Marvelous Horizontal Analysis Is The Comparison Of

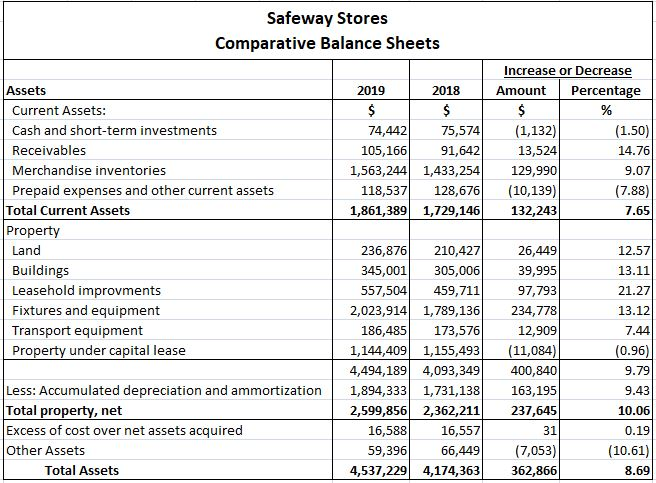

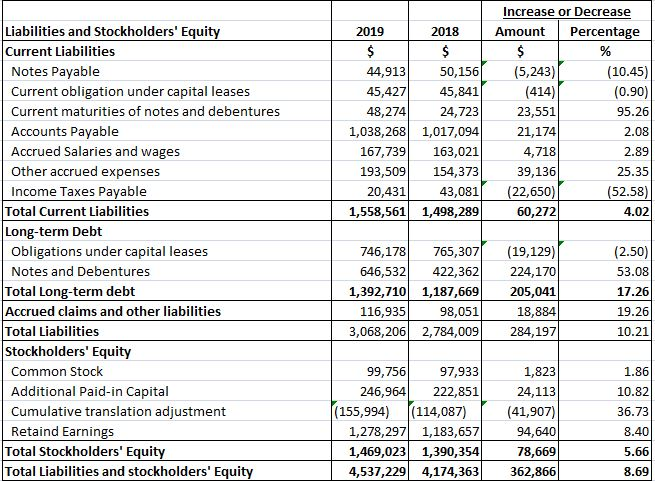

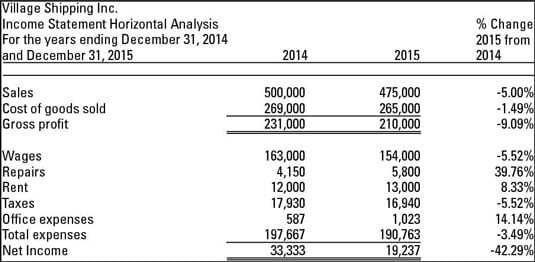

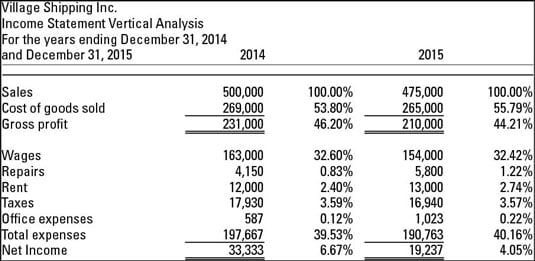

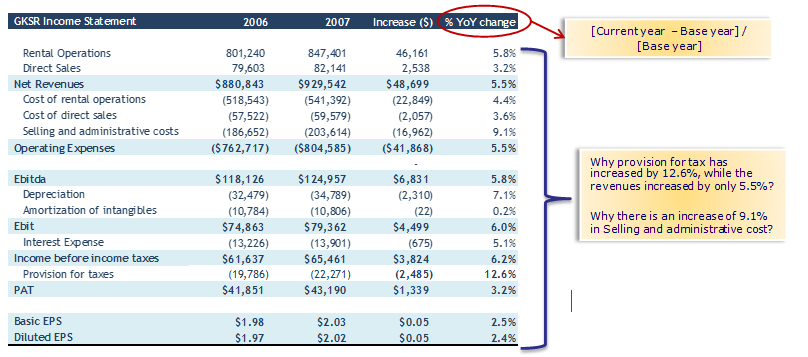

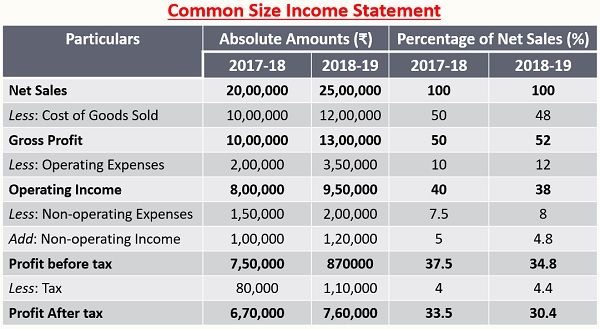

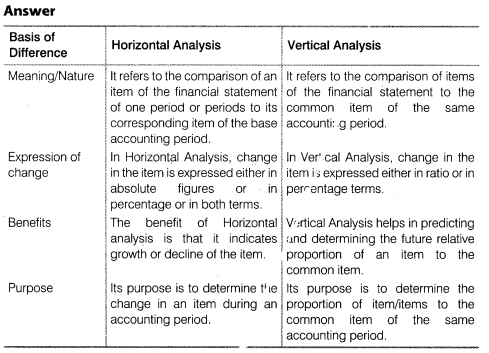

Definition Horizontal analysis is a process used to analyzed financial statements by comparing the specific financial information for a particular accounting period with information from another period.

Horizontal analysis is the comparison of. Horizontal analysis is used in financial statement analysis to compare historical data such as ratios or line items over a number of accounting periods. What Is Horizontal Analysis. Year used for comparison.

It denotes the percentage change in the same line item of the next accounting period compared to the value of the baseline accounting period. Definition of Horizontal Analysis Horizontal analysis looks at amounts from the financial statements over a horizon of many years. Definition of Horizontal Analysis Horizontal Analysis is that type of financial statement analysis in which an item of financial statement of a particular year is analysed and interpreted after making its comparison with that of another years corresponding item.

Horizontal analysis refers to the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters months or years. Financial information that can be compared from one accounting period to another or from one business to another. What is Horizontal Analysis.

WHAT IS HORIZONTAL ANALYSIS. Horizontal analysis is the comparison of a companys financial condition and performance across time. The analysis uses such an approach to analyze historical trends.

Horizontal analysis uses a line-by-line comparison to compare the totals. Horizontal analysis is the comparison of each financial statement amount to another amount on the same financial statement. Horizontal analysis also called time series analysis focuses on trends and changes in numbers over time.

By contrast a vertical analysis looks only at one year. A horizontal analysis typically looks at a number of years. This is why horizontal analysis is also called Trend analysis.