Wonderful Valuation Balance Sheet Of Insurance Company

The document Valuation Balance Sheet - Insurance Company accounts Advanced Corporate Accounting B Com Notes EduRev is a part of the B Com Course Advanced Corporate Accounting.

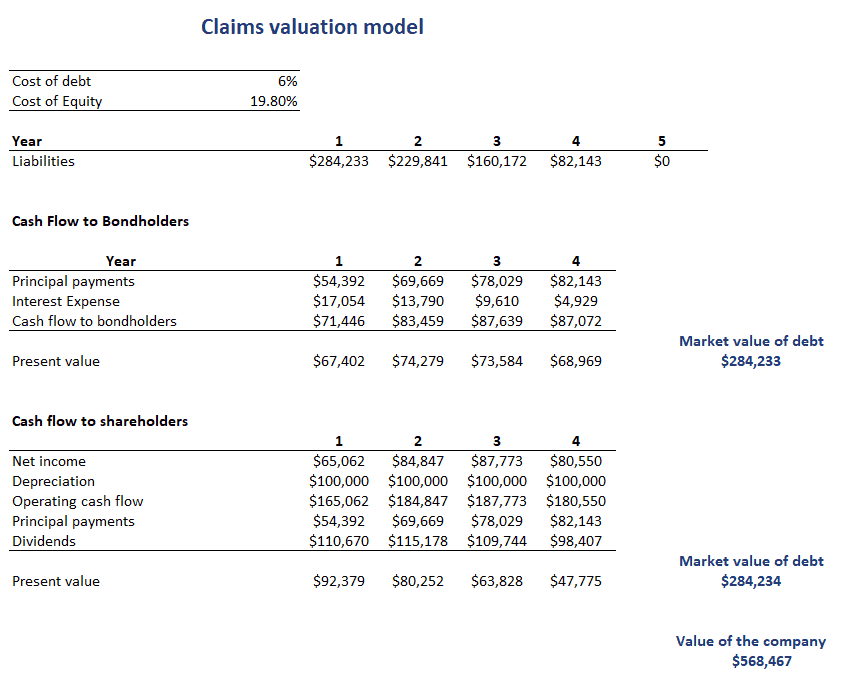

Valuation balance sheet of insurance company. Valuation balance sheet is prepared by the life insurance company or it is prepared by the actuary for the life insurance company. The primary purpose of the insurance business is the spreading of risks. See multiples and ratios.

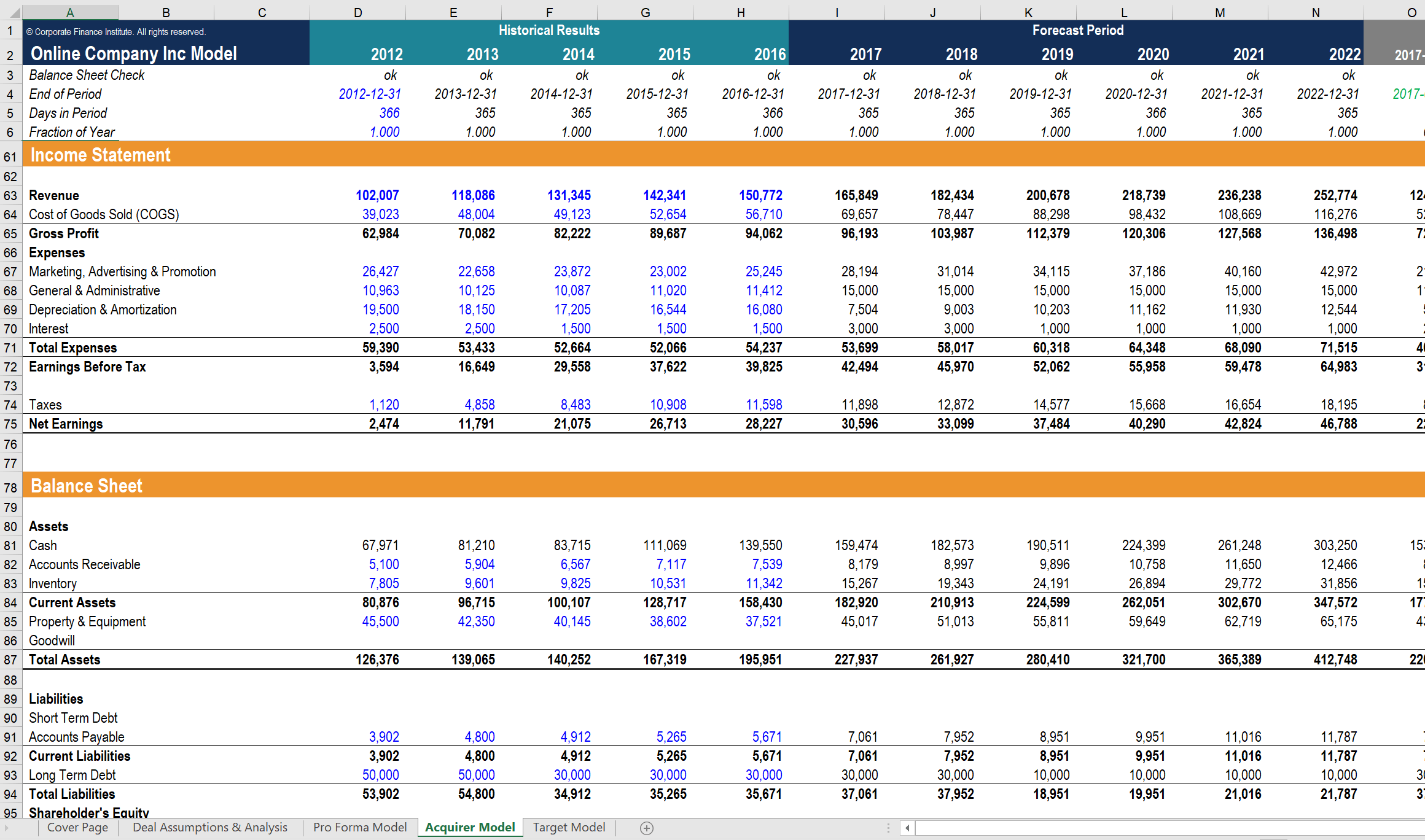

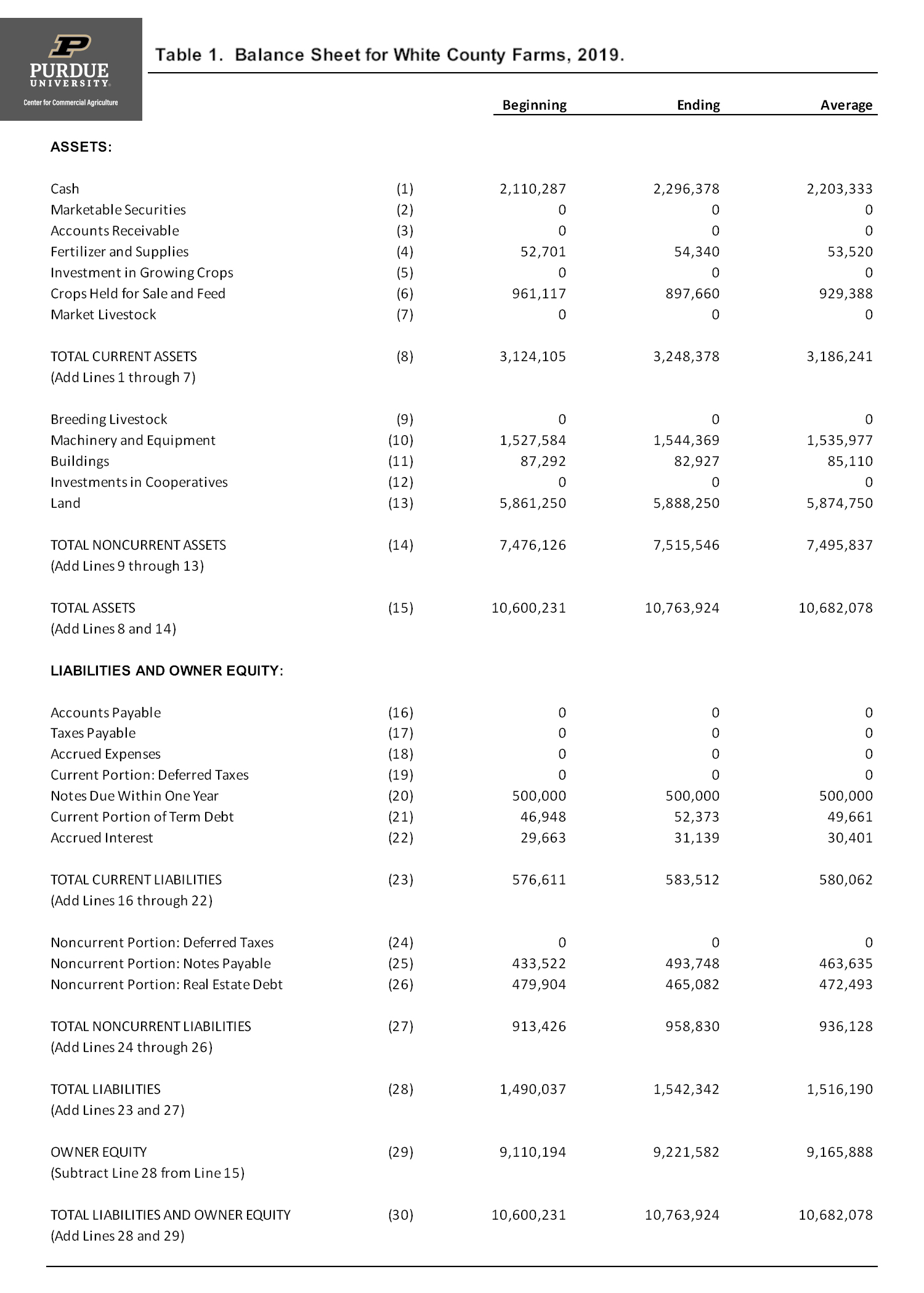

Investors use balance sheets to evaluate a companys financial health. In the Balance Sheet the net defined benefit liability asset shall be recognised. The method of calculation is done by highly technical experts called actuaries is ascertained by preparing a statement known as valuation balance sheet.

Recognised in the Balance Sheet Present Value of Obligations. Request your PitchBook free trial to see how our global data will benefit you. Debt investments and equity investments recorded using the cost method are classified as trading securities availableforsale.

Insurance companies are balance-sheet-driven businesses so well start here with the assets. AJG and Brown Brown Inc. Request your PitchBook free trial to see how our global data will benefit you.

See multiples and ratios. An Actuary is a person who evaluates risk in an insurance given by an insurance company. Youll arguably find the most important aspect of an insurance companys finances in its balance sheet so lets take a look at what you can typically expect to see on an insurers balance sheet.

Content updated daily for company balance sheet. Ad See the value of a company before and after a round of funding. An example of a valuation account that is associated with an asset is.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)