Out Of This World 26as Statement Means

Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

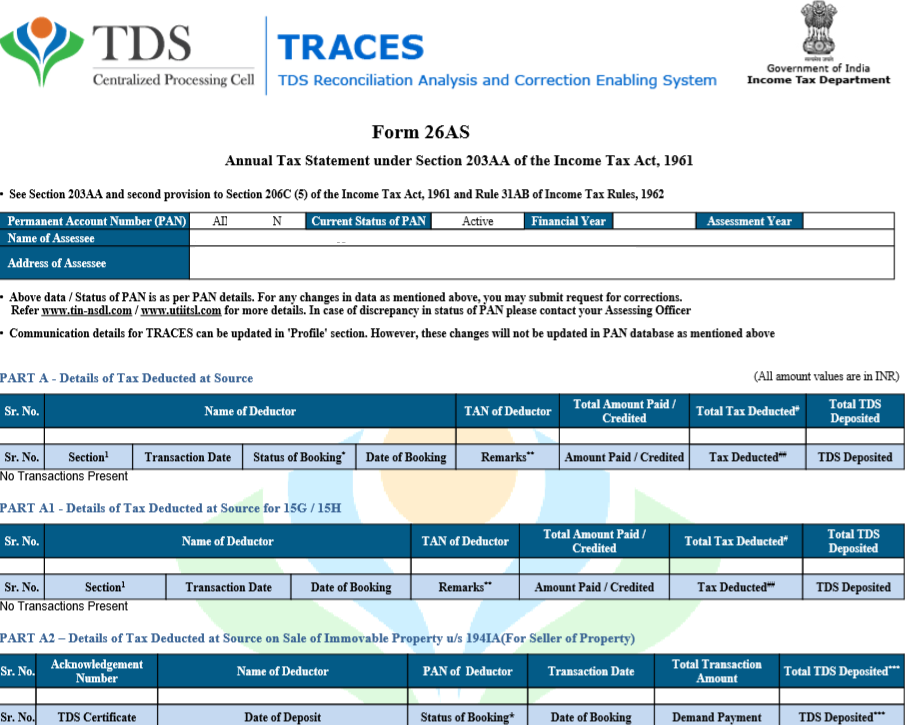

26as statement means. In May the Income Tax Department notified the new annual information statement in Form 26AS. Form 26AS is a consolidated tax deduction statement which keeps all your annual record of any tax paid by you or on your behalf. It is advised to download your form 26AS to recheck the TDS and advance tax paid before filing income tax return.

Form 26AS is introduced by income tax department and tdscpcl. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary pension. It is also known as Tax Credit Statement or Annual Tax Statement.

View Tax Credit Statement Form 26AS Perform the following steps to view or download the Form-26AS from e-Filing portal. This feature is available for only those valid PANs for which TDS TCS statement has been previously filed by the deductor. However not all banks provide the facility.

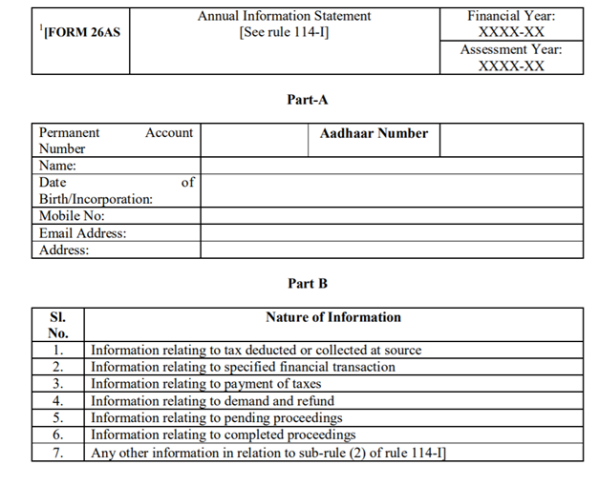

The Budget for 2020-21 had announced the revised Form 26AS giving a more comprehensive profile of the taxpayer going beyond the details of tax collected and deducted at source. Form 26 AS contains the details of the tax credit in an account or appearing in the Permanent Account Number of the respective assessee as per the records of the Department of Income Tax which can later be claimed by the taxpayer. Following SFT will be reported in Form 26AS.

If you have Form 26AS and you find that all taxes are shown in this form then there is no need to collect form 16-A also. Details of Tax Deducted at Source TDS from the taxpayers income. With the help of Form 26AS we can view all the detail relating to income tax paid TDS deduction refund and transaction relating Annual Information Report etc.

You can also verify TDS certificate issued to you in the form of form 16 16A by your deductor against Form 26AS. Form 26AS is an annual statement which includes all the details pertaining to the tax deducted at source TDS information regarding the tax collected by your collectors the advance tax you have paid self-assessment tax payments information regarding the refund you have received over the course of a financial year regular assessment tax that you have deposited and information regarding high-value. It is a really useful tool which not only gives you annual tax related information but also saves you from income tax noticesIn this part we will analysis each part of form 26AS.