Best Aggregate Cash Flow Tax Deferred Examples

The DTA is found under current assets on the balance sheet.

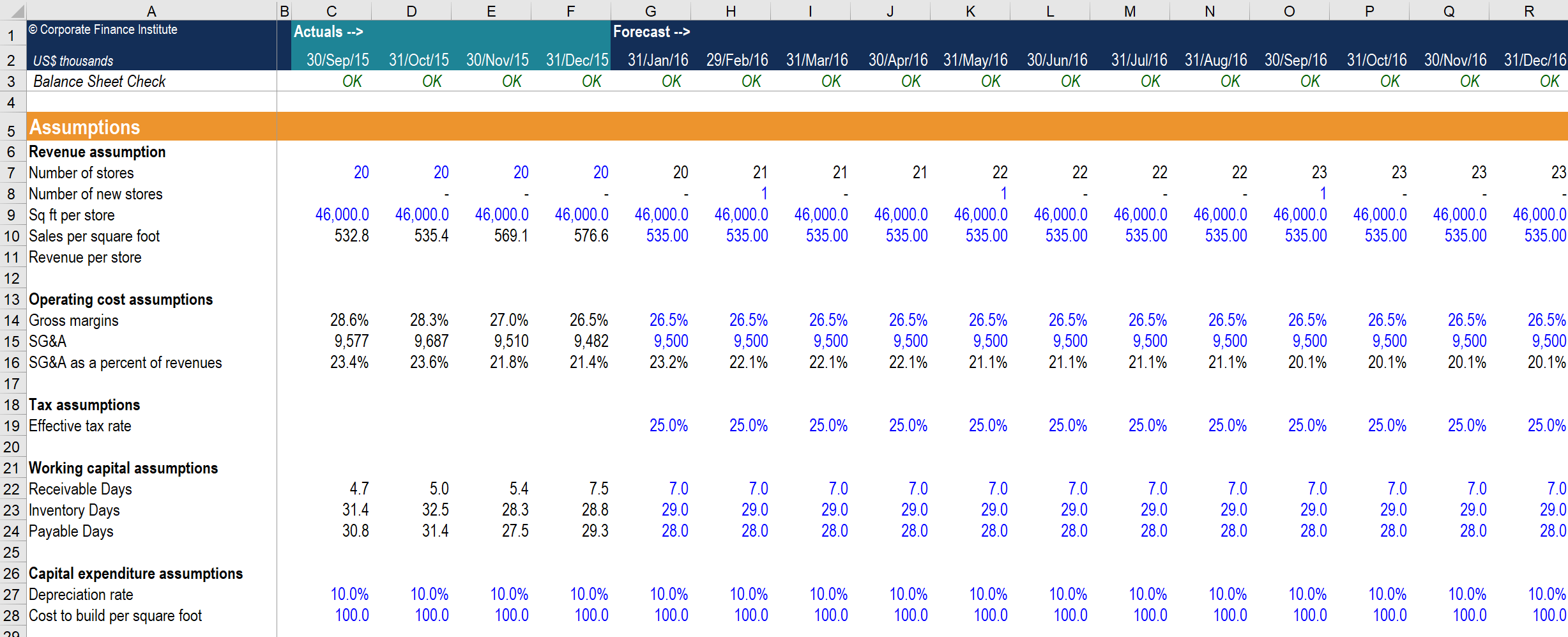

Aggregate cash flow tax deferred examples. 1 net income after taxes. For corporations deferred tax liabilities are netted against deferred tax assets and reported on the balance sheet. Deferred tax balances arising from temporary differences would generally only be included in the carrying amount if the entitys specific tax circumstances are reflected in the model ie.

27 Central Avenue. Wendcharles I LLC. This is the amount of deduction required to result in a corporate taxpayers paying an effective 155 rate of tax on the aggregate foreign cash position portion of the Sec.

For example lets assume you need 1000000 in 15 years to fund the promised benefit you would need to contribute 46342 each year for 15 years at a 5 interest rate to fully fund your obligation. The concept is explained further in the video below. The amounts reported in the statement of cash flows are aggregate amounts for the reporting.

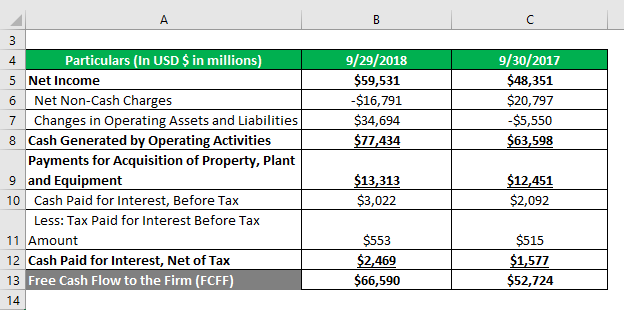

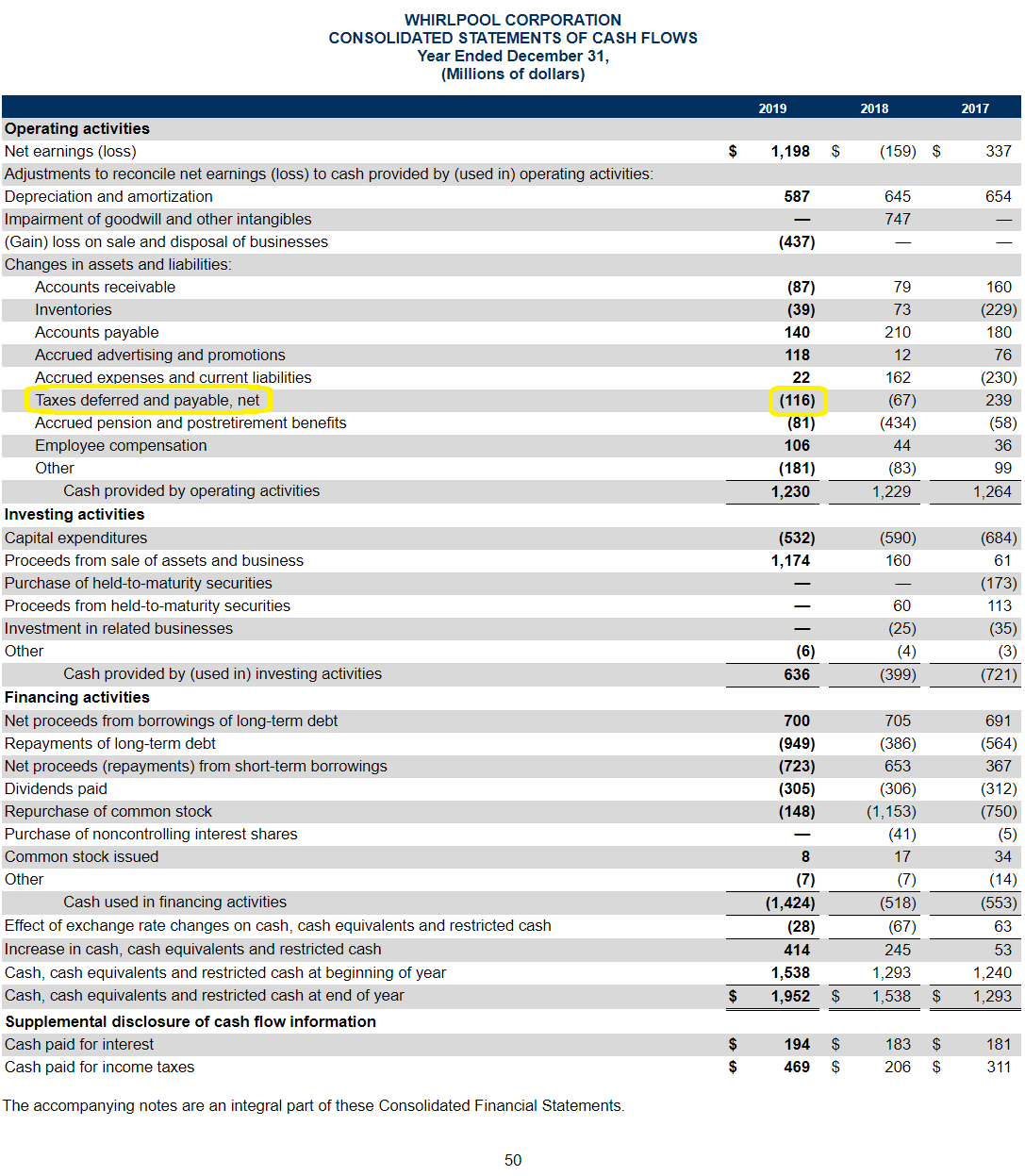

Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. Tax expense is defined as the aggregate amount included in. Deferred Tax on Statement of Cash Flow.

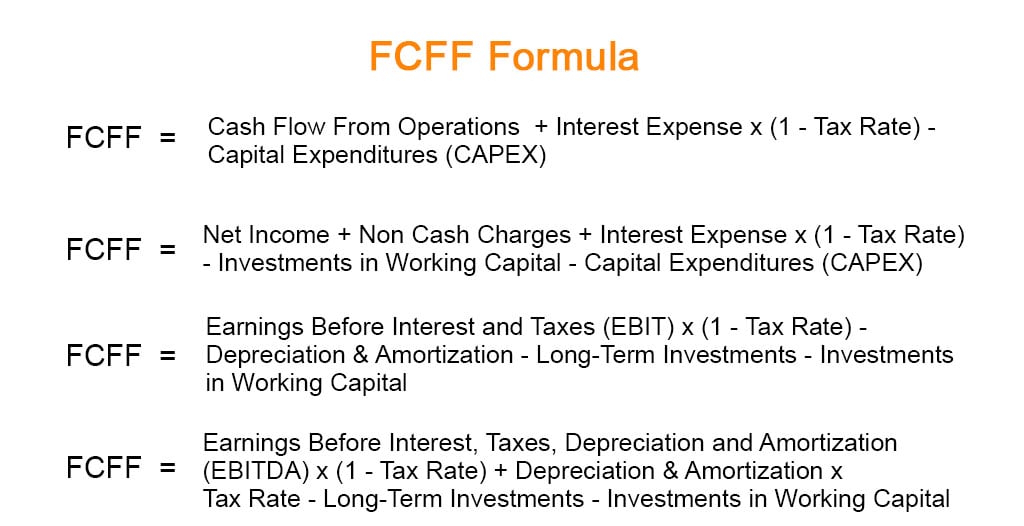

Deferred rent is a liability created when the cash payments and straight-line rent expense for an operating lease under ASC 840 do not equal one another. Example at right is based on conference report accompanying tax bill p. Unlevered Free Cash Flow Tutorial.

The model reflects the tax cash flows arising from the reversal of the temporary differences rather than reflecting tax outflows at 30 of forecasted. Deferred Income Tax Liabilities Explained with Real-Life Example in a 10-k Deferred income taxes in a companys consolidated balance sheet and cash flow statement is an easy concept in principle but when deferred income tax liabilities or assets change from year to year thats where it can get more confusing. The transition to ASC 842 will result in the elimination of the deferred rent account from the balance sheet but will generally not impact net income or tax expense.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)