Perfect Unclaimed Dividend In Cash Flow Statement

Are solved by group of students and teacher of Commerce which is also the largest student community of Commerce.

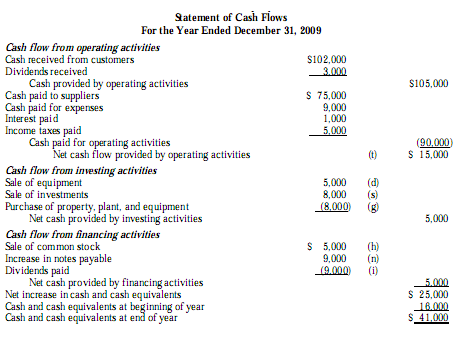

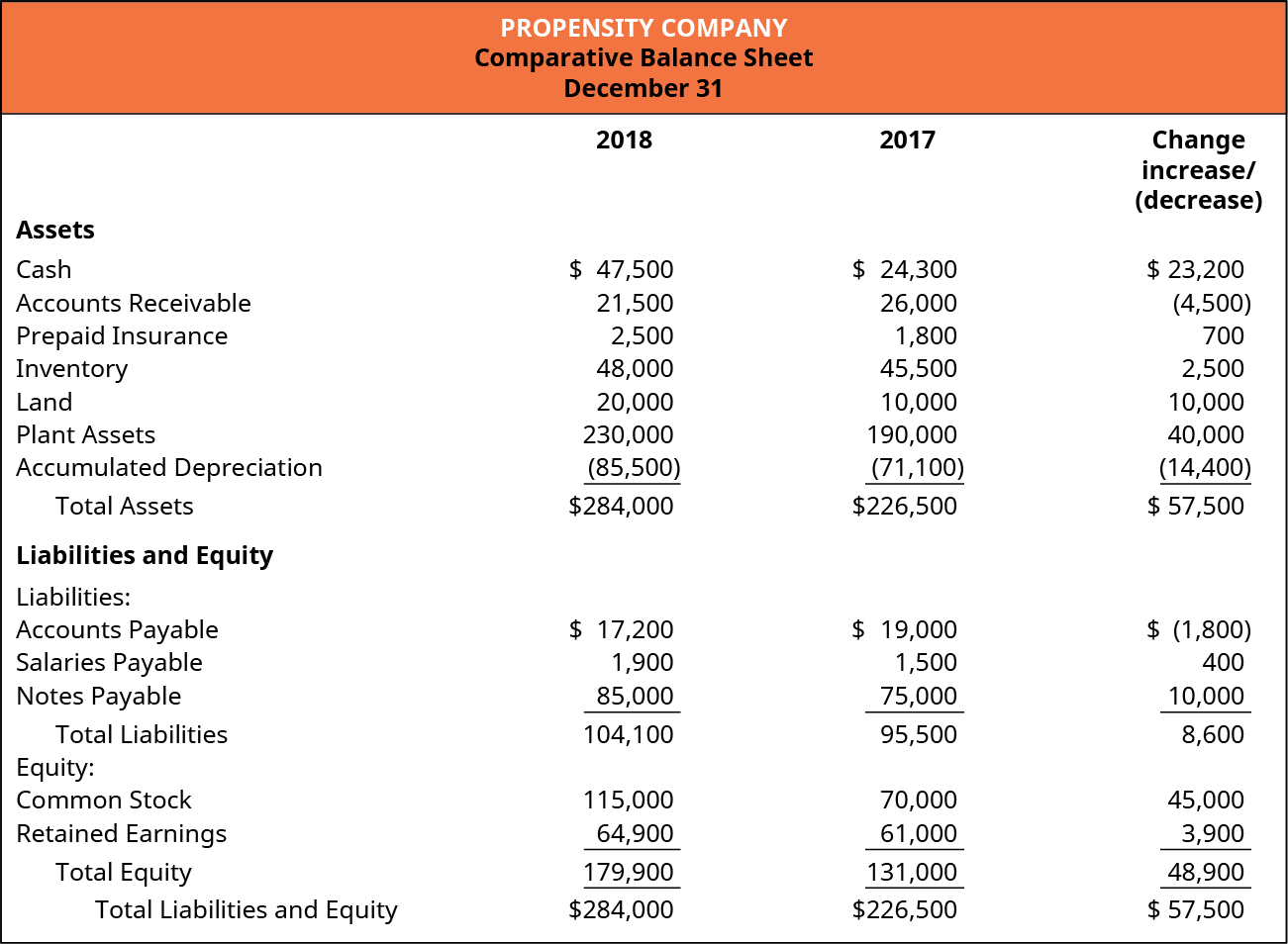

Unclaimed dividend in cash flow statement. For example entity can disclose interest paid either as operating activity or financing activity. Type of Financial Statement. Payment of lease liabilities -670 Interest paid on lease liabilities -149 Unclaimed dividends 15.

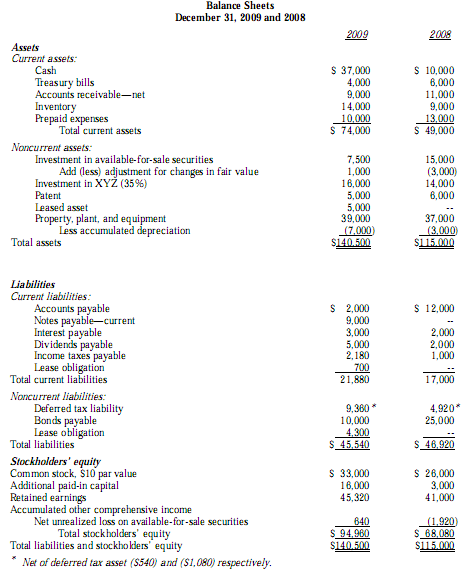

This discussion on How will Unclaimed dividend treated in cash flow statement. For and on behalf of the Board For MGB Co. Unclaimed dividend is shown on the liability side of a balance sheet under the head Reserves and Surplus along with capital.

In Unclaimed dividend account. If a company incurs losses then it is not created. Interim dividend is paid in the same year it is declared.

It appears outside the balance sheet as additional information. Unclaimed dividends 5 1 Repayment of lease liabilities -1655 Interest paid on lease liabilities -288 Net cash used in provided by financing activities 1938 1. Non-current liabilities are reported on a companys balance sheet along with current liabilities assets and equity.

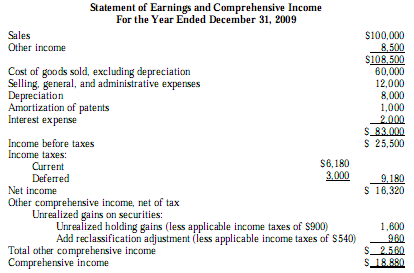

Entity is given an option to make its own decision that under what activity in Statement of Cash Flows the interest paidreceived and dividends paidreceived be disclosed. It is added while calculating profit before tax and the amount paidDeclared - Unpaid or Unclaimed is considered as outflow in financing activities. Is done on EduRev.

Cash flows from financing activities. In simple words each shall be disclosed separately in Statement of Cash Flows. Also it will be added to determine Net Profit Before Tax and Extraordinary Items under Cash Flow from Operating Activities.