Ideal Non Owner Changes In Equity

Changes in ownership interests Changes in a parents ownership interest in a subsidiary that do not result in the parent losing control of the subsidiary are equity transactions ie.

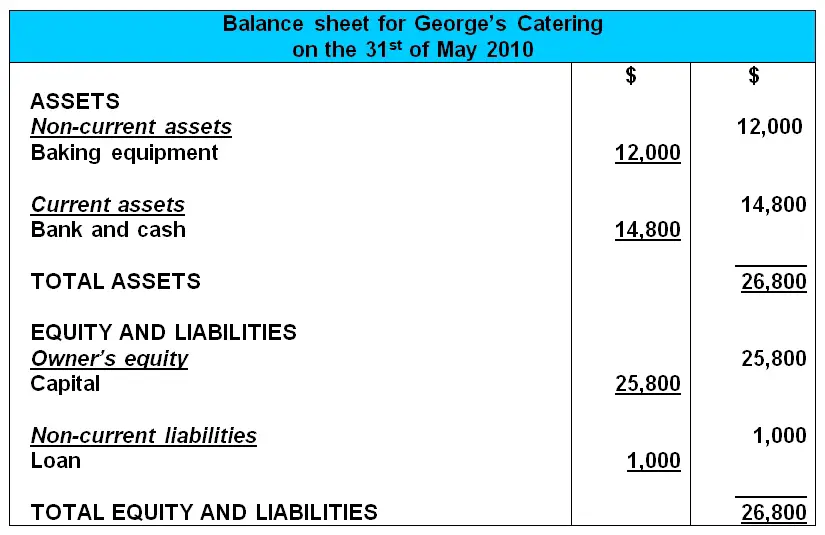

Non owner changes in equity. Transactions with owners in their capacity as owners. Passed SBR soo happy as thought a horrible paper. A negative owners equity occurs when the value of liabilities exceeds the value of assets.

Must present all non-owner changes in equity comprehensive income either. List some examples of the components of comprehensive income. ACOWtancy I passed SBL and AAA and I used your site instead of textbooks.

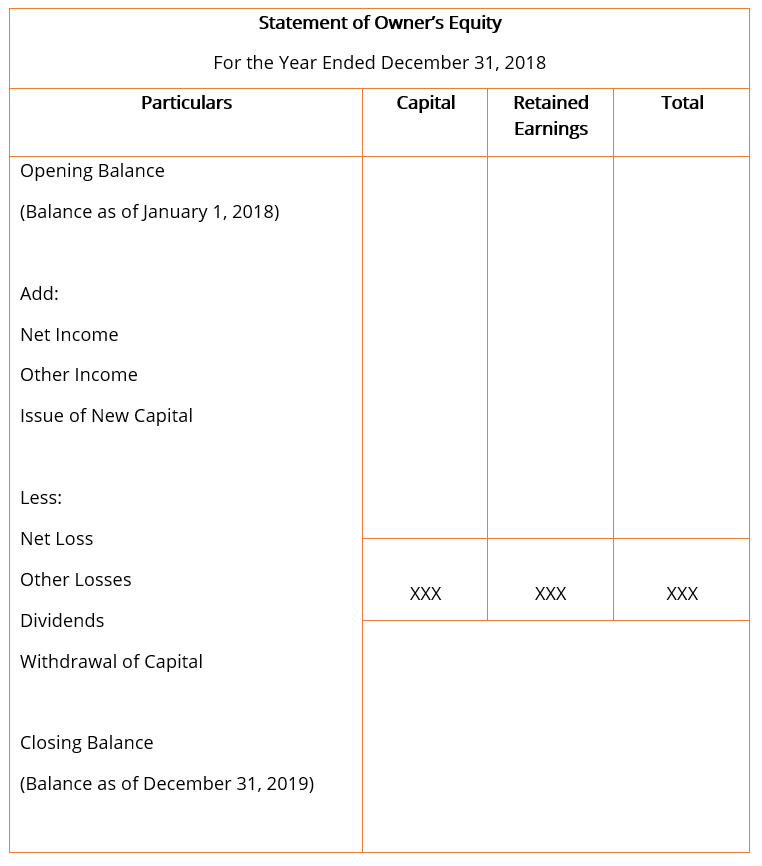

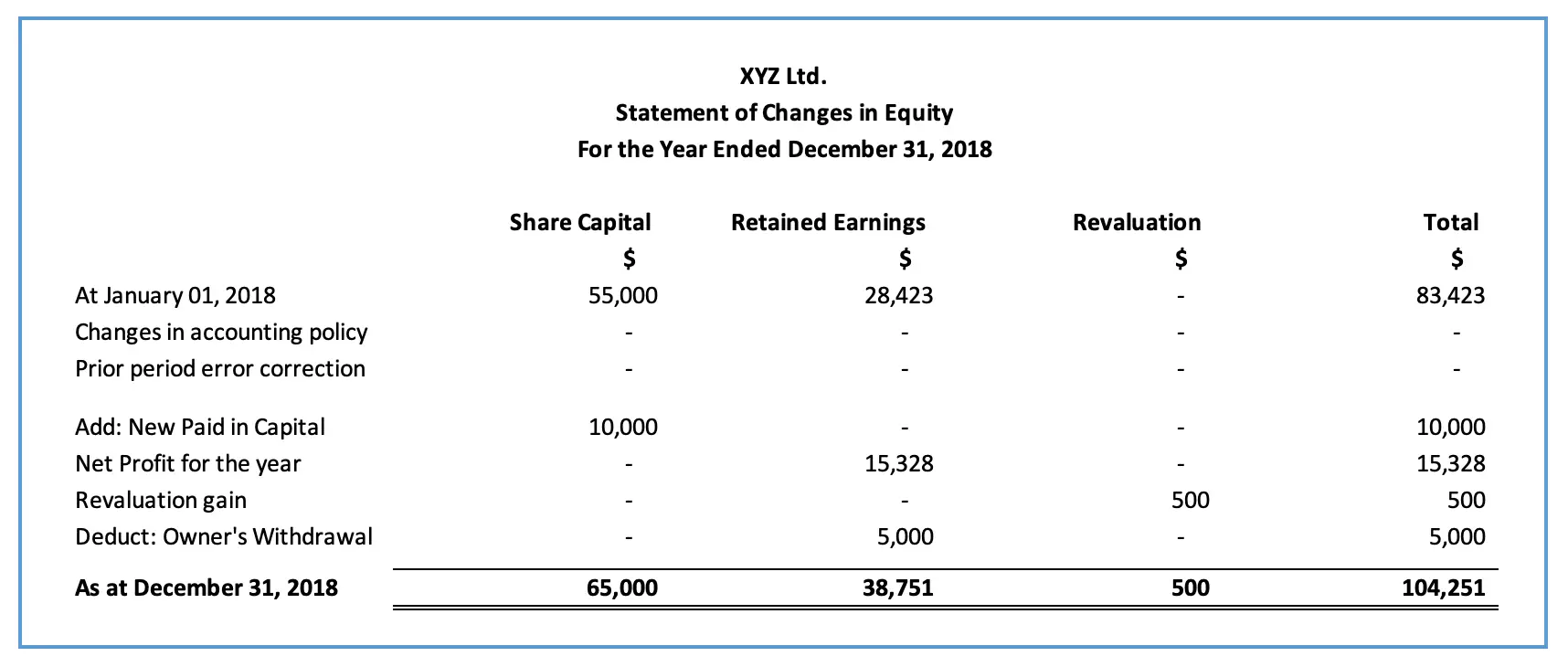

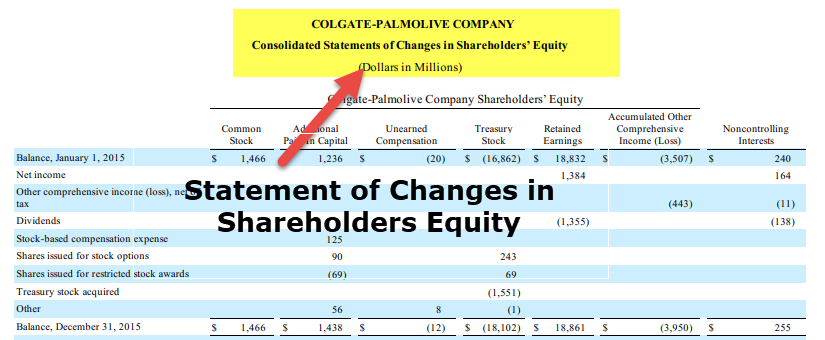

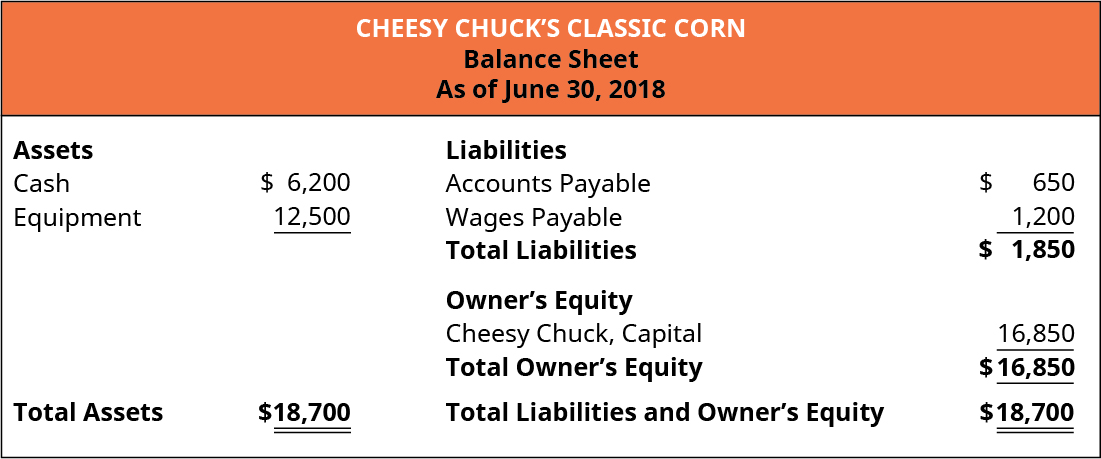

It is the variation in a companys net assets from non-owner sources during a specific period. The statement of changes in equity is a reconciliation of the beginning and ending balances in a companys equity during a reporting period. It includes only details of transactions with owners with all non-owner changes in equity presented as a single line total comprehensive income.

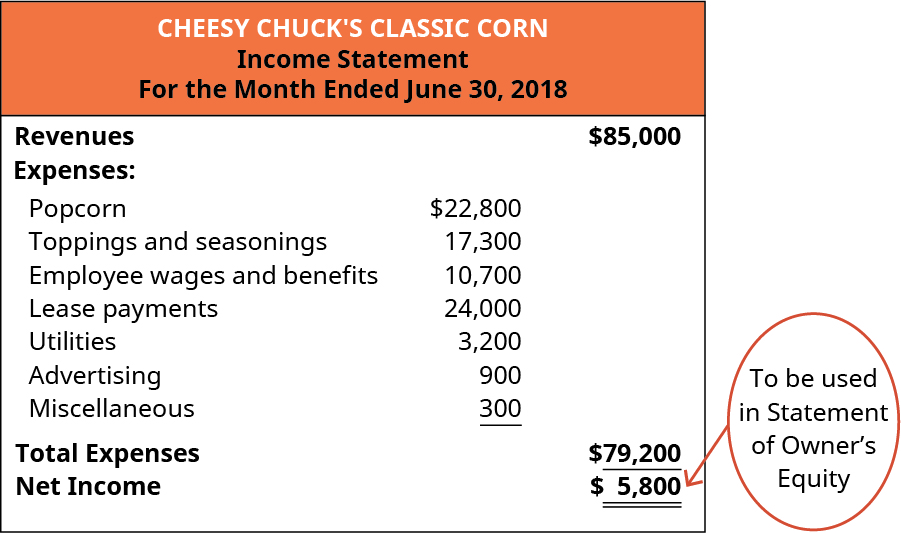

Decided that all owner changes in equity should be presented in the statement of changes in equity separately from non-owner changes in equity. Movement in shareholders equity over an accounting period comprises the following elements. In single statement of comprehensive income or In two statements income stat ement and separate statement of comprehensive income 19 Statement of Comprehensive Income 20 Either Or And.

It is not considered an essential part of the monthly financial statements and so is the most likely of all the financial statements not to be issued. Define other comprehensive income and total comprehensive income. The companys CFO has asked you to prepare a statement of changes in equity for the company for the year ended 30 June 2014.

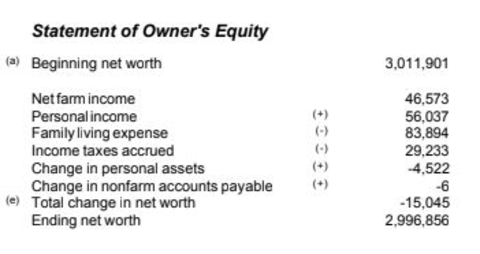

Statement of Changes in Owners Equity. This is referred to broadly as nonowner changes in equity that result from events and circumstances other than changes in investments by owners or distributions to them. All non-owner changes in equity ie comprehensive income are required to be presented in one statement of comprehensive income or in two statements a separate income statement and a statement of comprehensive income.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)