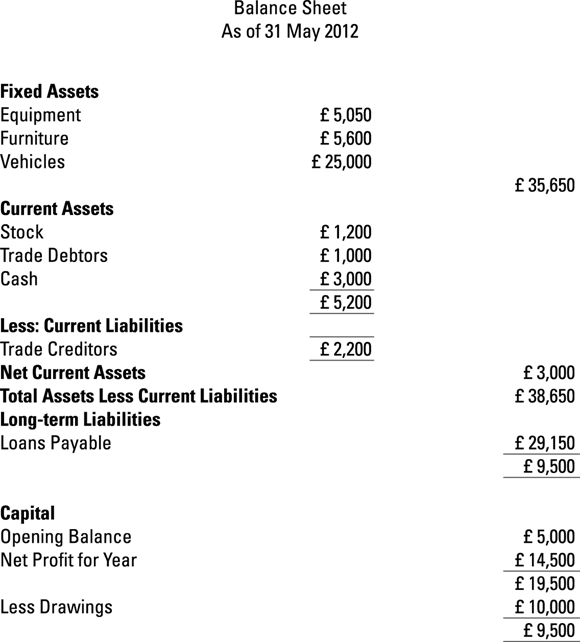

At the time of sale Accounts Receivable will go up by the Amount Company. If you have a debt security such as a loan to someone the value is the amount the loan is worth or the price at which you could sell it to another party. Quarterly statement showing age wise details of the debt is to be sent to customers requesting payment.

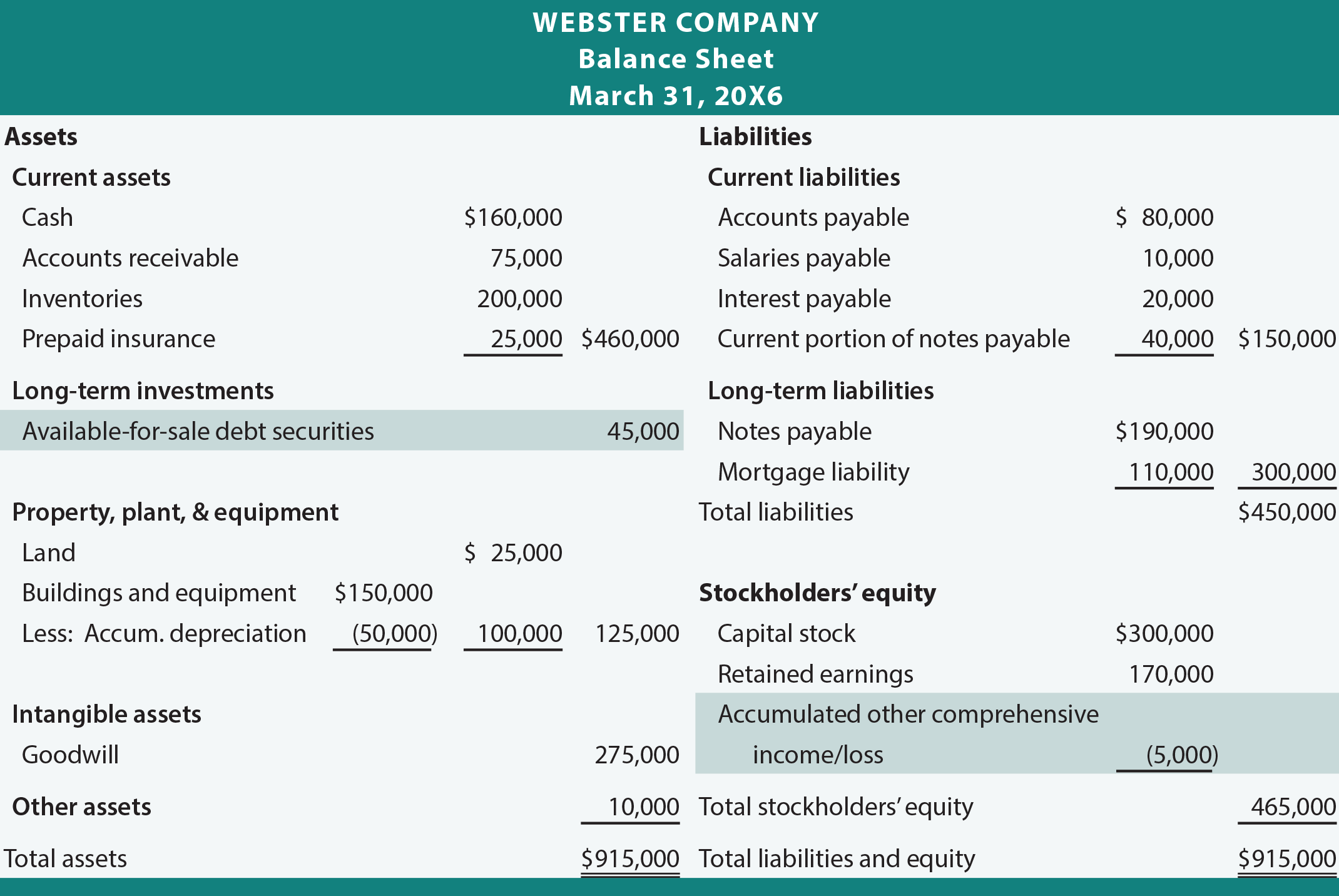

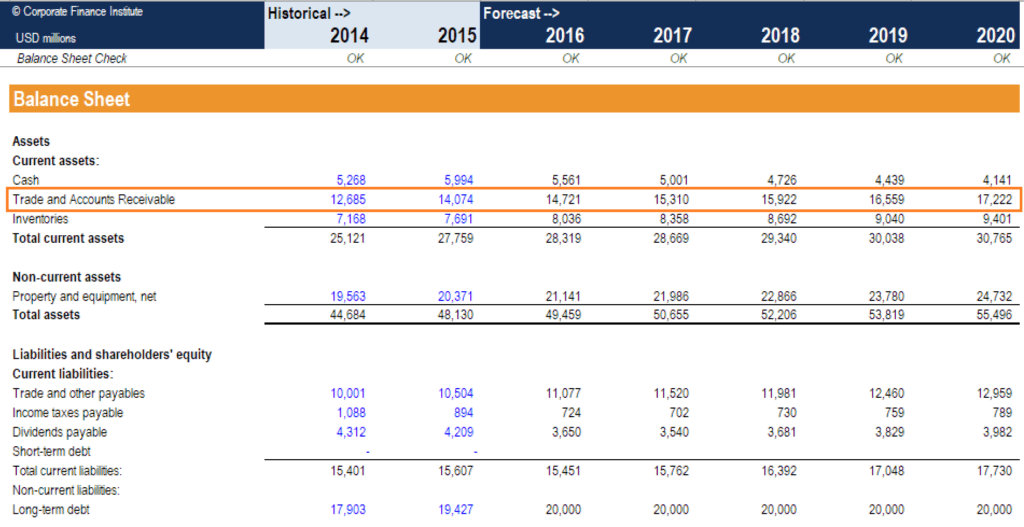

Total Debt in a balance sheet is the sum of money borrowed and is due to be paid. These assets are short term as the company intends to. Once cash has been properly considered the other important part of the balance sheet for business owners is the companys debt position and in particular the value and status of any loans provided to the business.

This account is made up of any debt incurred by a company that is due within one year. The main objectives of the balance sheet are as follows. To provide the information about capital and owners equity.

Debt investments and equity investments recorded using the cost method are classified as trading securities availableforsale securities or in the case of debt investments heldtomaturity securities. In the balance sheet of companies it is. VAT is added to the sales from the profit and loss account and sales VAT are put into the balance sheet as trade debtors.