Beautiful Ratio Analysis Of Titan Company

Ad See all the ways PitchBook can help you explore company data.

Ratio analysis of titan company. Core EBITDA Margin 1172 1006 1018 863 804 961. Research and analyze 3 Million companies. Startups venture-backed PE-backed and public.

1984-Dividend payout ratio cash profit 2938. In 2012 the ratio goes up to 109 as compared to 2011 which means that the company has the ability to pay its liabilities as the definition says that higher the ratio. COMPANYS GROWTH OVER THE YEARS.

Cash earnings retention ratio. Research and analyze 3 Million companies. The company has a good cash flow management.

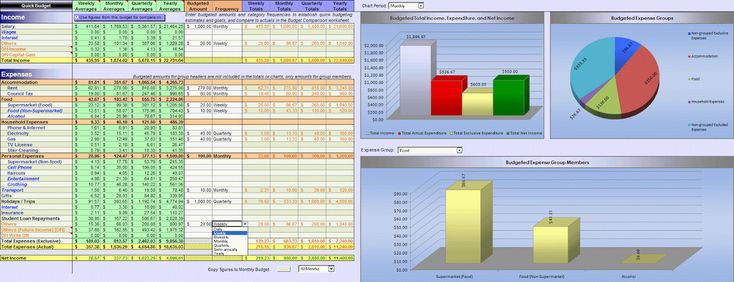

Current Ratio Current Assets Current Liabilities This ratio denotes the operating financial health of the company. ROA 1196 1316 1235 849 973 1366. Operating Margin 914.

You should be able to track the changes in TITAN COMPANY individual financial statements over time to develop the understanding of its risk liquidity profitability or other critical and vital indicators. Company including debt equity ratio turnover ratio etc. The current ratio measures the companys ability to pay short-term and long-term obligations.

This is due to the jewellery business where inventory turnover is low. TITAN TITAN Stock Analysis Notes. Financial Ratios Analysis of Titan Company Ltd.