Outrageous Going Concern Disclosure In Audit Report Example Of Income And Expenditure Account And Balance Sheet

When preparing financial statements management shall make an assessment of the entitys ability to continue as a going concern.

Going concern disclosure in audit report example of income and expenditure account and balance sheet. It is quite similar to the Trading and Profit and Loss Account of a trading concern and is. Other misstatements identified will be communicated to the extent that they merit the attention of the Audit. An appendix illustrating example disclosures for the early adoption of IFRS 9 Financial Instruments taking into account the amendments arising from IFRS 9 Financial Instruments 2010 and Mandatory Effective Date and Transition Disclosures Amendments to IFRS 9 and IFRS 7 2011.

Going concern assumption 2. Substantial Doubt Alleviated by Managements Plans. Of the 52 prepared on a going concern basis five received audit Disclaimers of.

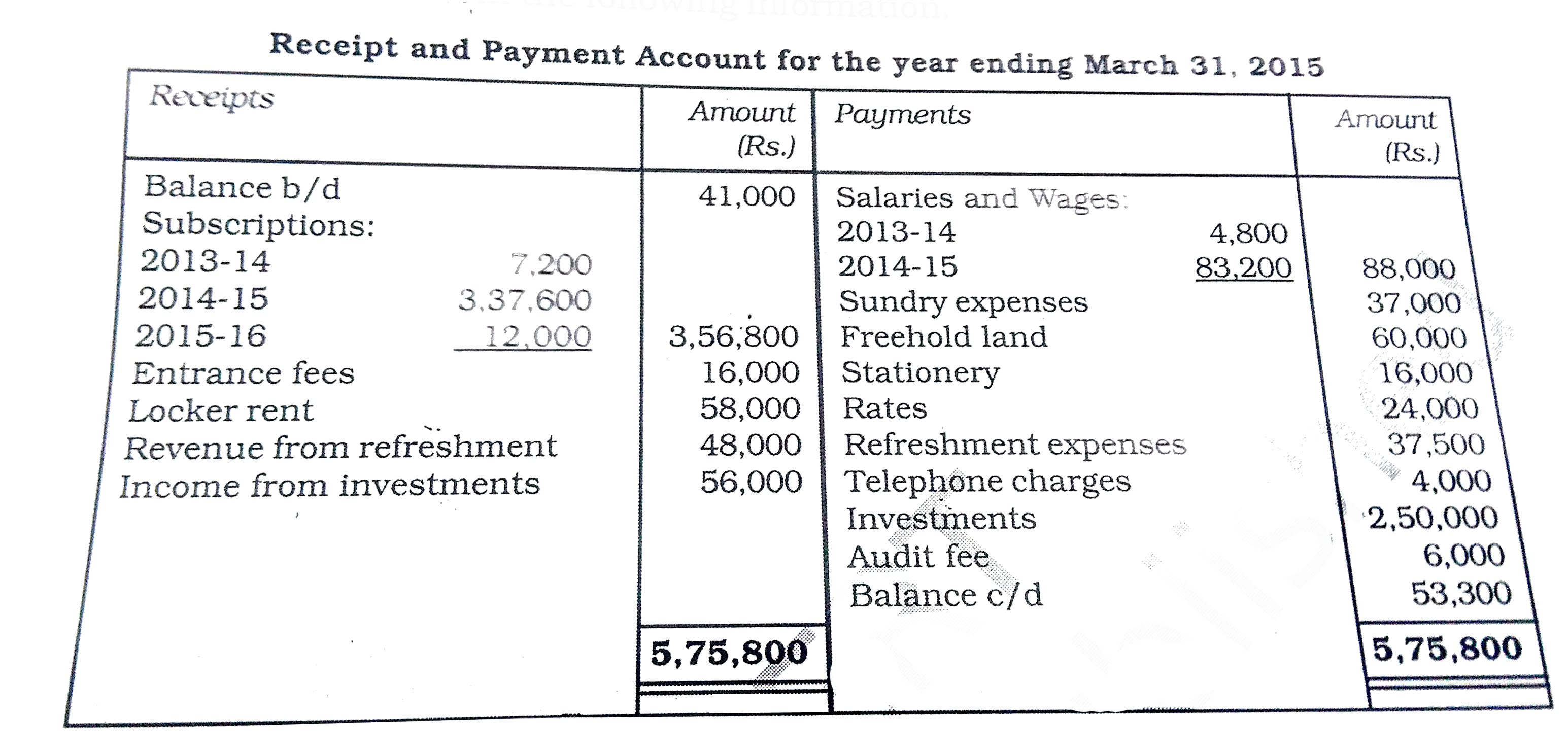

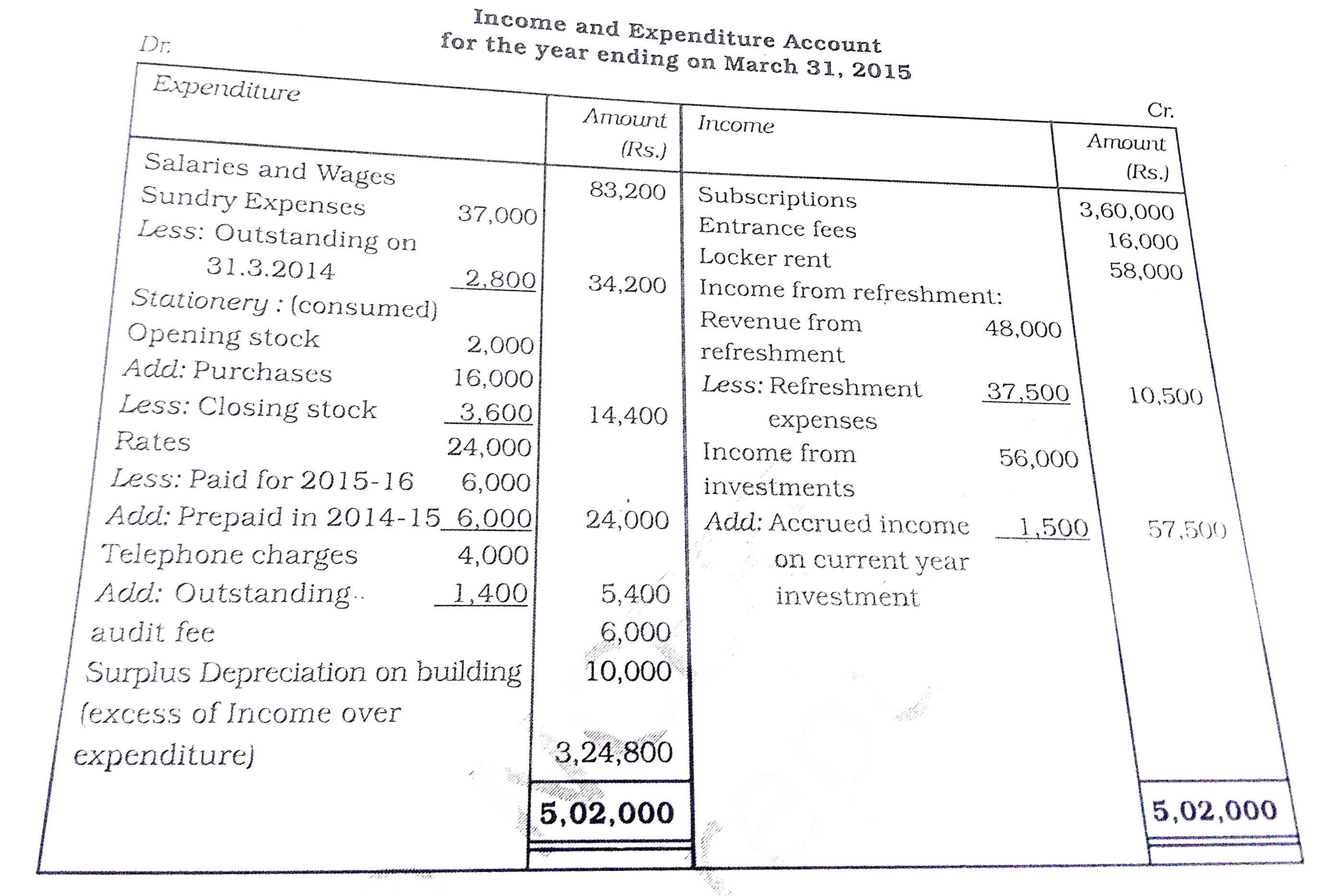

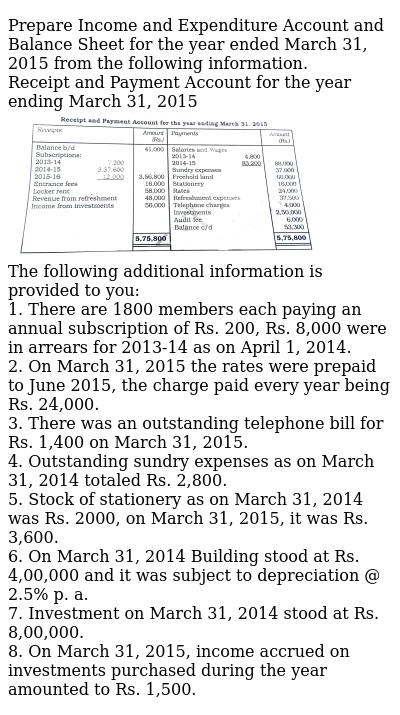

The Income and Expenditure Account is a summary of all items of incomes and expenses which relate to the ongoing accounting year. Guidance on disclosures that it expects from an entity when an auditors report includes an explanatory paragraph that reflects substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time The Codification of Financial Reporting Policies Section 60702. Internal matters for example work stoppages or other labor difficulties substantial dependence on the.

Financial statements shall be prepared on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. The auditor assesses a companys capacity to proceed as a going concern for a period not more than one year following the date of the financial reports being audited. ASU 2014-15 does not replace existing auditing guidance on going concern.

Audit of a complete set of financial statements of a listed entity using a fair presentation framework. Of these four entities prepared their financial statements using the realisation basis ie. The auditors obligation is slightly different as the requirement is from a minimum 12 months from the date of signing of the financial report and therefore the auditor is.

The auditor will in turn audit managements disclosures. Note X Financial Condition Describe conditions or events giving rise to a substantial doubt about the governments ability to continue as a going concern for a reasonable period of time Describe managements plan These planned actions are expected to enable the government to continue operating and. 14 Statement of cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)