Heartwarming Income Statement And Related Information

Thus the income before extraordinary items is.

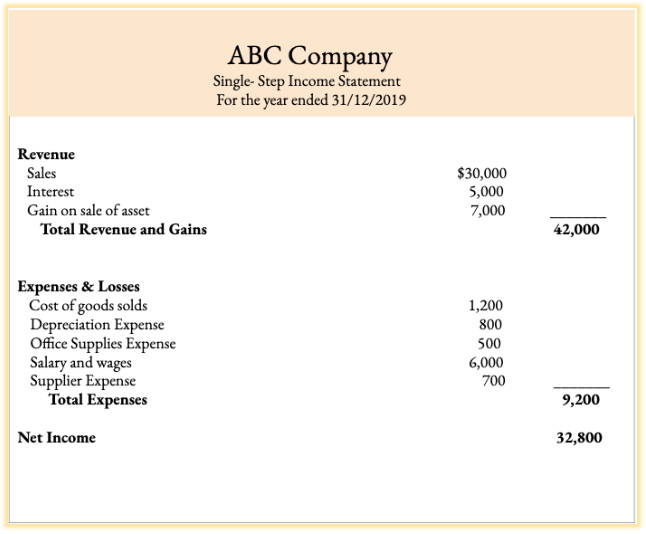

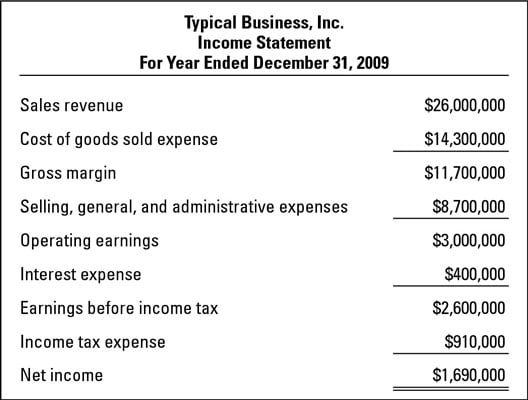

Income statement and related information. FElements of the Income Statement Gains Increases in equity net assets from peripheral or incidental transactions. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. Questions related to finance.

CHAPTER 4 INCOME STATEMENT AND RELATED INFORMATION IFRS questions are available at the end of this chapter. Limitations of the income statement. An income statement is one of the most common and critical of the financial statements youre likely to encounter.

Peripheral or incidental transactions. Income Statement and Related Information Intermediate Accounting 13th - Donald E. The income statement is one of three statements.

What information provided by a variable income statement is used in computing the break even point id this information on absorption costing income statement. Income Statement and Related Information Chapter 4 Intermediate Accounting 12th Edition Kieso Weygandt and Warfield Prepared by Coby Harmon University of Slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. - The firm is taxed at a 10 rate each year.

Income Statement and Related Information. This course was aimed to introduce the accounting standards setting process and regularities and professionals bodies which create this standards furthermore. The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time.

Usefulness of the income statement. The income taxes payable for the year are 1080000 including 360000 that is applicable to an extraordinary gain. Income Statement and Related Information Description.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)