Best Interest On Bank Overdraft In Balance Sheet

Ad Find Bank overdraft.

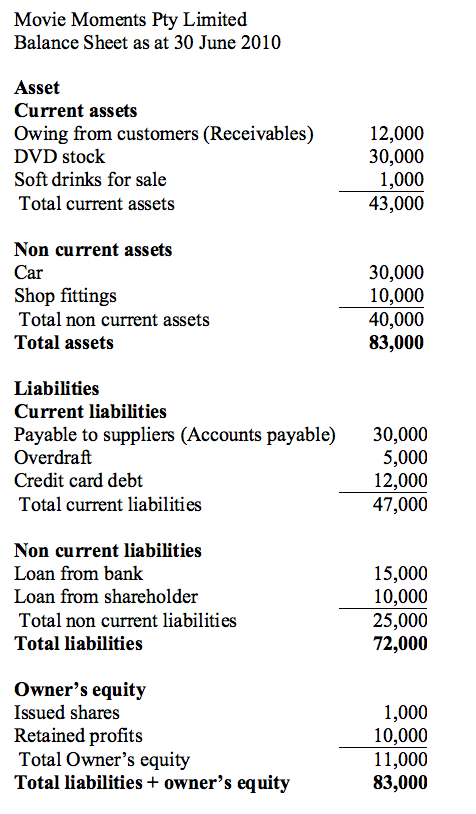

Interest on bank overdraft in balance sheet. Ad This is the newest place to search delivering top results from across the web. Debenture Interest Unpaid Dividend and Bank Overdraft From the following Balance Sheet s of A Ltd. The overdraft loan period is 6 months from June 1 to December 1 2020 with an interest of 12 per year on the used amount.

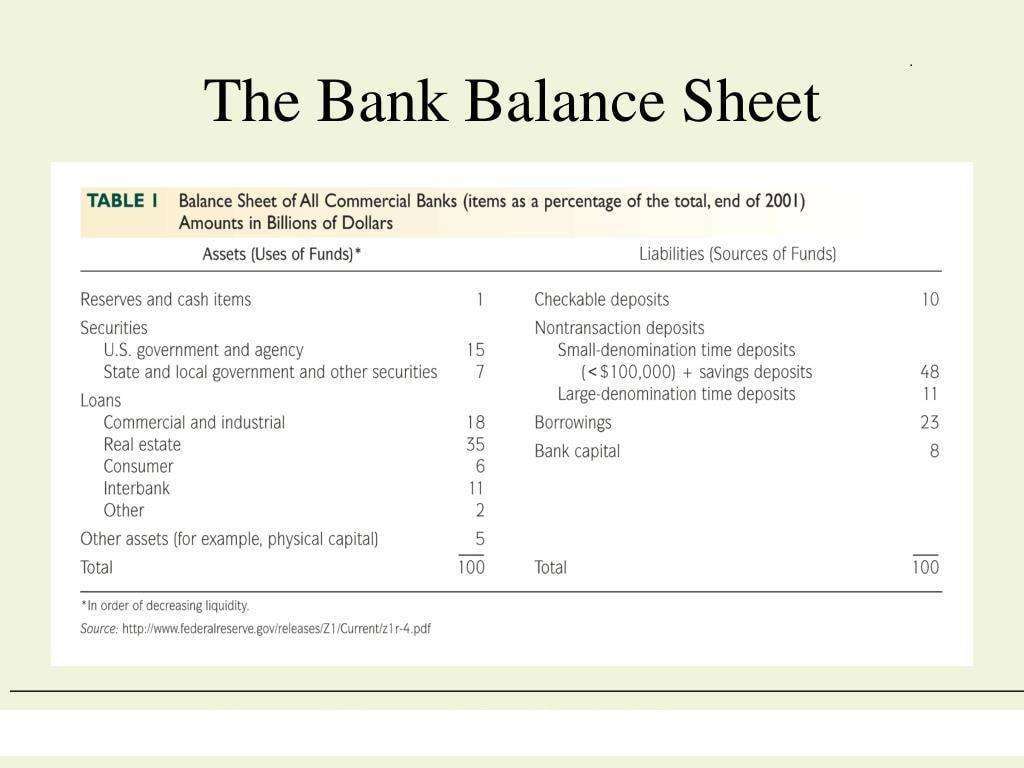

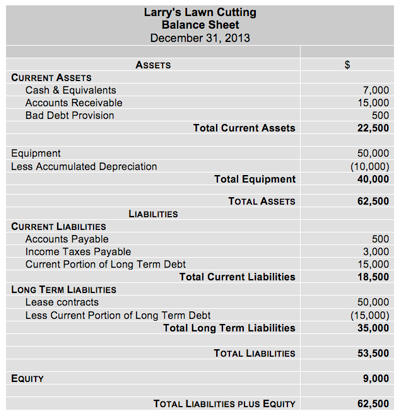

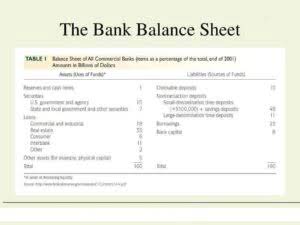

Short term borrowing to help fund a temporary shortage of funds is more likely to involve a bank overdraft. A sole trader accounts capital account is overdrawn per the Balance Sheet. Part of an entitys cash management.

At an enquiry into his accounts and tax return the inspector says that because the capital account is overdrawn in the accounts Due to the level of drawings taken from the business therefore the bank interest paid and claimed in the Profit and. A bank loan is shown on the balance sheet as a long-term liability. Ad Find Overdraft Bank.

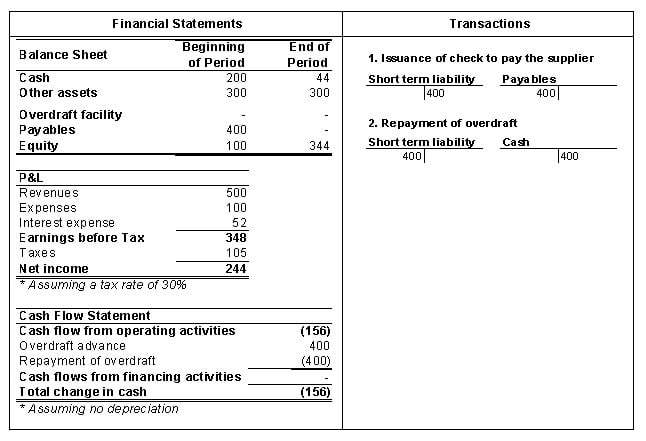

Bank charges on the company bank account are allowable as is interest on an overdraft or bank loan. Prep are Cash Flow S tatement as per AS-3 Revised. In that case bank overdrafts are included as component of cash and cash equivalents.

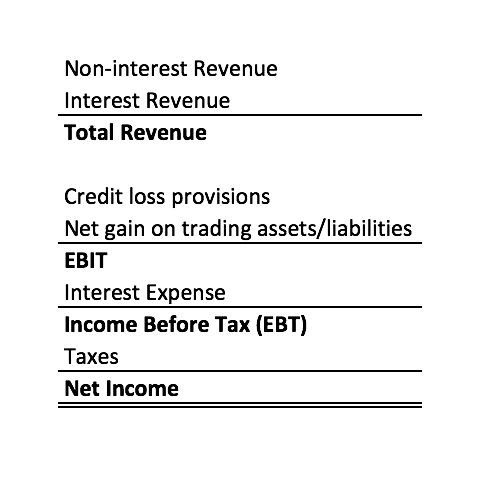

Interest on the loan is recorded as an expense on the Profit and Loss Account. Of course any interest and fees indicated on the banks overdraft statement will need to be reported generally entered as an expense on the profitloss sheet. Any capital repayments will reduce the long-term liability on the balance sheet.

In case of fixed loans one has to pay the interest on the loan amount irrespective of the bank balance. The company ABC is required to pay back any amount of overdraft used with the interest at the end of the overdraft loan period. Find content updated daily for banks that allow overdrafts.