Amazing Interpretation Of Comparative Balance Sheet

These three balance sheet segments give investors an idea as to what the company owns and owes as well as the amount invested by the shareholders.

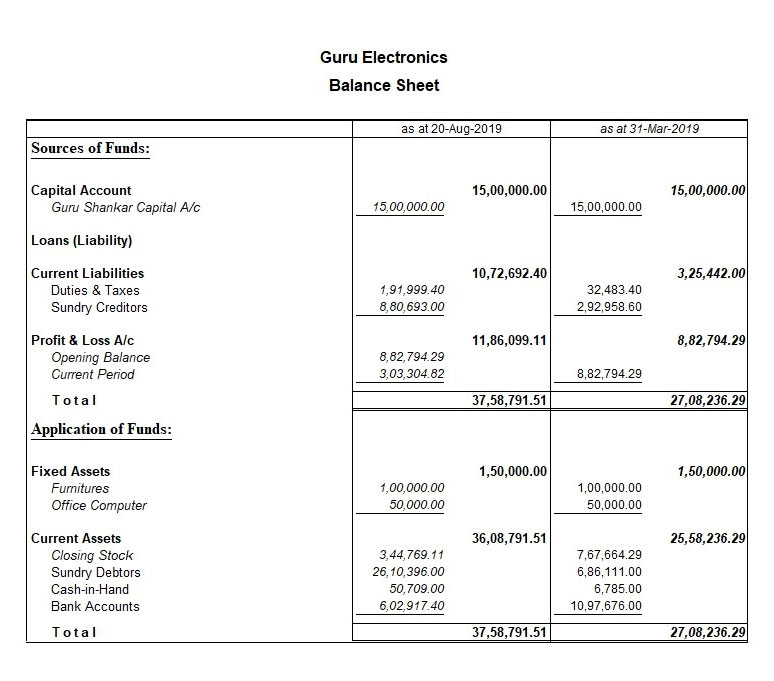

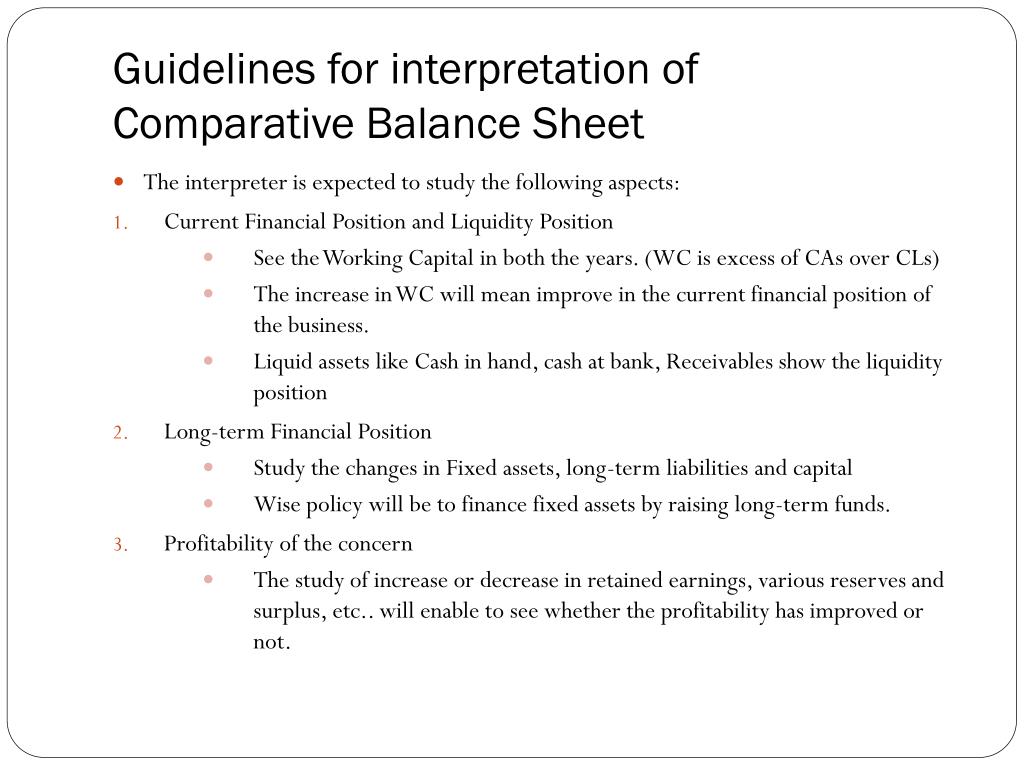

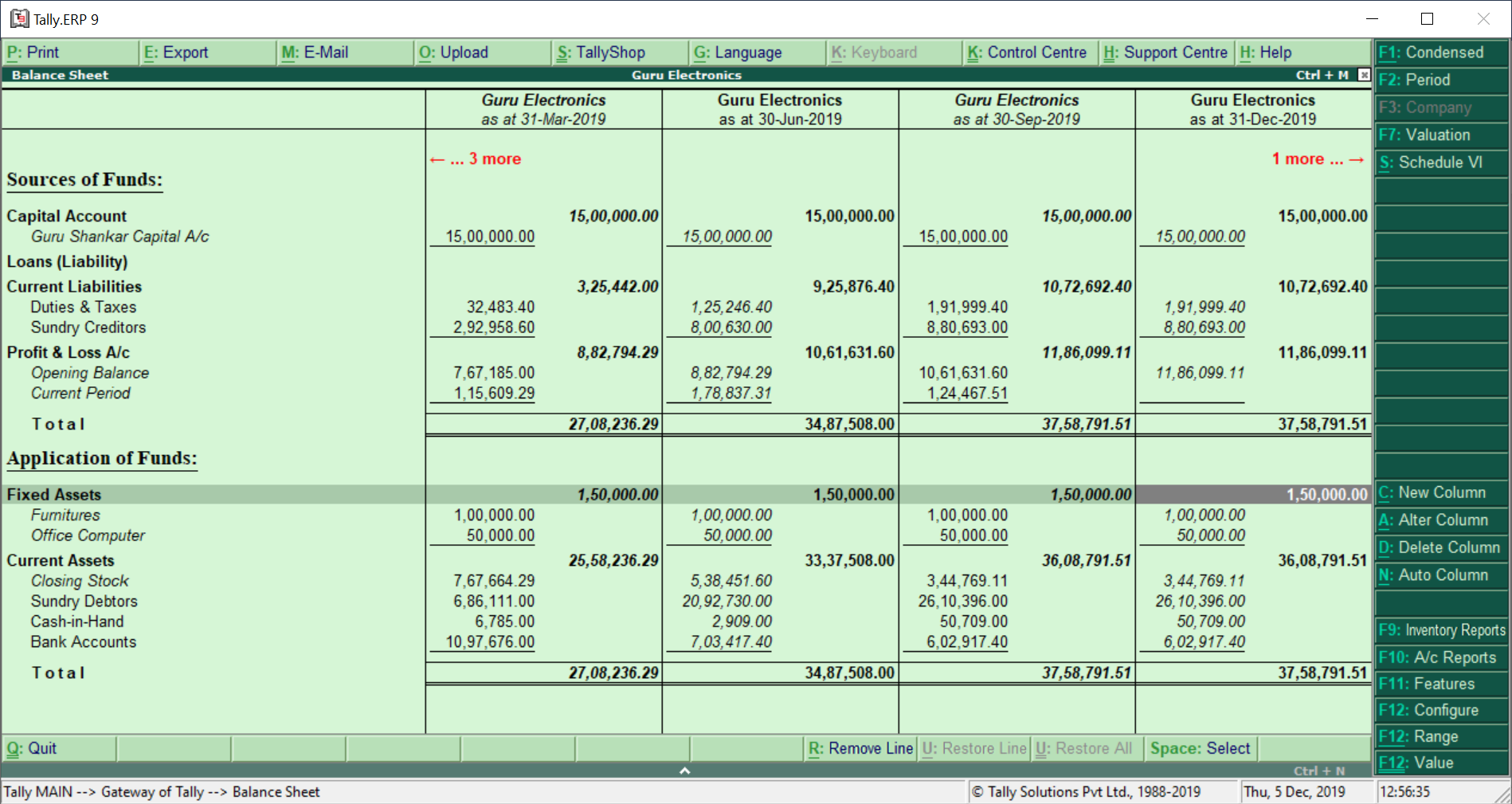

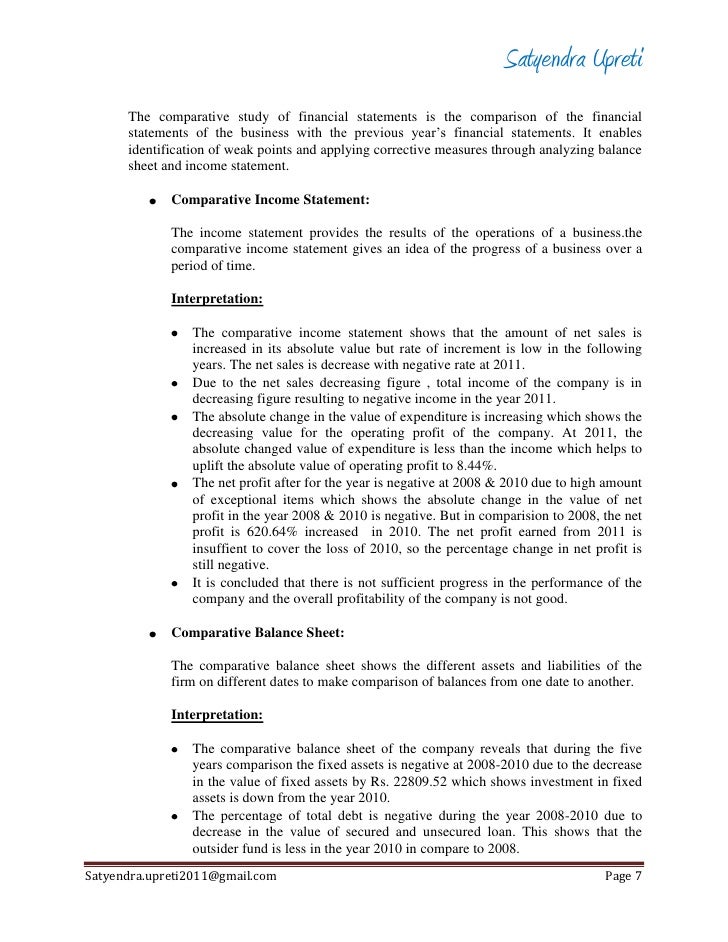

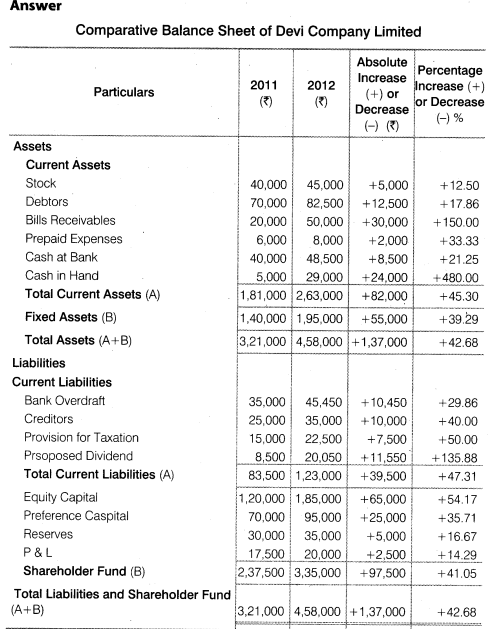

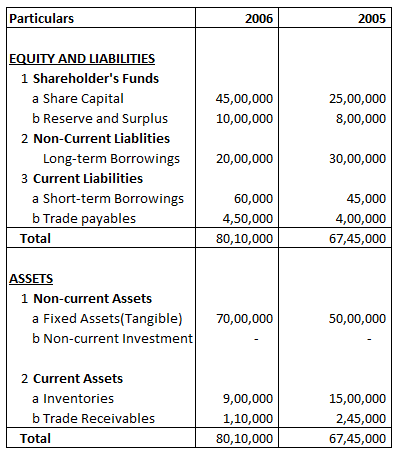

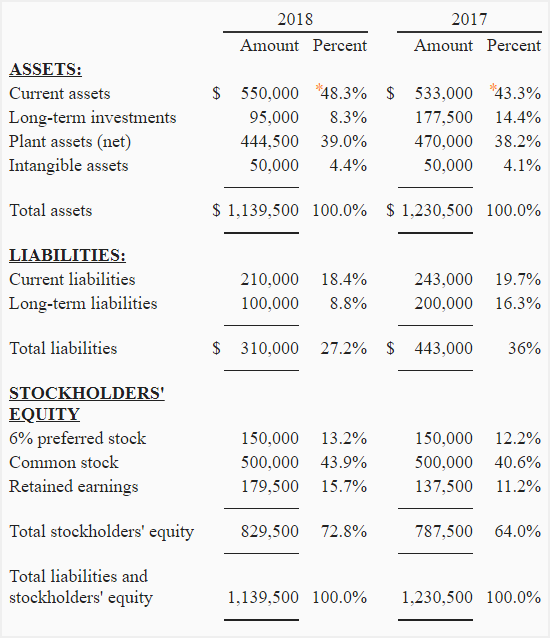

Interpretation of comparative balance sheet. Assets and liabilities of business for the previous year as well as the current year Changes increase or decrease in such assets and liabilities over the year both in absolute and relative terms. The balance sheet is an annual financial snapshot. A Criticisms and Analysis b Comparison and Trend Study.

As a technique of financial analysis accounting ratios measure the comparative significance of the individual items of the income and position statements. Interpretation of Financial Statements includes. Comparative Balance Sheet b Comparative Income Statement c Common-size Statement d All the above.

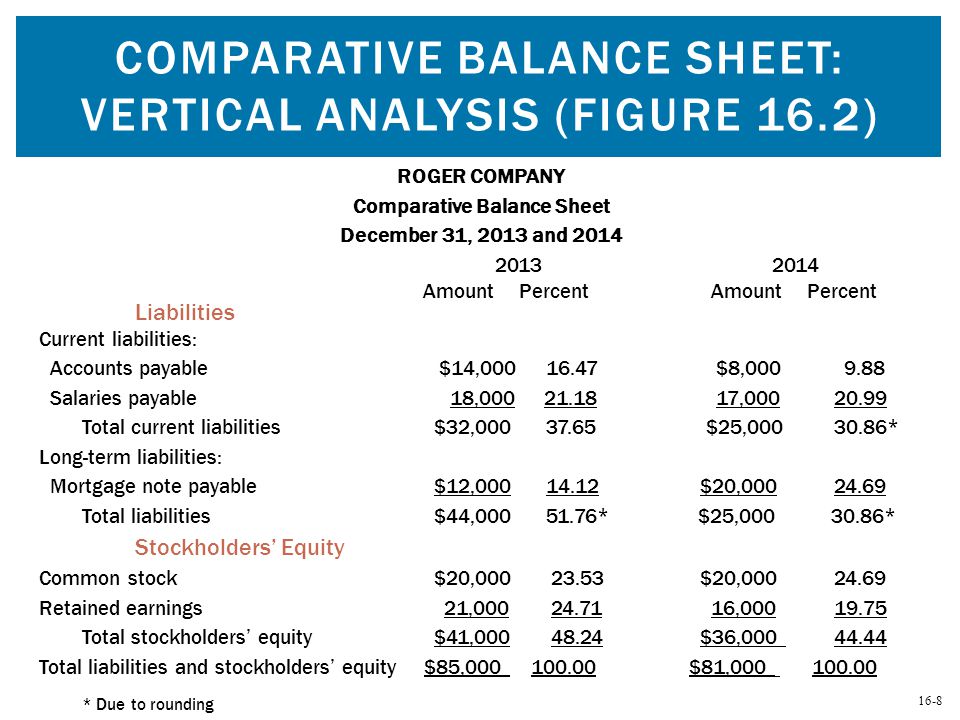

You can compare several balance sheets from your company each of which has the same date but on different months or different years. Recall that horizontal analysis calculates changes in comparative statement items or totals. A comparative balance sheet showcases.

The single balance sheet focuses on the financial status of the concern as on a particular date the comparative balance sheet focuses on the changes that have taken place in one accounting period. I Comparative Balance Sheet. For full course visit.

A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. As business owners we are so busy with the day-to-day operations of running a business that we may forget to take a look at our business as a whole and ignore any company financial statement analysis. It summarizes a companys assets liabilities and shareholders equity at a specific point in time.

Balance Sheet provides information about financial position of the enterprise. The comparative financial statements of Synotech Inc will serve as a basis for an example of horizontal analysis and vertical analysis of a balance sheet and a statement of income and retained earnings. Between various items of a balance sheet and a statement of profit and loss of a firm.