Neat Low Current Ratio Interpretation

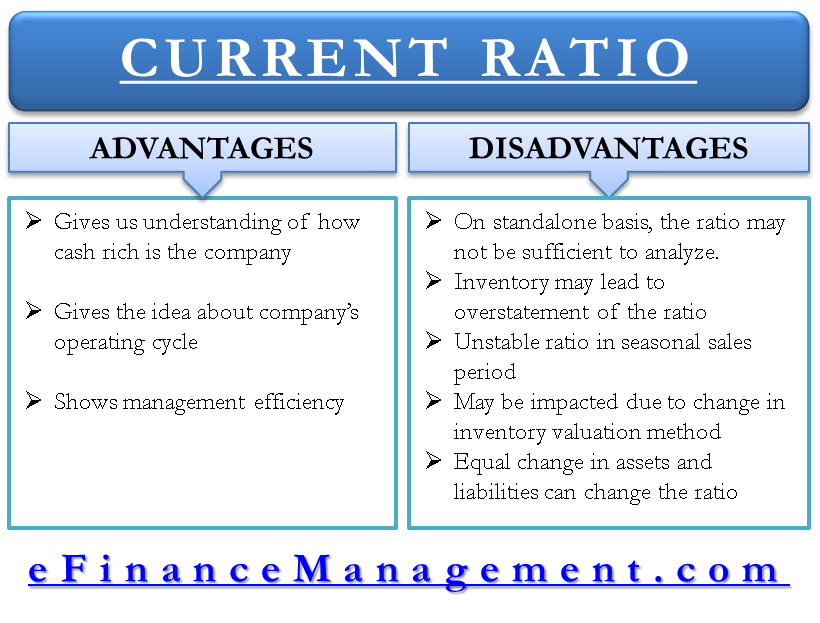

There is no such thing as an ideal current ratio a good point to make in an exam.

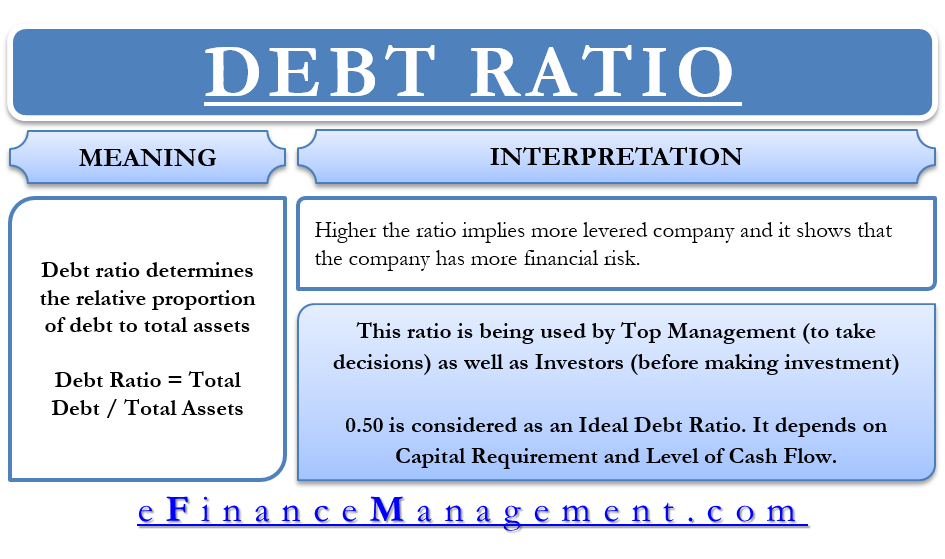

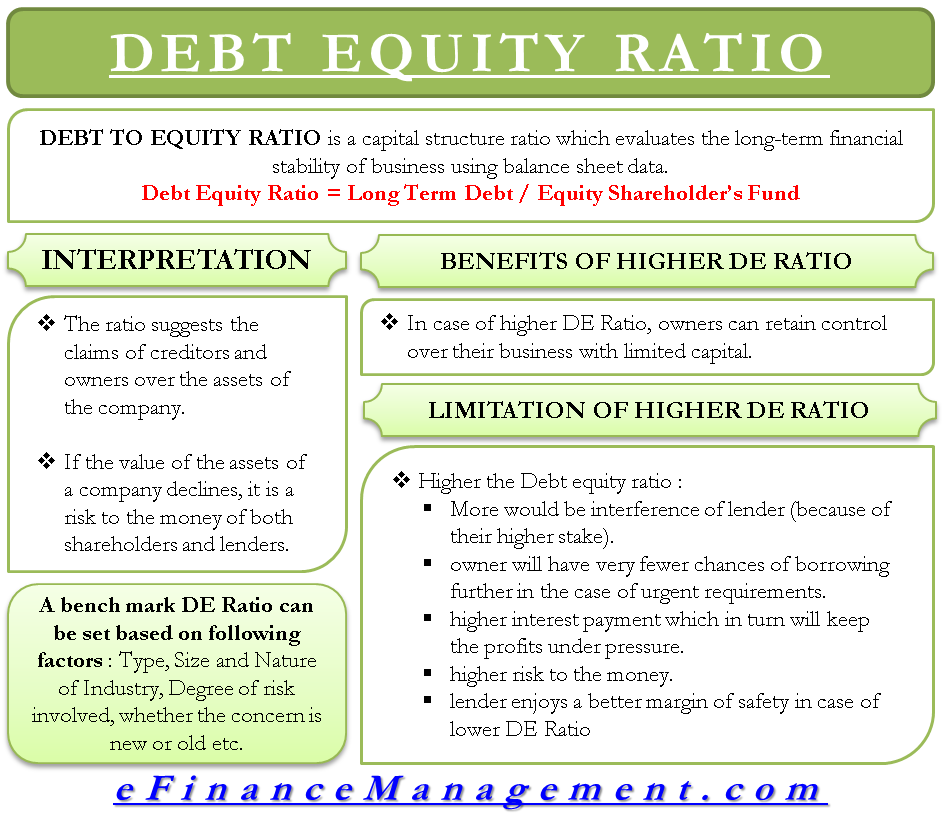

Low current ratio interpretation. The amounts collected from debtors is not satisfactory. Debt To Equity. Reasons of High Current Ratio.

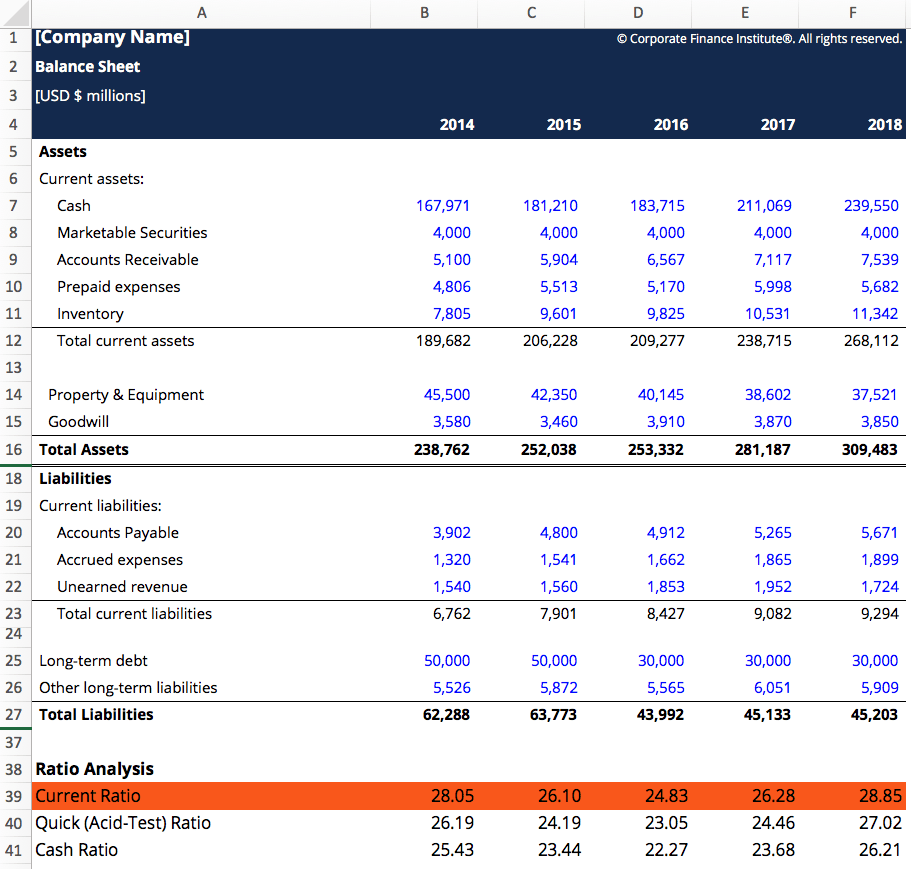

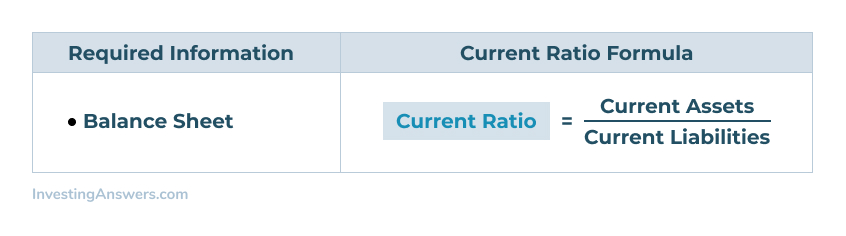

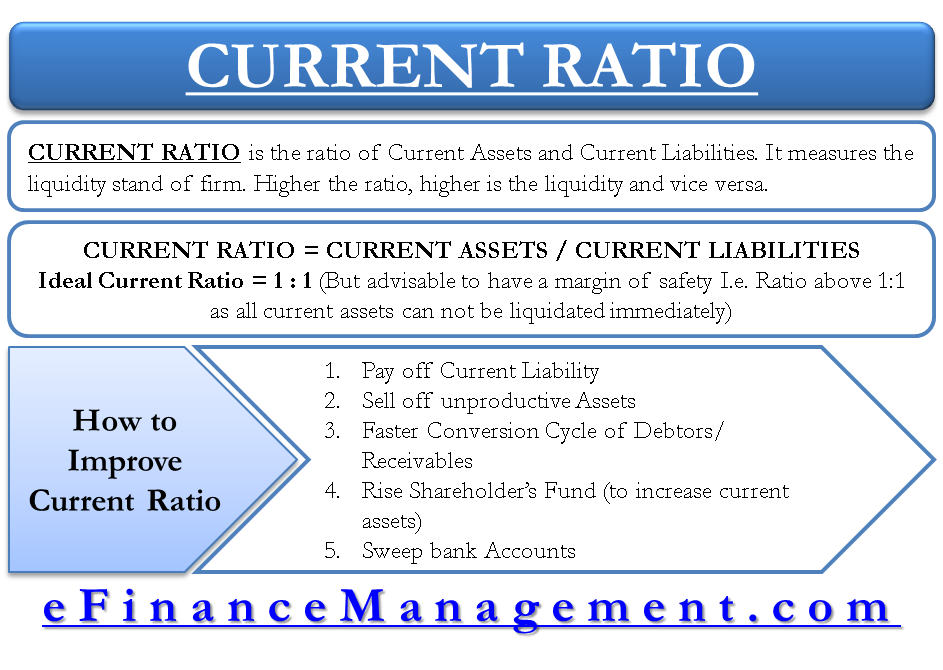

A minimum Current Ratio of 1 is usually a good sign although 15 or 2 is safer. The current ratio is balance-sheet financial performance measure of company liquidity. A low current ratio of less than 1 indicates that the companys current liabilities are more than its current assets and the business may not be able to cover its short-term debt with its existing financial resources.

It is important to note that both of these are current. At the outset the point of thinking is that why do we need to manage liquidity position. If Current Assets Current Liabilities then Ratio is equal to 10 - Current Assets are just enough to pay down the short term obligations.

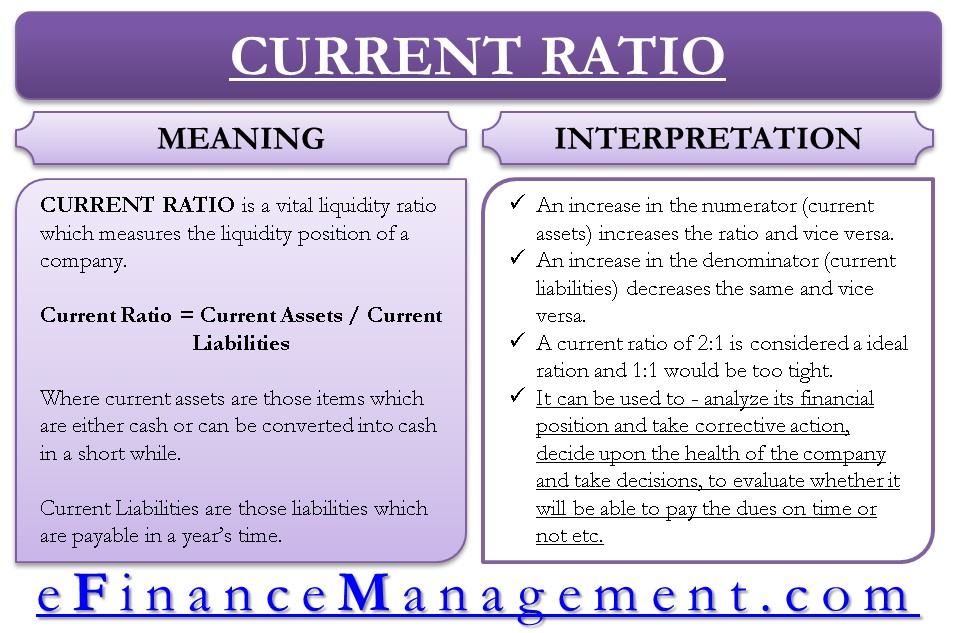

Interpretation of Current Ratios. Different businesses and industries work with different levels of cover. Short term obligations also known as current liabilities are the liabilities payable within a short period of.

Current ratio also known as working capital ratio is a popular tool to evaluate short-term solvency position of a business. However if the ratio is below 1 a company can still operate if it generates strong cash flow or has access to. Current ratio may be defined as the relationship between current assets and current liabilities.

It is one of the liquidity ratios calculated to manage or control the liquidity position of a company. The current ratio is calculated by dividing a companys current assets by its current liabilities. It indicates poor sale.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)