Awesome Ready Ratios Ratio Analysis

:max_bytes(150000):strip_icc()/dotdash_Final_Forecasting_Market_Direction_With_Put-Call_Ratios_Nov_2020-01-4e7625ce7f2945f98ae81546e6611823.jpg)

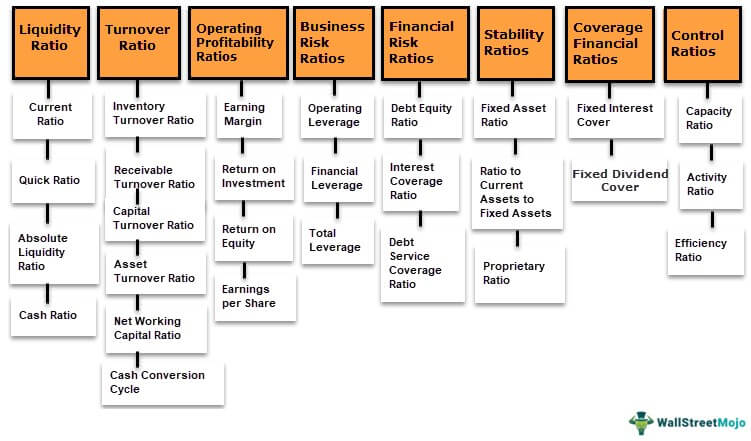

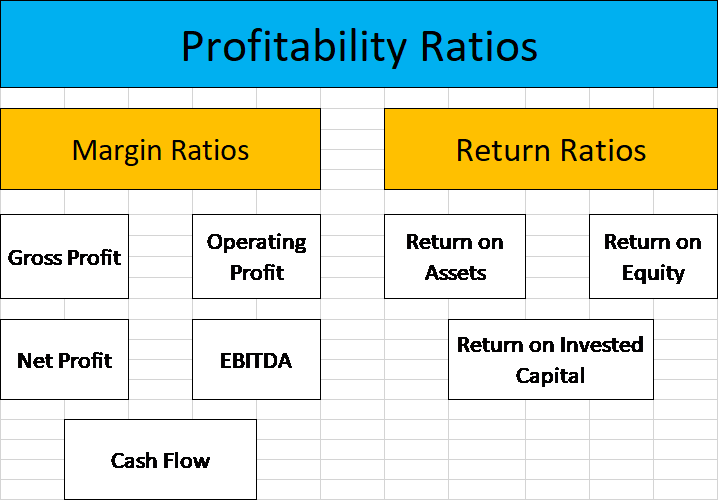

Financial ratios are usually split into seven main categories.

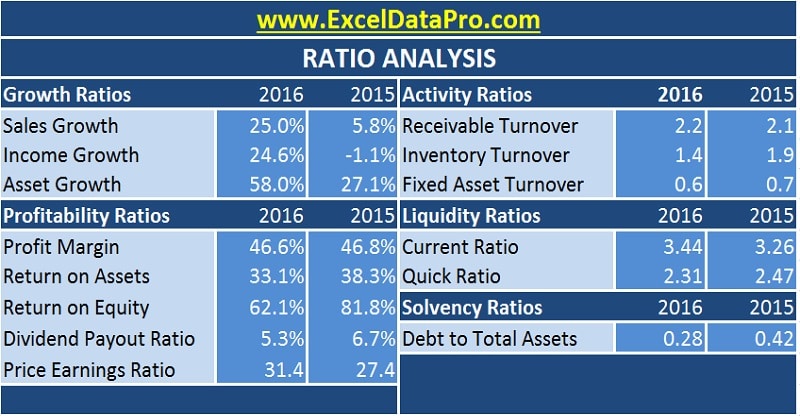

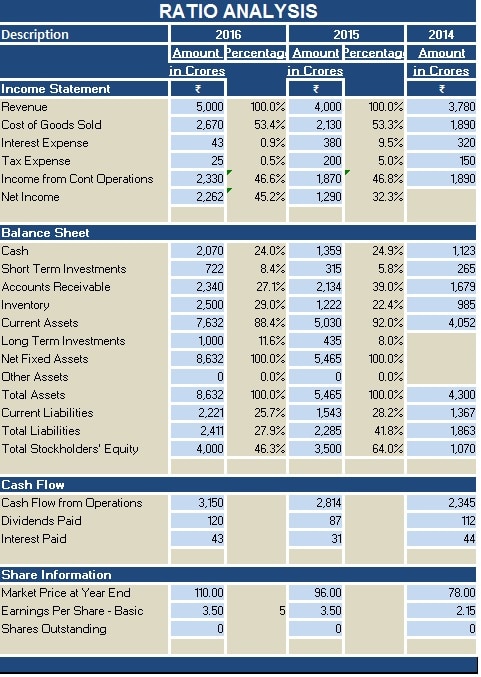

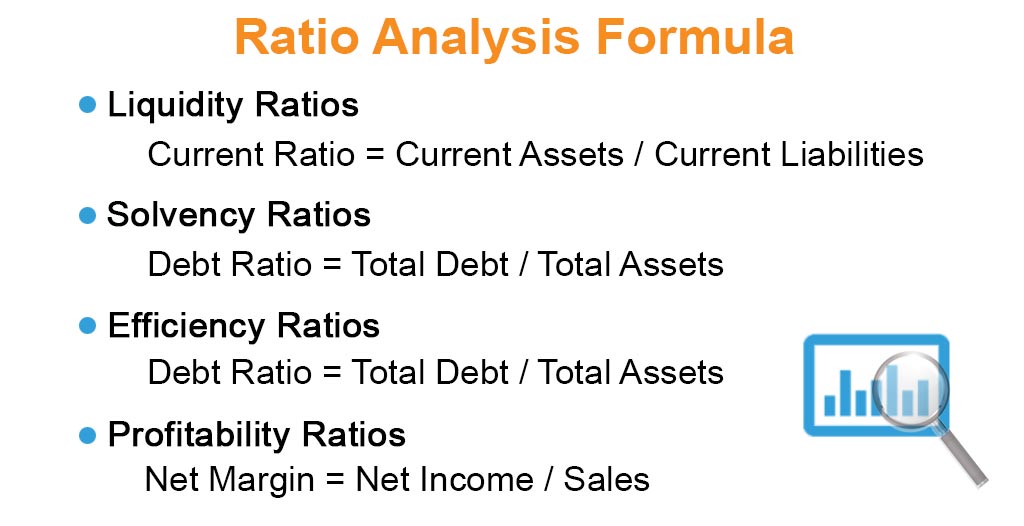

Ready ratios ratio analysis. In addition you will learn market-based ratios that provide insight about what the market for shares and bonds believes about future prospects of the fi rm. It can be calculated separately by dividing net income by average total assets or by multiplying the profit margin ratio times the asset turnover ratio. All you need to do is to enter data from your financial statements and the template will automatically calculate the ratios.

Return on Assets ROA 08. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. Includes annual quarterly and trailing numbers with full history and charts.

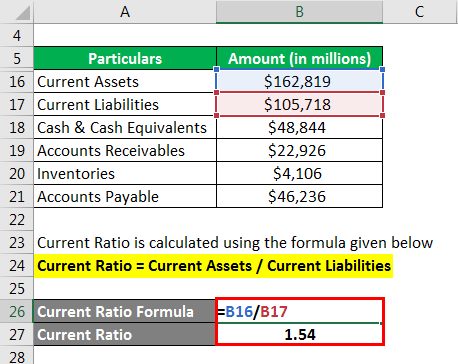

Return on Capital ROIC 06. Liquidity ratio tells about how well placed is the company to pay-off its short term debts like current liabilities. In the process of financial ratio analysis what we are going to check.

Liquidity solvency efficiency profitability equity market prospects investment leverage and coverage. ROA is a combination of the profit margin ratio and the asset turnover ratio.

Financial analysis is the process of using fi nancial information to assist in investment and fi nancial decision making. Ratio Analysis Template is a ready-to-use template in Excel Google Sheets and OpenOffice Calc that helps you to know the financial performance in key areas. Financial ratios and metrics for Tesla stock TSLA.

Debt Equity Ratio. The information shown in equation format can also be shown as follows. Ratio analysis is a quantitative method of gaining insight into a companys liquidity operational efficiency and profitability by studying its financial statements such as the balance sheet and income statement.

/Budget-Investment-Money-Finance-Business-Savings-2789112-cc070176791847f58bbd24b155399740.jpg)