Amazing Loss On Disposal Of Assets Cash Flow

When a company sells fixed assets such as property and equipment and collects proceeds amounting to less than the assets book value a loss on the disposal of assets is recorded as a nonoperating loss on the.

Loss on disposal of assets cash flow. It is because both the cash proceeds and carrying amount are zero. Hence there is a gain of 1000. An asset is fully depreciated and must be disposed of.

The coverage limits provide protection for securities and cash up to an aggregate of 150 million subject to maximum limits of 375 million for any one customers securities and 900000 for any one customers cash. Cash inflows from disposal of fixed assets is reflected in the cash flows from investing activities section of the statement of cash flows. 1000 gain Gain 3500-30000275001000 The book value of the asset is 2500 it is sold for 3500.

The debited account is Accumulated Depreciation and the credited account is the relevant Asset account eg Fixed Assets or Equipment. The asset disposal may be a result of several events. This video shows how to account for the disposal of a fixed asset on the Statement of Cash Flows.

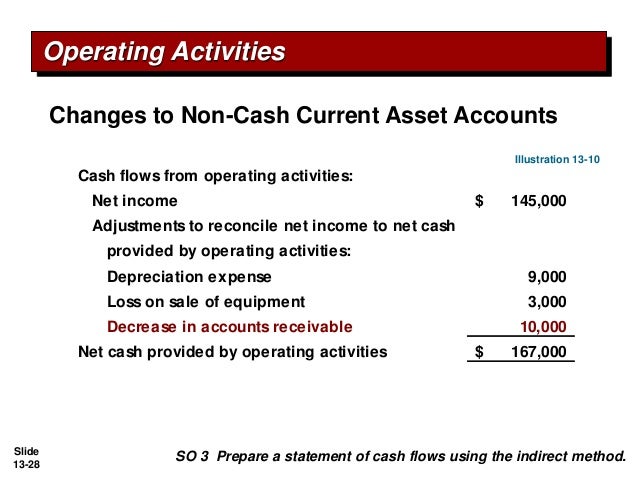

The cash flow statement shows the impact of your companys sales and profit generating or operating activities on its cash. In that initial reconciliation the profit before tax is adjusted for expenses that have been charged against profit that are not cash out flows. If the proceeds are more than book value the result is a gain.

The cash proceeds from the sale of the fixed asset are sho. Loss on Disposal of Assets When a company sells fixed assets such as property and equipment and collects proceeds amounting to less than the assets book value a loss on the disposal of assets is recorded as a nonoperating loss on the income statement. What is the amount of the gain or loss on disposal of the fixed asset.

Enter any proceeds from the sale of the asset in the disposal account. Definition Disposal account The disposal account is the account which is used to make all of the entries relating to the sale of the asset and also determines the profit or loss on disposal. An asset is sold because it is no longer useful or needed.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)