First Class Unit Trust Balance Sheet

Cash bank balances.

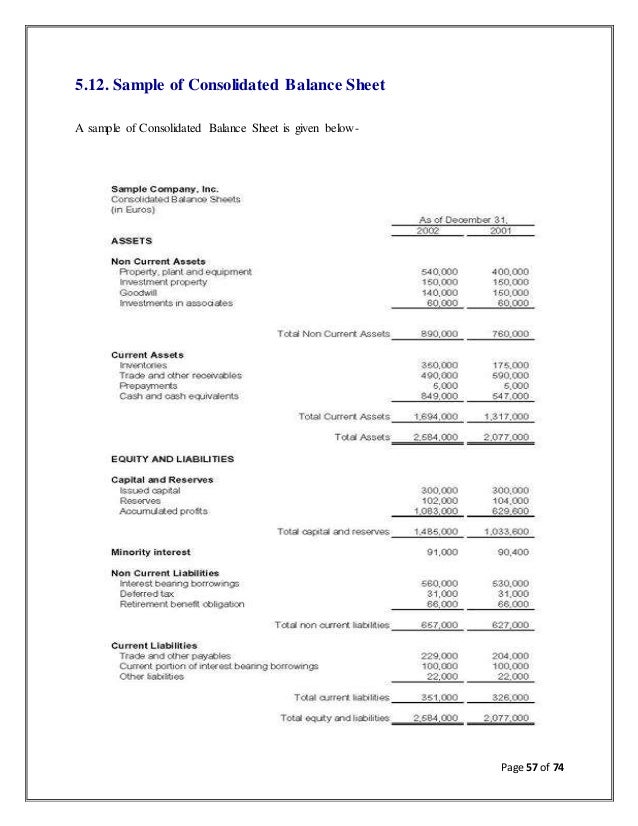

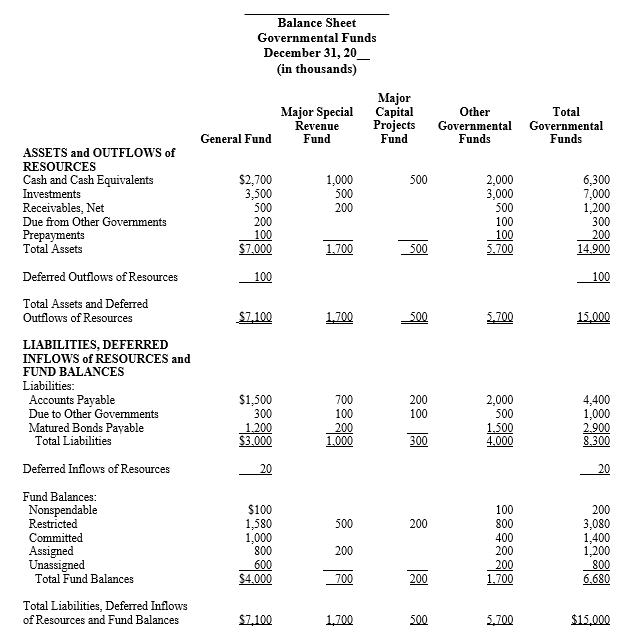

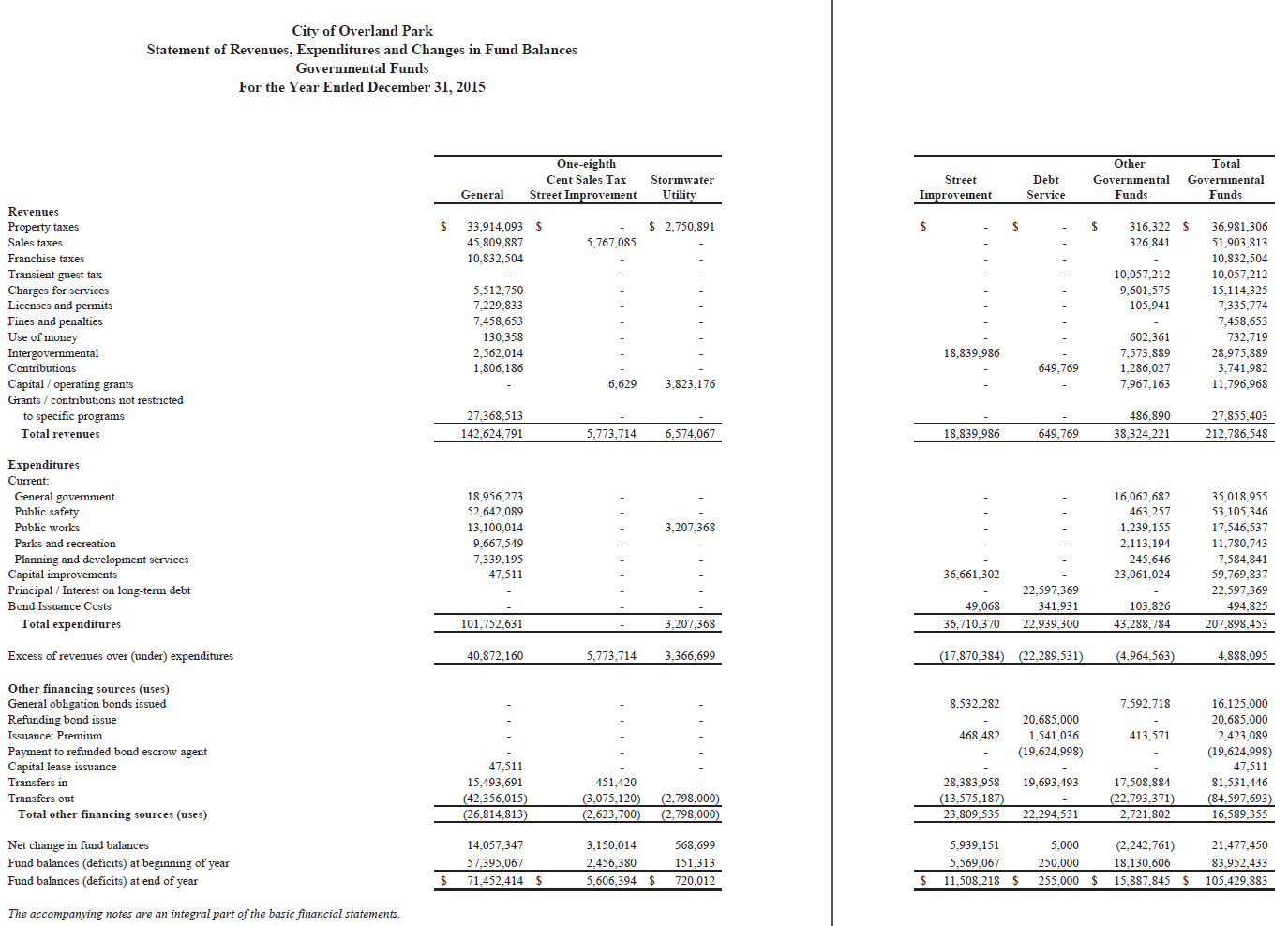

Unit trust balance sheet. WHAT ARE UNIT TRUSTS. Hire-purchase payables non-current portion. To illustrate suppose ABC Bank sets up an off-balance sheet trust called XYZ Trust.

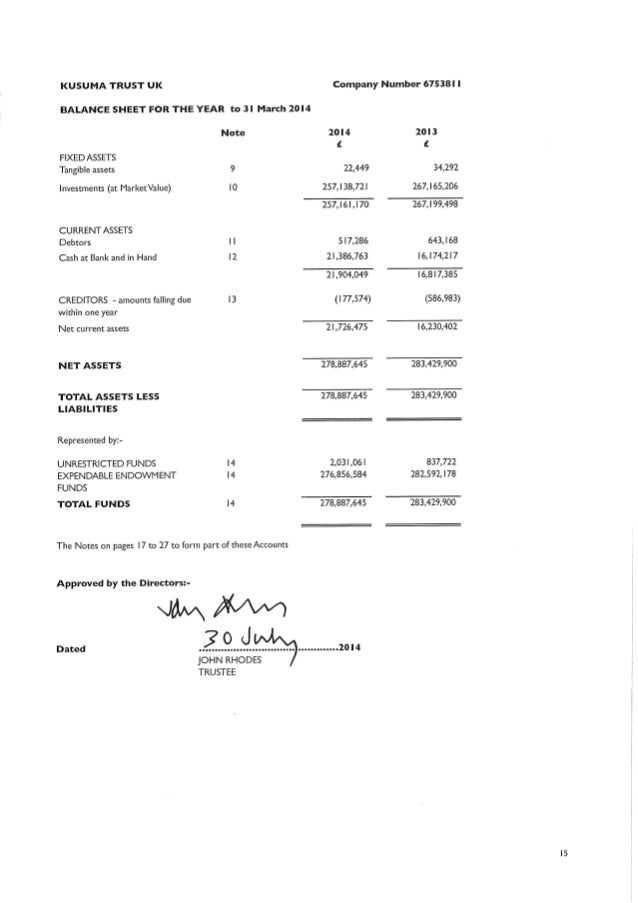

In other words they are listed on the report for the same amount of money the company paid for them. The balance sheet of a charitable trust is to be studied from this point of view. Please click here for the Schedules of similarities and differences between South African regulations and the regulations governing the foreign unit trusts which Allan Gray represents in South Africa.

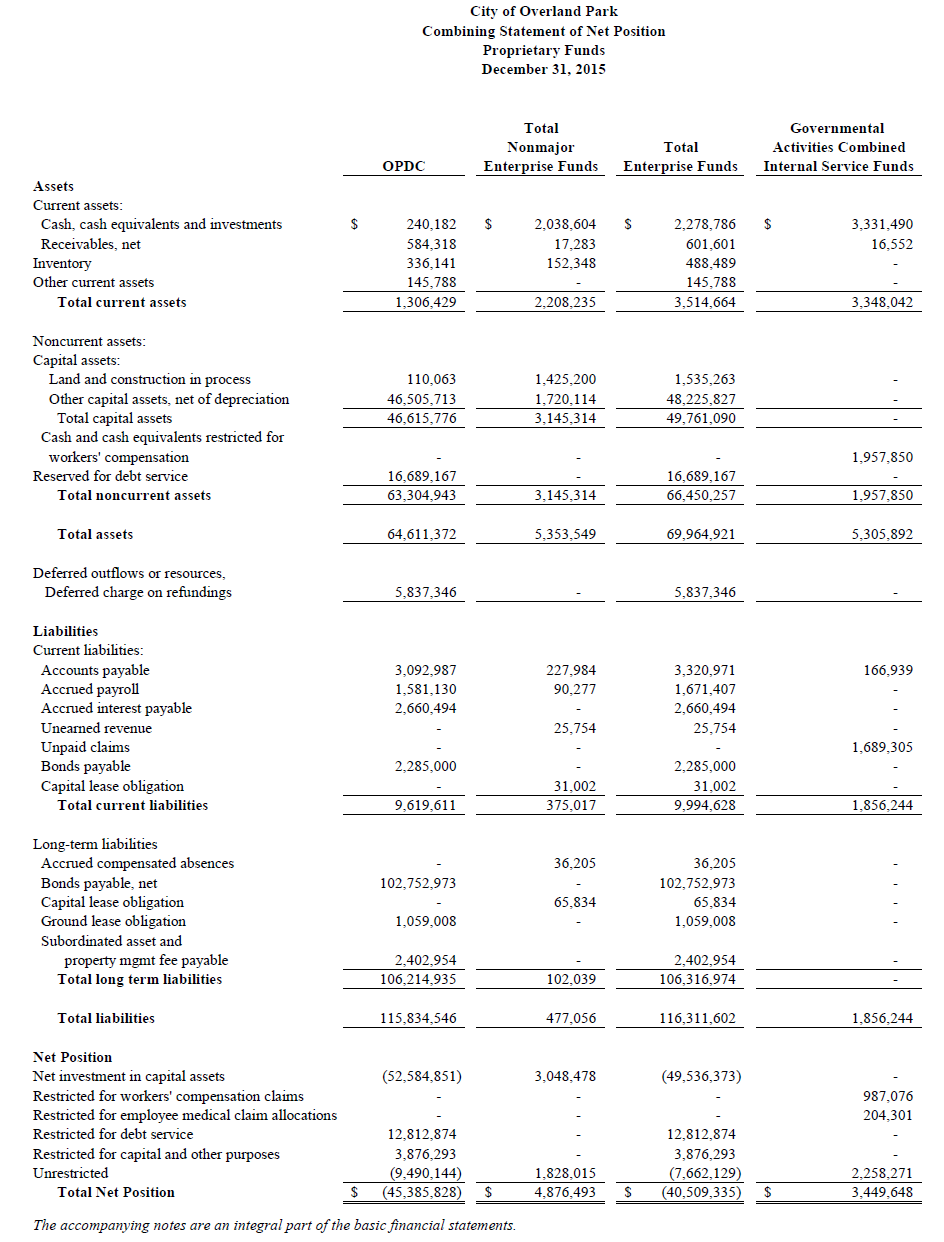

Later XYZ Trust loans the 5 million to ABC Bank. Total assets A B 92276355. Under the Current Asset notice there is an Investment in Unit Trust.

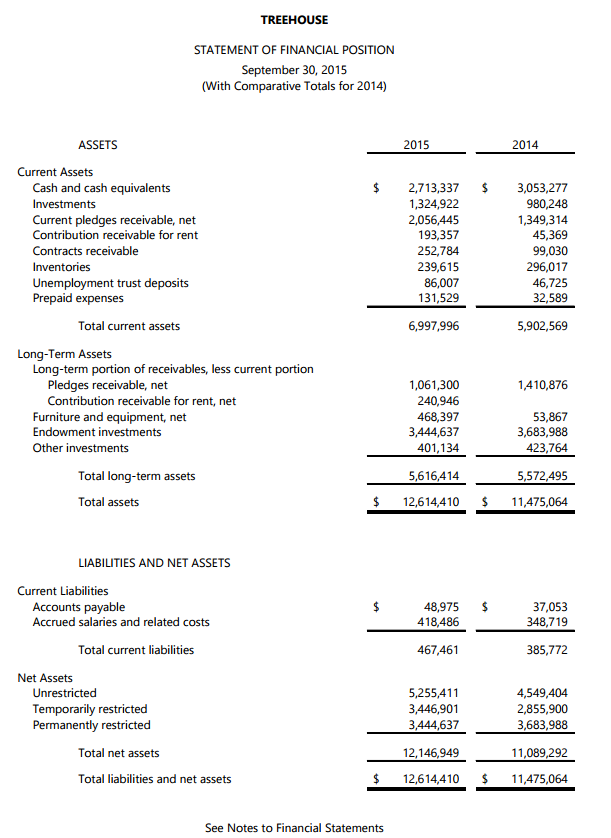

The term unit trusts is used to refer to all similar offshore pooled investments including those that may be structured differently such as mutual funds. This is the net of the balances carried forward over the years from the start of the balance sheet of the trust. EASTSPRING INVESTMENTS UNIT TRUSTS - GLOBAL BALANCED SGD The investment objective of Eastspring Investments Unit Trusts - Global Balanced Fund is to maximise total return in the medium to long term by investing primarily in a portfolio comprising global equities and high quality debt securities of major global bond markets.

Review the latest Balance Sheet Statement for MG UNIT TRUST ASXMGC - including Assets Liabilities and Equity figures. However what I would like to highlight is to always look at this line item together with other cash equivalents and borrowings. EASTSPRING INVESTMENTS UNIT TRUSTS - ASIAN BALANCED SGD The fund aims to maximise total return in the medium to long term by investing in a portfolio comprising of equities of companies in Asia ex Japan and quality corporate bonds and other fixed income securities issued in the US.

Investment in unit trusts. Instead we have suggested that while they remain in the liability side of the unit trusts balance sheet and are an asset of the super fund they should be expressed as Distributions Payable in the trusts accounts and Distributions Receivable in the super fund. Start your free trial today for full access.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)