Fine Beautiful Reconciliation Of Variable And Absorption Costing

Variable manufacturing costs 1000units 7 per unit 7000.

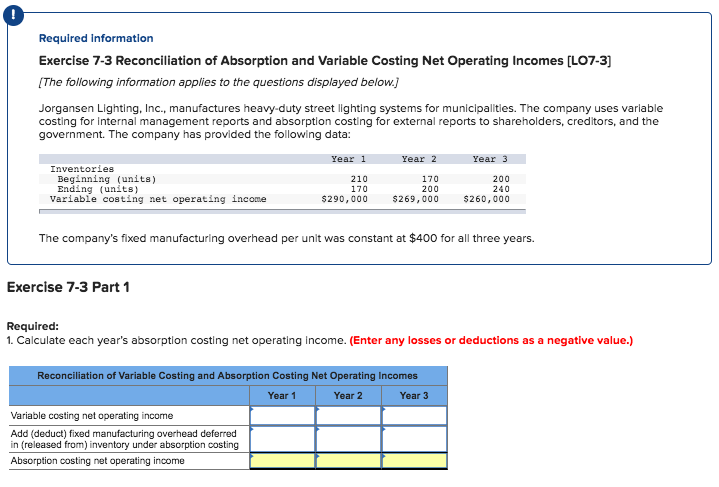

Reconciliation of variable and absorption costing. Absorption costing is the acceptable method for tax and external reporting purposes. Manufacture- heavy-duty transformers for electrical switching stations The company uses variable costing for internal management reports and absorption costing for external reports to shareholders. Blackstone Tools produced 12000 electric drills during 20X0.

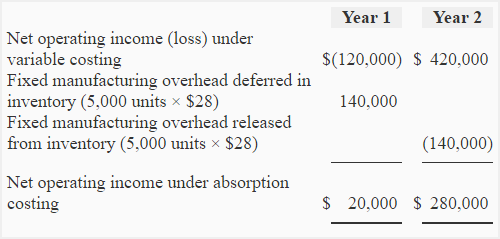

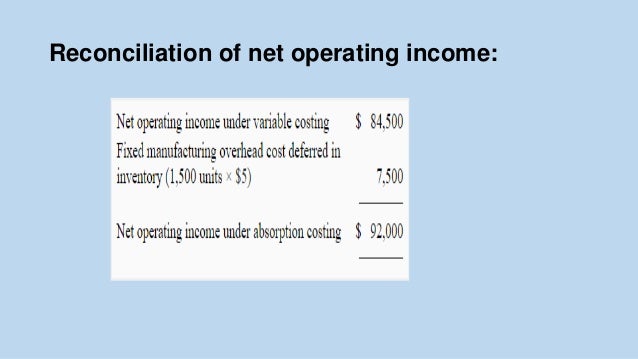

Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year Year 2 Year 3 Variable costing net operating income ad e18red ag ov in fralersed Absorption costing net operating income 0 2. An accounting process used to compare two sets of records to ensure the figures are in agreement and are accurate. Under throughput costing only the unit-level spending for direct costs is assigned as a product cost.

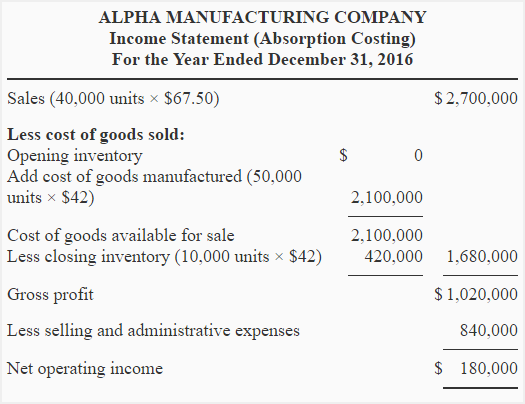

Reconciliation of marginal costing and absorption costing profits. Absorption Costing Approach Sales 1200x9 10800. Expected production was only 10500 drills.

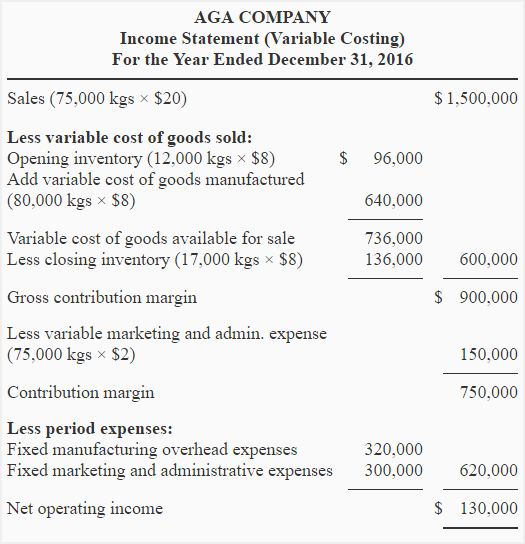

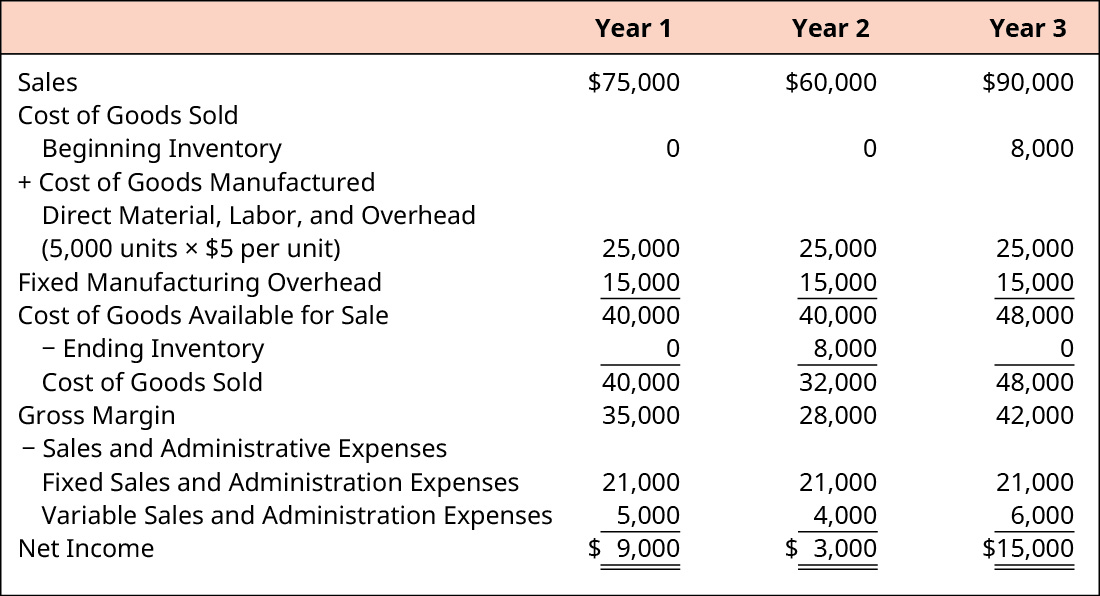

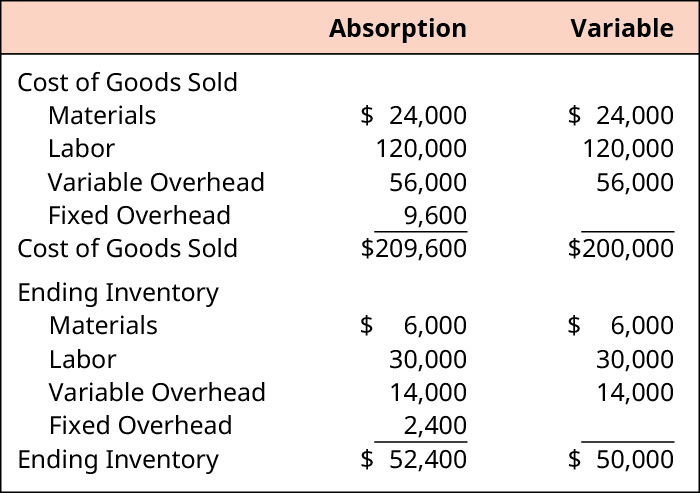

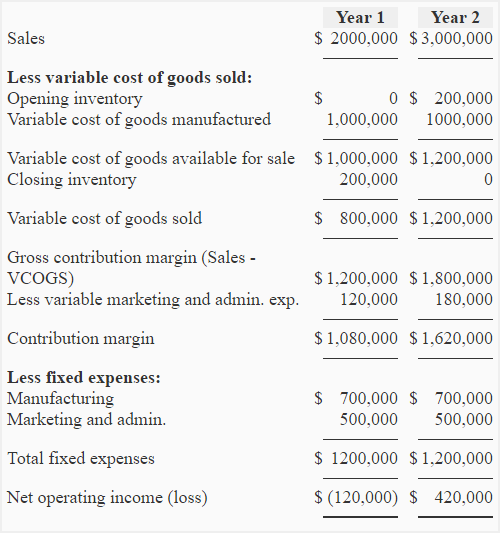

Reconciliation of Variable-Costing and Absorption-Costing Operating Income. As has been said here due to changes in inventory levels from period to period. The ending inventory figure under the variable costing method is 5000 lower than it is under the absorption costing method.

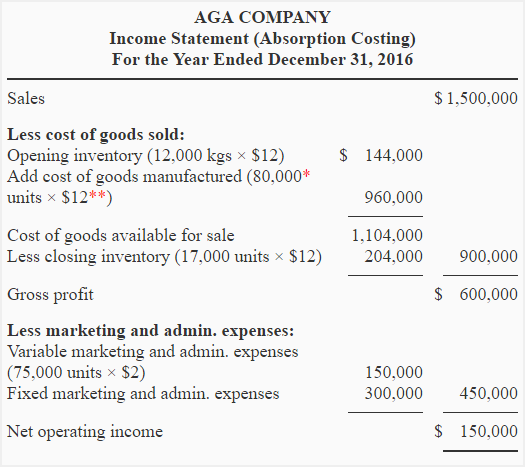

Variable costing income statement and reconciliation SOLVED. Under variable costing only variable costs are treated as product costs. Production cost of sales.

Prepare an income statement of Alpha Manufacturing Company using variable costing system. The reason is that under variable costing Only the variable manufacturing costs are assigned to units of product and therefore included in the inventory. In the case of Weber Light Aircraft the net operating incomes are the same in January but differ in the other two months.