Smart Provision For Bad Debts Is An Expense

Some companies might use the description provision for bad debts on its income statement in order to report the credit losses that pertain to the period of the income statement.

Provision for bad debts is an expense. Under this accounting treatment 5420 would be written off as bad debt and provisions for bad debts will be increased from 5600 to 7000 ie. Doubtful debts or bad debts is an expense and has already occurred. Under the accounting standard FRS 39 which sets out the principles for recognising and measuring financial instruments general and specific provisions for bad and doubtful debts will no longer be made.

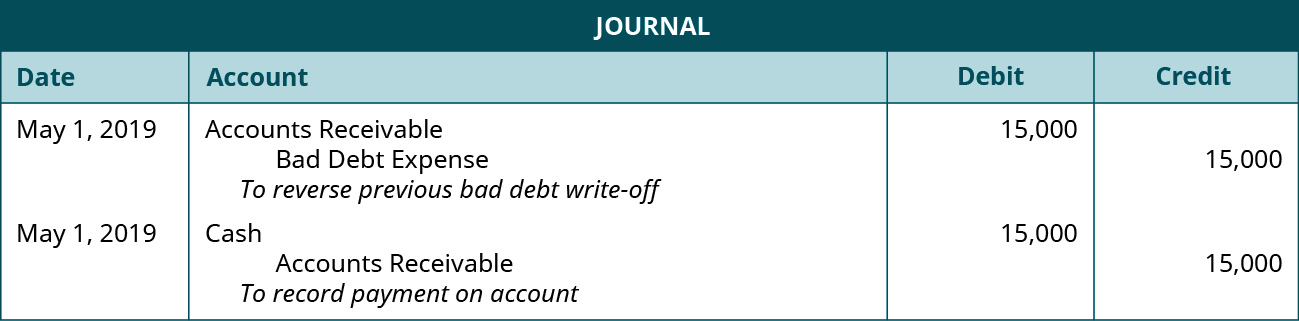

You can either specifically write it off in the P L as Bad Debt woff or else you can reverse the sale invoice inc VAT if applicable by way of issuing an internal Debit Note. The provision for doubtful debt is first made in the income statement and that reduces the profitability. In accounting according to Prudence concept which states that business should record any possible future losses in accounts even if it has not take place yet but to write a gain or a profit only when they have been incurred or received.

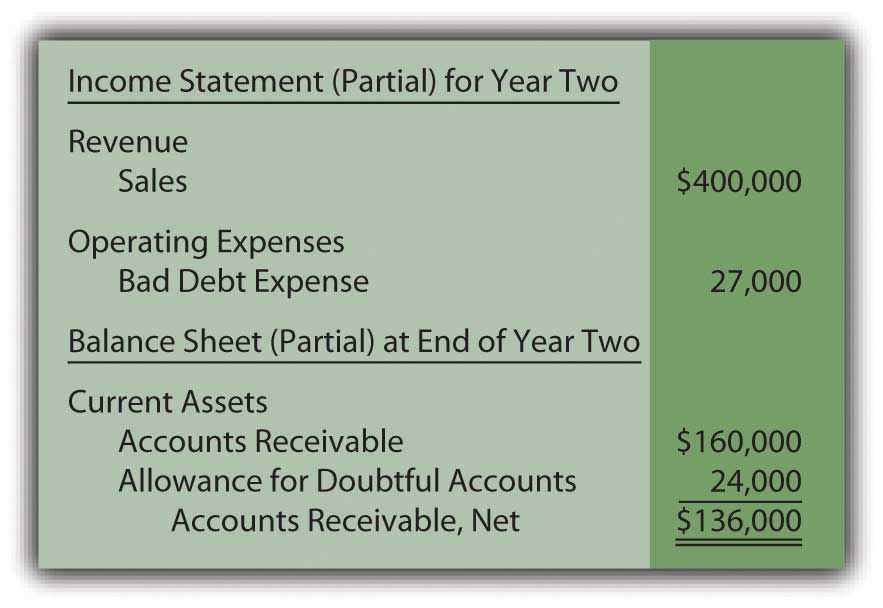

It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal credit sales it will appear as an operating expense on the companys income statement. An allowance for doubtful accounts or bad debt reserve is a contra asset account it either has a credit balance or a balance of zero that decreases your accounts receivable.

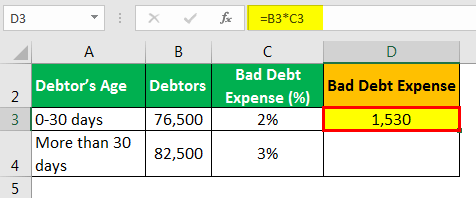

In that case provision for bad debts would be an income statement account. The provision for bad debt expenses out any future uncollectible invoice related to the accounts receivable booked this year no matter when the bad debt occurs. For income tax purposes impairment losses on trade debts that are.

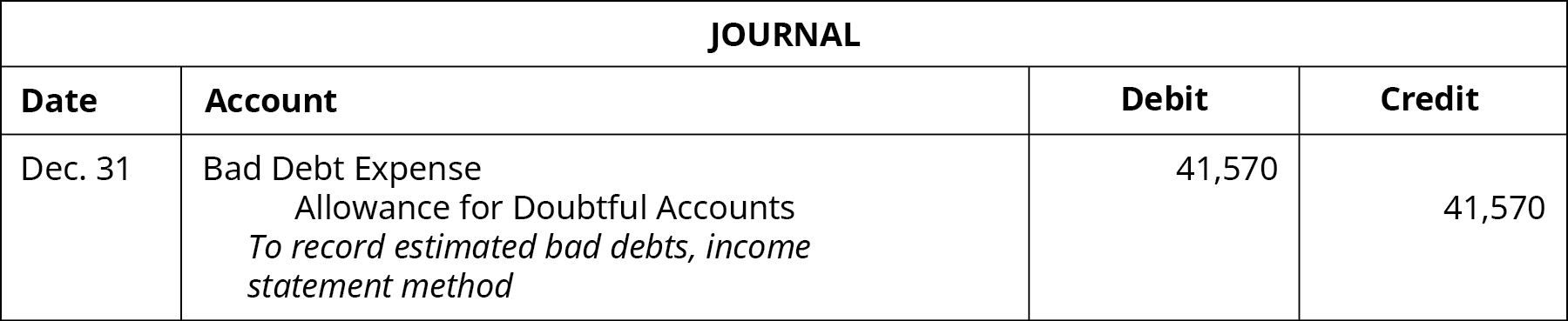

The provision is a future loss - a future loss that must be recorded as soon as it becomes likely to occur. An additional provision would be made for. Bad debt expense is an estimate of the uncollectible accounts for the current accounting period.

A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial. When you record bad debt expense on the income statement you also increase the allowance for bad debt on the balance sheet. This way only the balance sheet items are affected and there is no effect of bad debt expense on future income statements.