Supreme Balance Sheet Reconciliation Meaning

What does this process mean for any business.

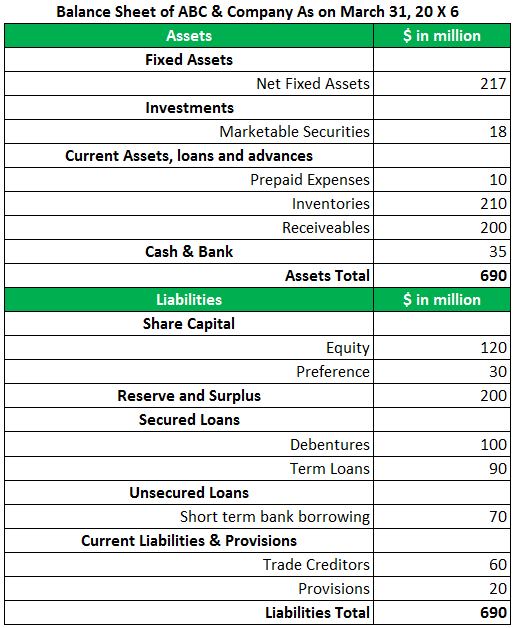

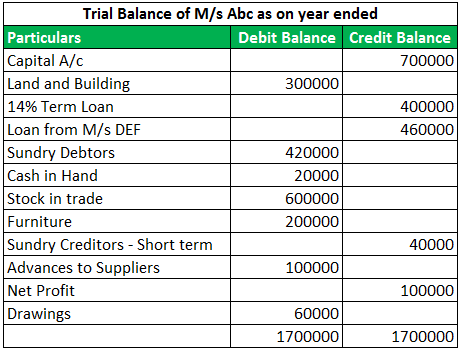

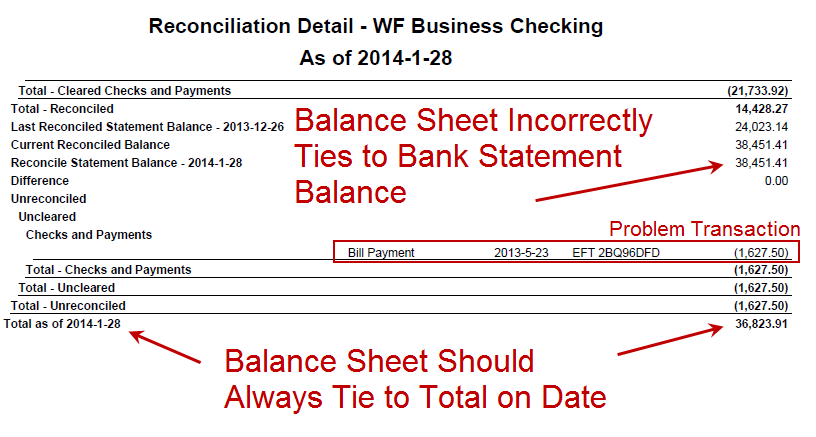

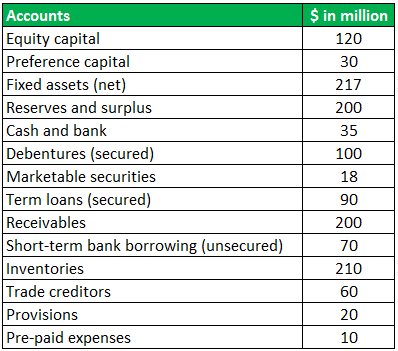

Balance sheet reconciliation meaning. A balance sheet ledger account reconciliation is the comparison of an asset or liability balance in the general ledger to another source of financial data such as a. According to Investopedia the definition of account reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. They are done at regular intervals and are a part of routine accounting procedures.

Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. Some reconciliations are necessary to ensure that cash inflows and outflows match between the income statement the balance sheet and the cash flow statement. Reconciling your companys balance sheet is one of the key elements to closing the books at the end of an accounting period.

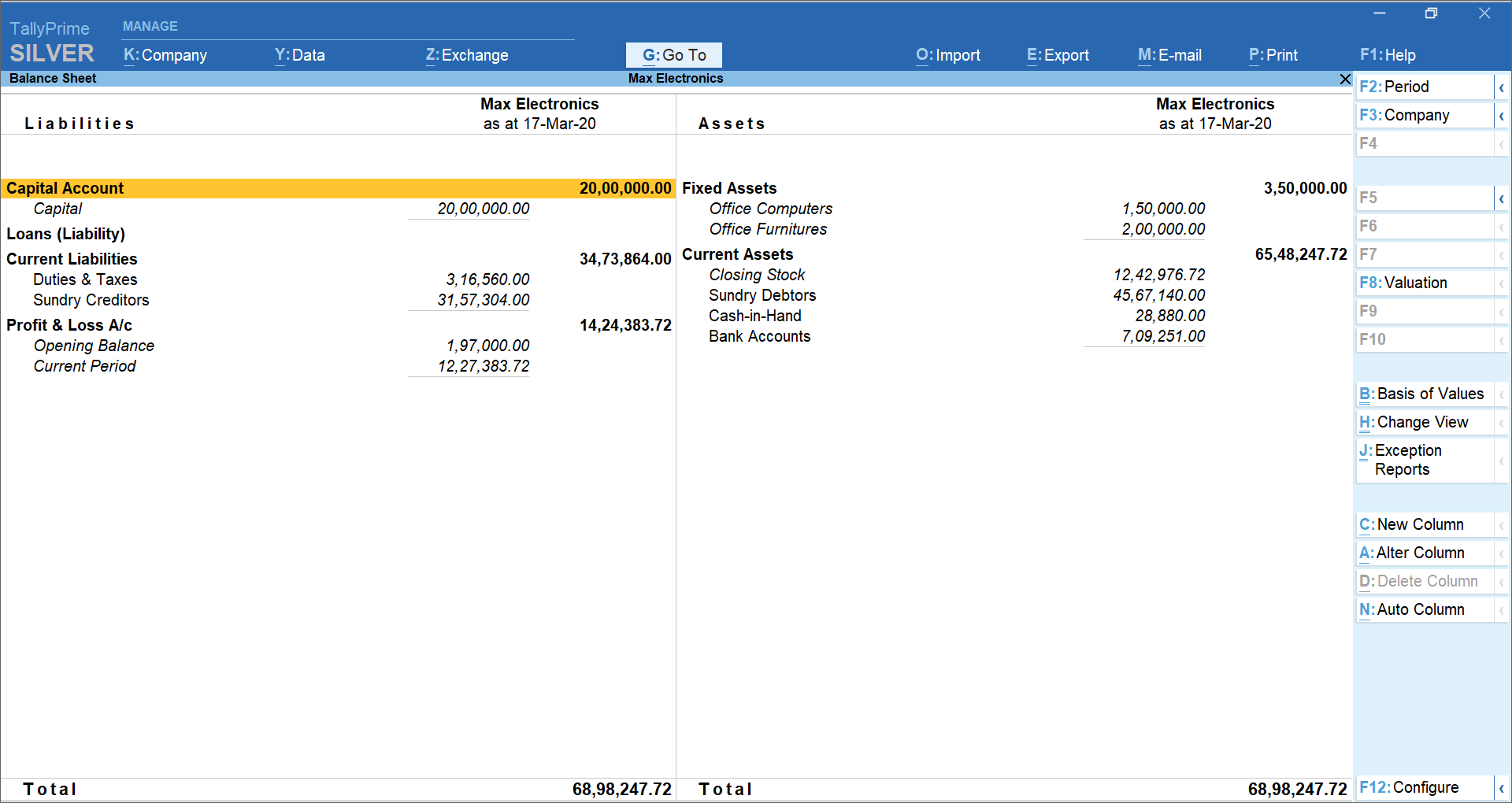

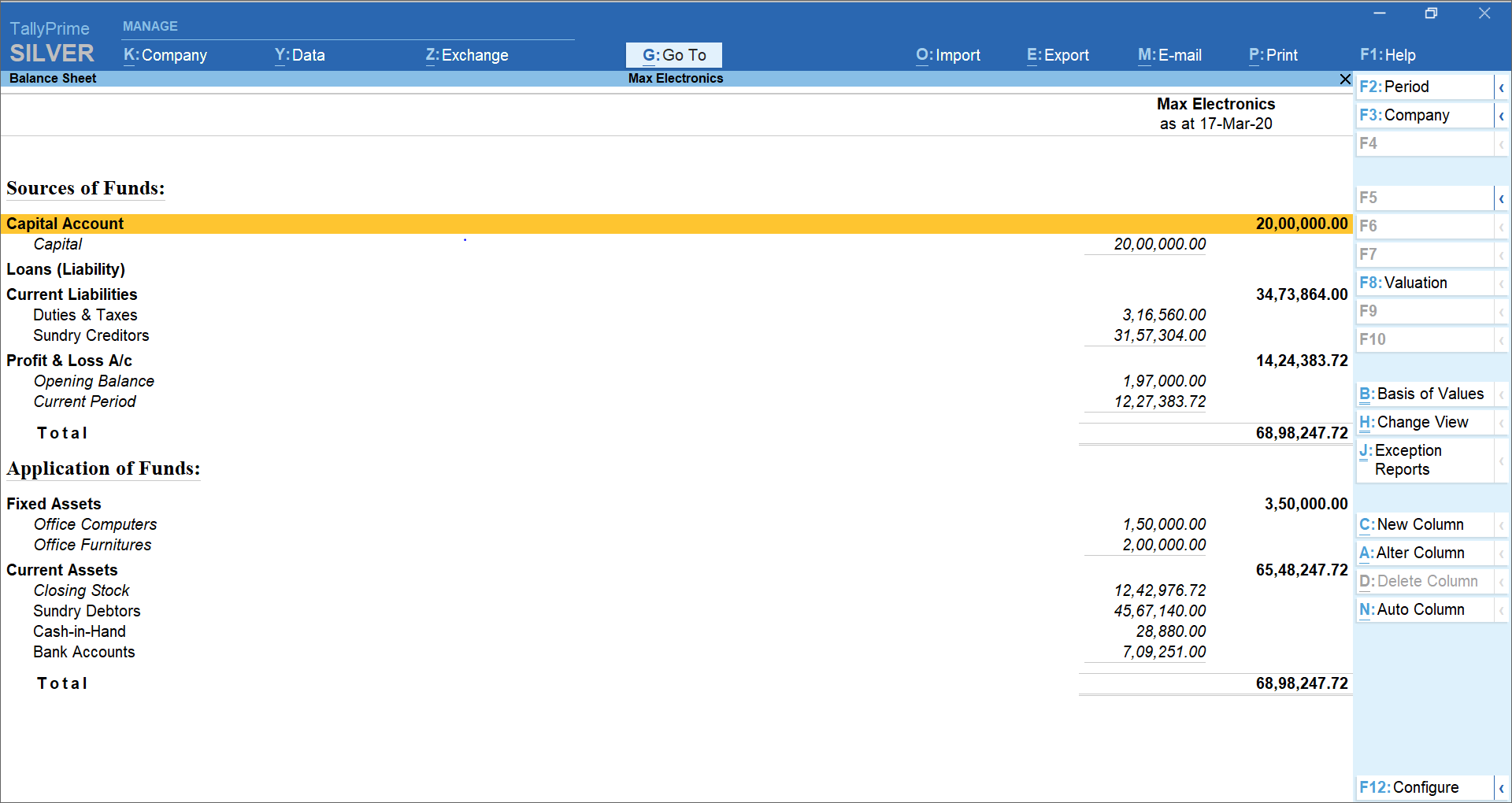

Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. Reconciliation is an accounting process that ensures that the actual amount of money spent matches the amount shown leaving an account at the end of a fiscal period. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet to the corresponding amount on its bank statement.

Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances while also ensuring that any differences between the two are adequately and reasonably explained. Reconciling the two accounts helps identify whether accounting changes are needed. A reconciliation is the process of comparing all the line items that appear on the balance sheet against the transactions that make up those balances.

One way to ensure the accuracy of the balance sheet is to conduct a balance sheet reconciliation at the end of every month or quarter. It includes cross-checking the closing balance of all the components of the balance sheet. This is known as balance sheet reconciliation and is extremely crucial for your business.

GAAP requires that if the direct method of presenting the cash flow statement is used the company must still reconcile the cash flows with the income statement and balance sheet. Balance sheet reconciliations are a vitally important part of a companys financial reporting process. They provide support and evidence that the numbers are accurate.