Cool Inventory Note Disclosure Example

Importance of the Notes.

Inventory note disclosure example. Sample 1 Sample 2 Based on 2 documents. In addition a manufacturer and others with inventory should disclose the method for valuing the inventory. Keeping in touch 226 Acknowledgements 228.

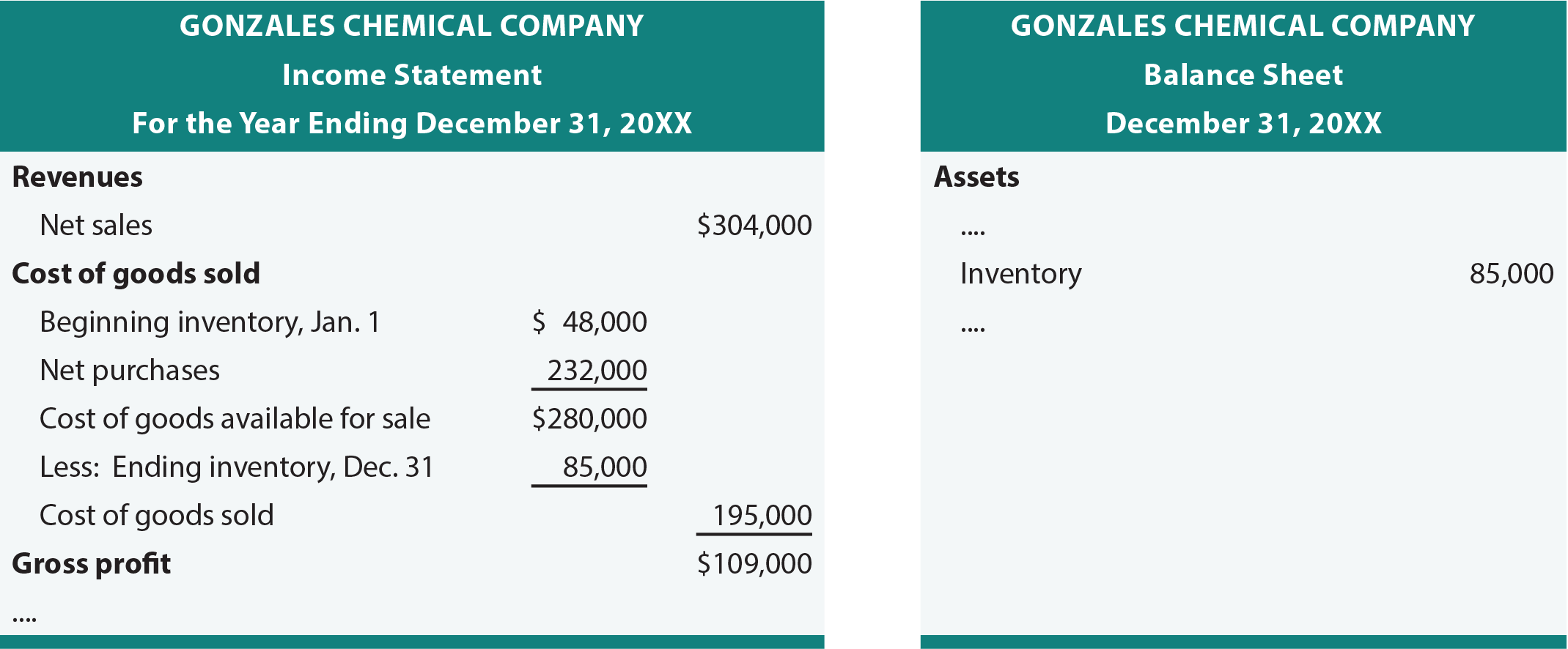

Notes to the Financial Statements for the financial year ended 31 December 2005 These notes form an integral part of and should be read in conjunction with the accompanying financial statements. 16 Inventory Inventory is stated at the lower of cost or net realisable value while cost is determined on a first-in-first-out basis. Disclosures required by the Singapore Companies Act SGX-ST Listing Manual and FRSs and INT FRSs that are issued at the date of publication August 31 2017.

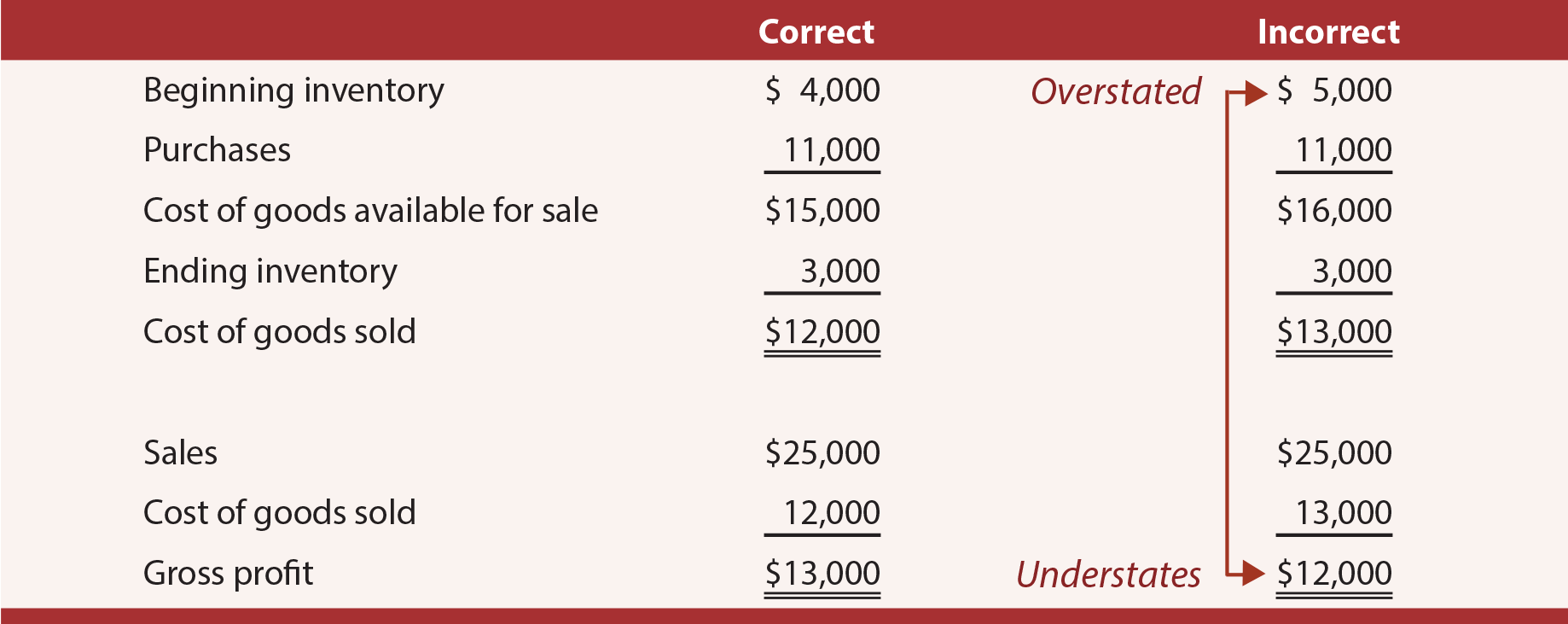

Company ABC is a manufacturing company specialized in the manufacturing of. For example if you estimate that youll have to write off 10000 of inventory in the period because of obsolescence credit the reserve account allowance for obsolete inventory and debit either. Basically the inventory method has such a distorting effect on ending inventory and costs of goods sold that the only way you could get a reasonable comparison for those firms would be to convert the LIFO firm to FIFO which were going to do right now in an example.

Inventory comprise of stationery that shall. US GAAP does not require the disclosure of write-down reversals because US GAAP does not allow for the reversal of write-downs. This update was effective for our fiscal year beginning January 1 2010 except for the gross presentation.

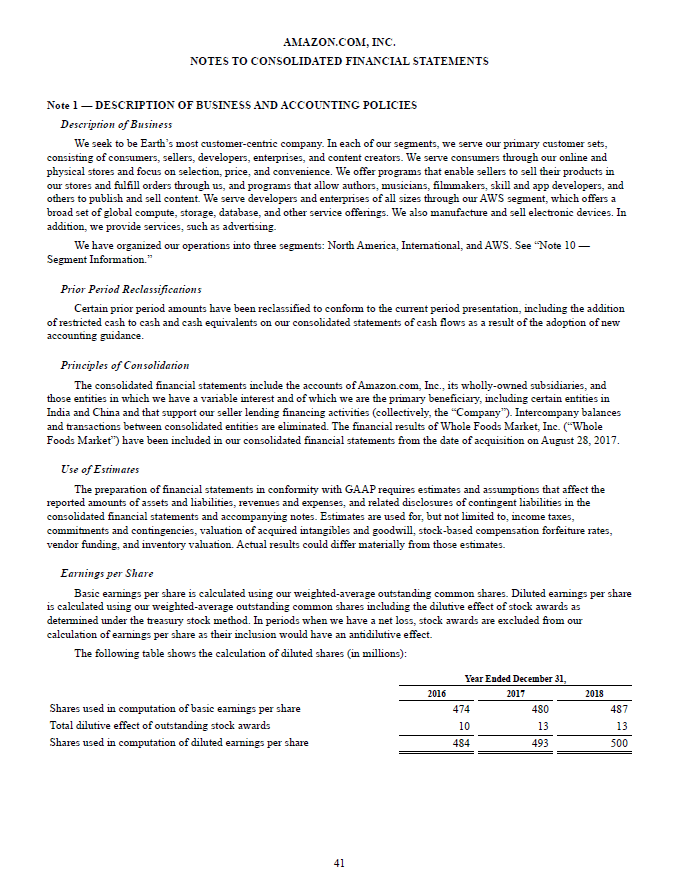

Disclosures that are applicable to public business entities subsequent to the issuance of ASU 2013-12. Notes to Consolidated Financial Statements. IV Example disclosures for entities that early adopt.

An example would be a business combination after the balance sheet date. Items in brackets indicate alternative disclosures. Net realisable value represents the estimated selling price in the ordinary course of business less any costs incurred in selling and distribution.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)