Perfect Treatment Of Bad Debts In Profit And Loss Account

It is the object here to examine the question of location in.

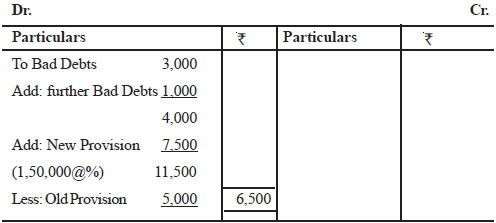

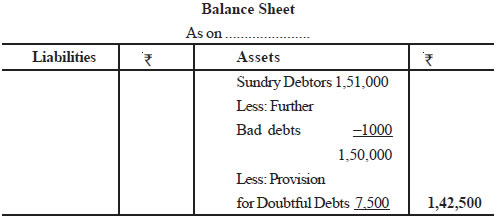

Treatment of bad debts in profit and loss account. After time pass-by and when it is assured that you will never collect that receivable then make permanent write-off by debit to provision for bad debts and credit to Accounts Receivable. Bad debts being an expense are recorded under operating expenses in the income statement or on the debit side of the Profit and loss ac. This can be achieved by a contra account called provision for bad debts.

An additional provision would be made for only 1400. This amount of projected bad debt is recorded to an expense account on the profit and loss statement and added to allowance for doubtful accounts on the balance sheet. Bank money is received 80000.

But the accountant is unsure when or how much the lossexpenses may occur. Thus the total debit to profit and loss account of Year 2015 would be 6820 ie. ALLOWANCE FOR BAD DEBTS EXPS CR.

The result appears as Net Accounts receivable. So the amount needs to be written off immediately in the books of accounts by crediting the Customers Account in the Debtors ledger and debiting the Bad Debts Account in the general ledger. A provision for bad debts is the different from the bad debts where the loss or expenses is certain.

Being money received from earlier bad debts. Bad Debts Written Off Income Statement 80000. When there is a bad debt debit your ADA account and credit your accounts receivable account.

Next year the actual amount of bad debts will be debited not to the Profit and Loss Account but to the Provision for Bad and Doubtful Debts Account which will then stand reduced. The idea is that a certain amount of bad debt can be expected for a given amount of sales based on historical data. But in this case all assume according to past records of the business.