Amazing Provision For Bad Debts Allowed In Income Tax

172 Section 361viia of the Income-tax Act provides for a deduction in respect of any provision for bad and doubtful debts made by a scheduled bank or a non-scheduled bank in relation to advances made by its rural branches of any amount not exceeding 1½ per cent of the aggregate average advances made by such branches.

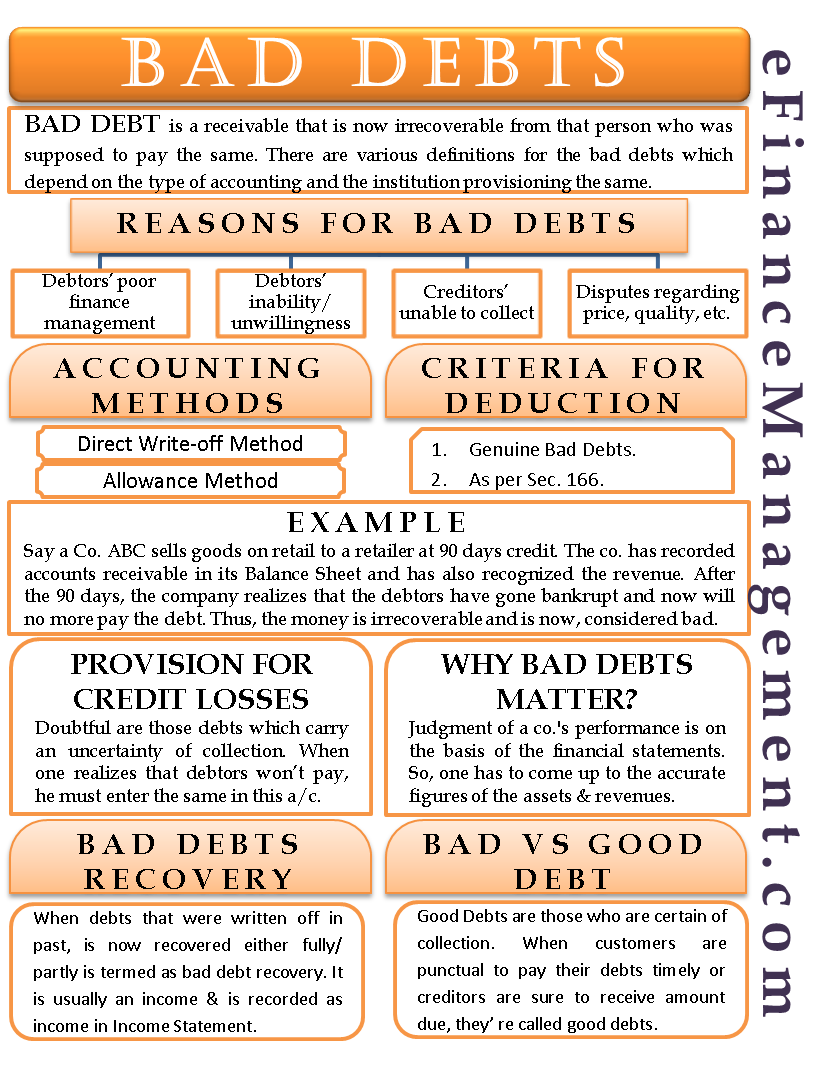

Provision for bad debts allowed in income tax. In order to eliminate the disputes in the matter of determining the year in which a bad debt can be allowed and also to rationalise the provisions the Amending Act 1987 has amended clause vii of sub-section 1 and clause i of sub-section 2 of the section to provide that the claim for bad debt will be allowed in the year in which such a bad debt has been written off as irrecoverable in the accounts. 30 HOW THE TAX LAW APPLIES 31 Bad Debts 311General Trade debts written off as bad are generally allowable as a deduction. 19 rows Provision for bad and doubtful debts general note impairment loss on trade debts.

Provision for bad debt is not an expense neither an income hence it cannot be a part of income statement rather it is a part of balance sheet. Trade debt is a debt that arises from the sales of goods or services and has been included in the gross income. Provision for Bad and Doubtful Debts.

To claim a bad debt deduction in an income year for an amount included in your assessable income that has not been recovered you must do all of the following. For bad debts will be allowable. A bad debt deduction may be claimed where you account for your assessable income on an accruals basis.

In respect of the aggregate average advances made by rural branches of the banks an additional deduction of 10. Banks are allowed deduction in respect of provision made for bad and doubtful debts for an amount not exceeding 5 per cent of their total income computed before making any deduction in this regard vide Chapter VI-A. The deduction us 361viia is allowed in respect of any provision for bad and doubtful debts made by the assessee.

Debts which are allowed as a deduction in ascertaining the adjusted income of a business is a trade debt which is irrecoverable either wholly or partly. And 24 other related matters. General and specific provisions for bad and doubtful debts would no longer be made.

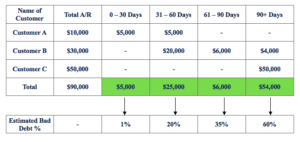

3 General Provision For Bad Debts General provision for bad debts which is based on a percentage of total sales or outstanding debts is not tax deductible even though the taxpayer may be required to do so under law and accounting convention. Such debt is written off as bad. In particular the Ruling explains the operation of paragraph 631b of the Income Tax Assessment Act 1936 the Act in relation to taxpayers in the business of the lending of money.