Fun Loss On Revaluation Journal Entry

Oracle Assets creates journal entries for the reinstatement to debit asset cost credit accumulated depreciation and reverse the gain or loss you recognized for the retirement.

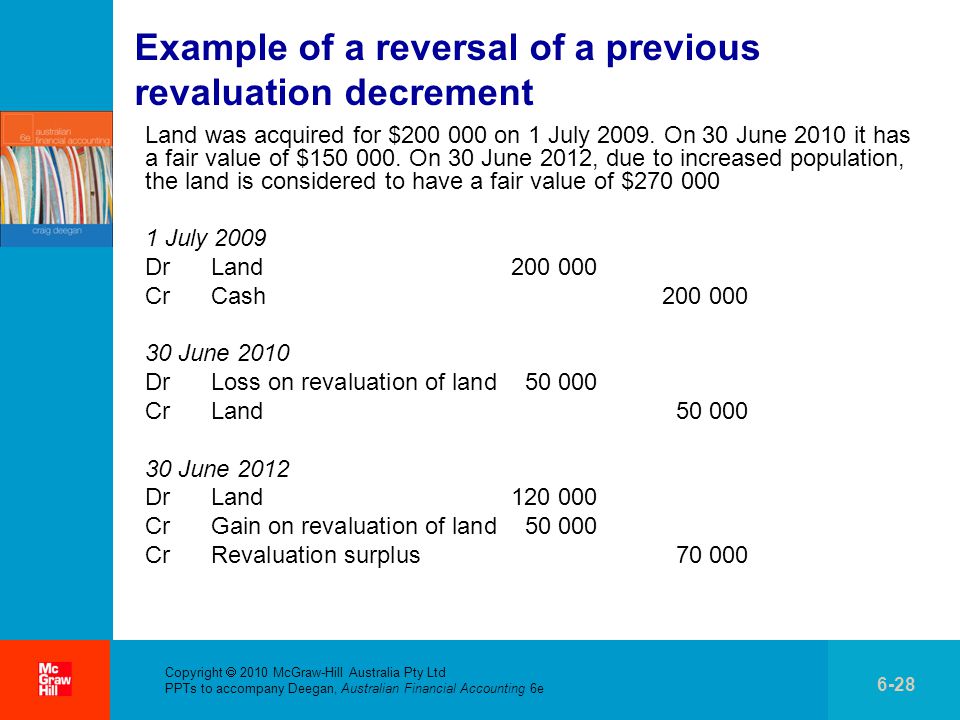

Loss on revaluation journal entry. If any revaluation reserve has accumulated in the past the revaluation loss should be recorded in the general journal as follows. Any additional loss must be charged as an expense in the statement of profit or loss. Currency revaluation debtors acc.

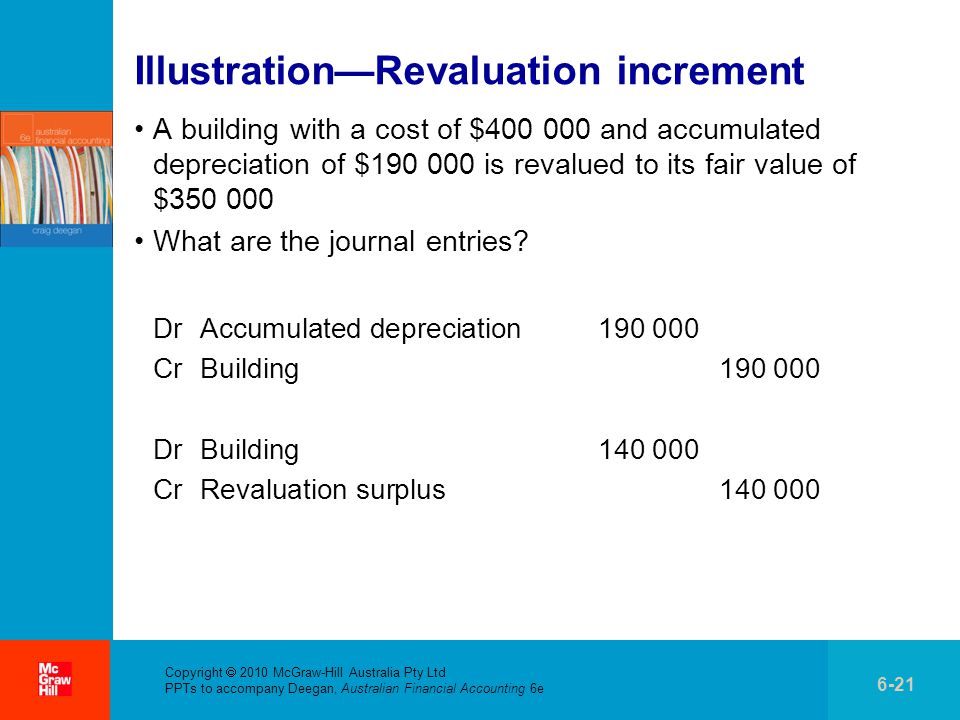

Revalue Accumulated Depreciation Example 1. Asset has a carrying amount of 70000 with a previously recognized revaluation loss of 20000 In this case previous revaluation loss will be reversed first and any amount of current gain over exceeding previous loss will be taken to revaluation. Dear All Can any one tell me the Accounting entries for posting foreign currency and foreign currency revaluation.

On the Main account page. Each accounting entry will post to the unrealized gain or loss and the main account being revalued. Revaluation Loss Treatment.

If the main account should be revalued in General ledger select Foreign currency revaluation. The net effect is the business recorded revenue of USD 6500 and received only USD 6100 recording a total foreign currency transaction exchange loss of USD 400 250 150. What are the journal entries involved in foreign currency revaluation.

The profit or loss from Revaluation Reserve profit are transferred to the capital account of all partners including retiring or deceased partners in their old profit sharing ratio. If the revaluation reserve accumulated in the past for the specific item of PPE exceeds its revaluation loss a single entry must be made in the general journal. Impairment loss is more than revaluation surplus.

Ive been presented with a trial balance which has three balance sheet accounts I have never seen before. Oracle Assets reverses the journal entries for proceeds of sale cost of removal net book value retired and revaluation. It should be kept on its historical book cost value.