Outrageous Ongc Financial Statement Analysis

Balance sheet Companies Ratio analysis.

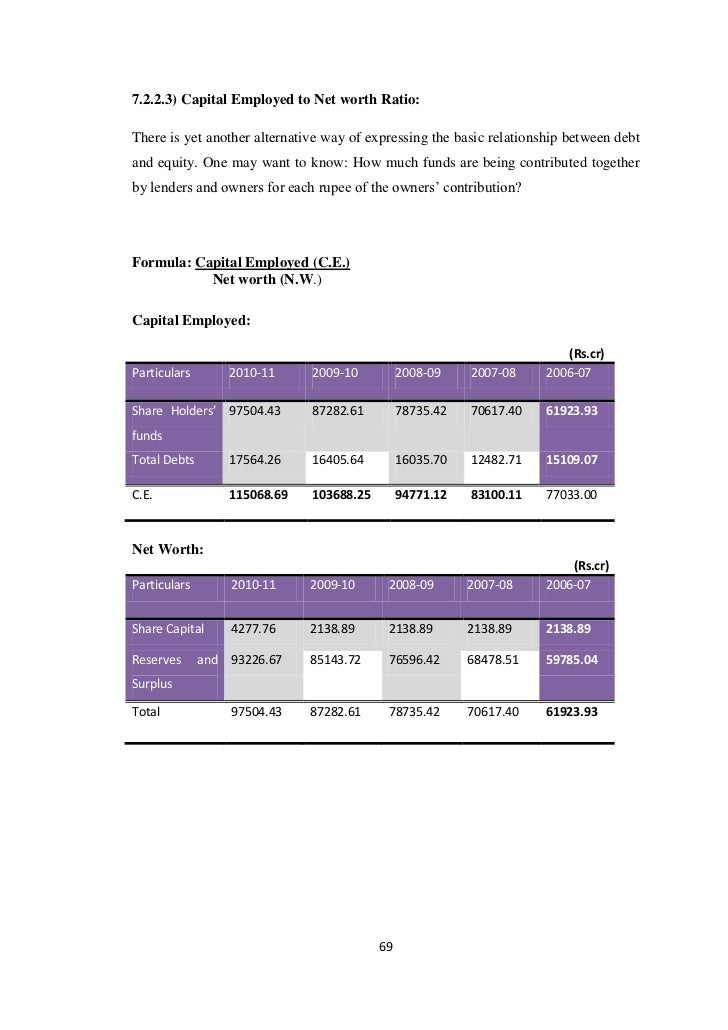

Ongc financial statement analysis. Intrinsic value is the calculated value of the company and may differ from current stock price. The main task of an analyst is to perform an extensive analysis of financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Each term of the base year is taken as 100 and on that basis the percentages for the other years are calculated.

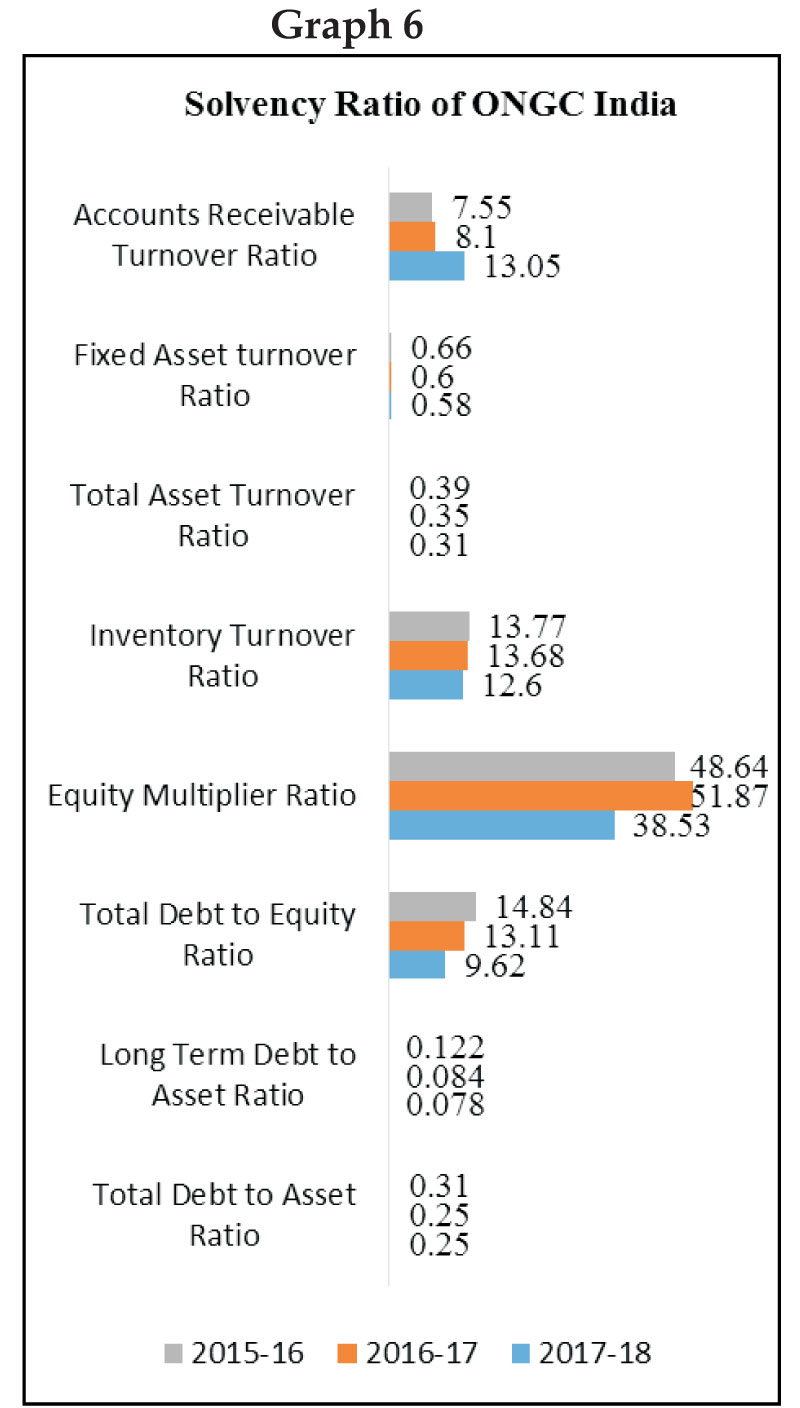

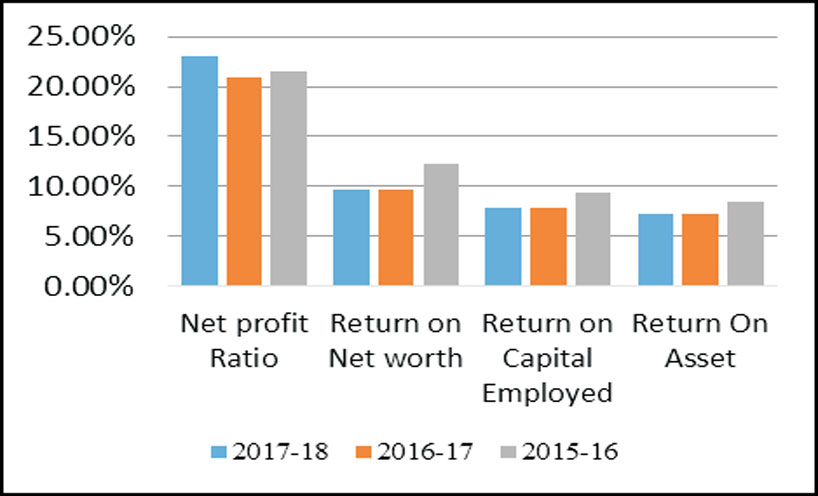

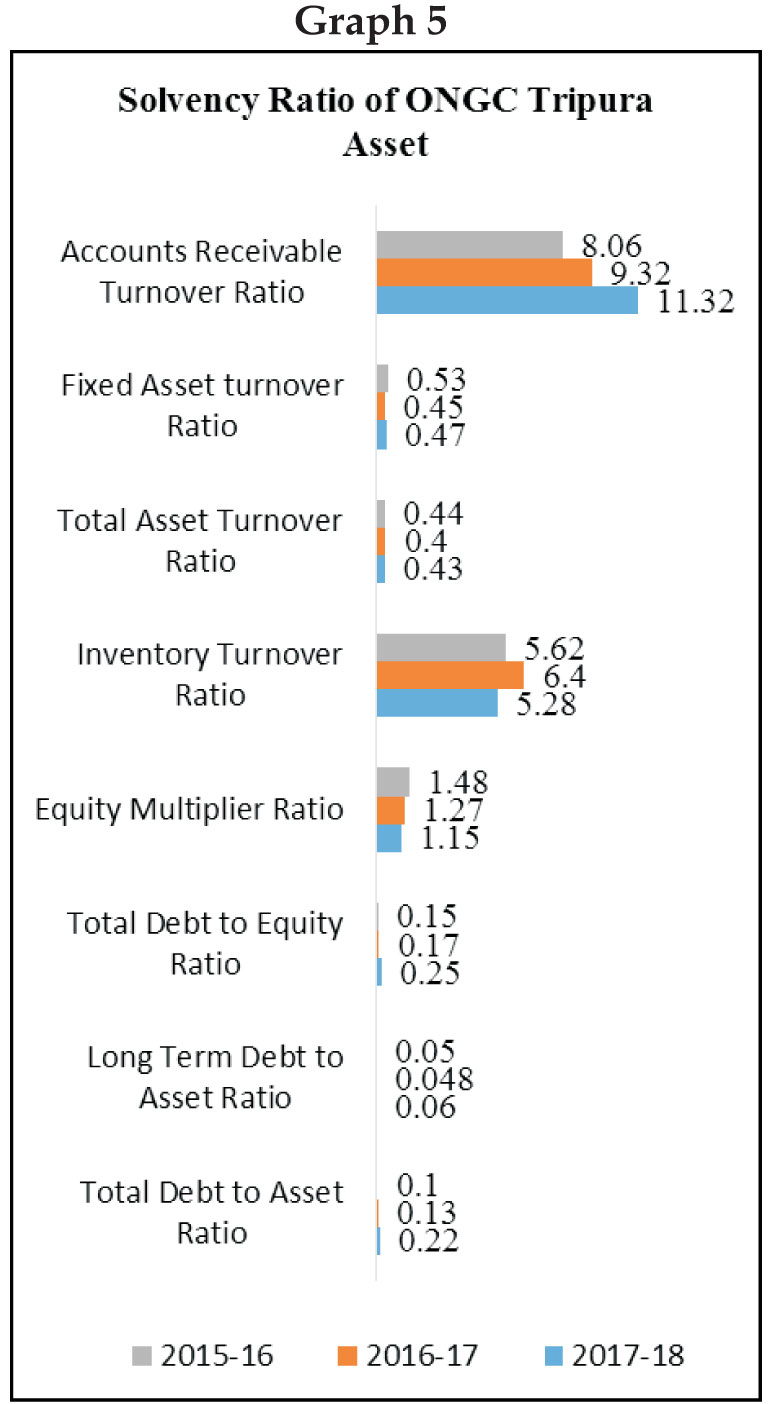

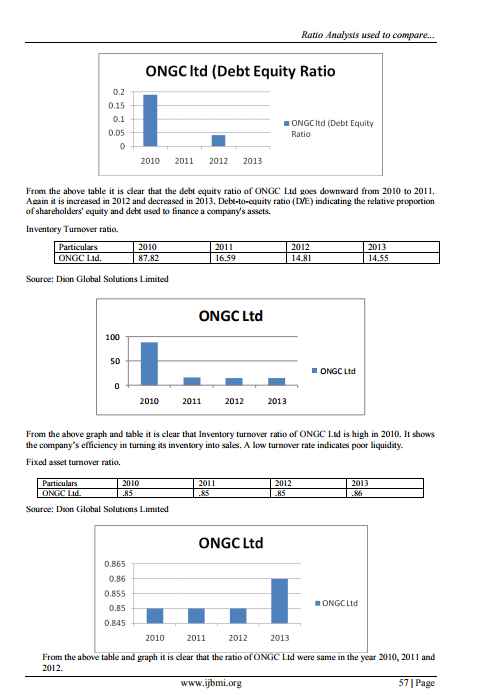

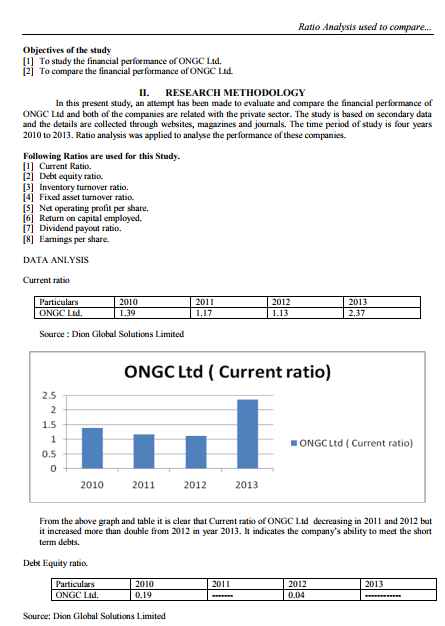

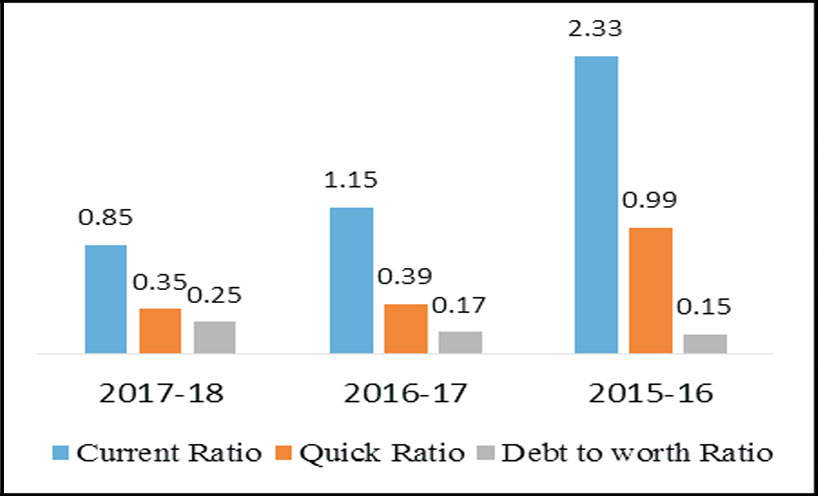

GAIL Misses Earnings Estimates. It is defined as thesystematic use of ratio to interpret the financial statement so that the strength andweakness of a firm as well as its historical performance and current financialcondition can be determined. - It is a good metric to check out the capital structure along with its performance.

2020-21 Q3- ONGCOVLMRPL Financial Results. Guide to Financial Statement Analysis. Download report Chapter 6.

The income statement indicates a companys. ONGC has a DE ratio of 00718 which means that the company has low proportion of debt in its capital. Benchmarks Nifty 1585605 320.

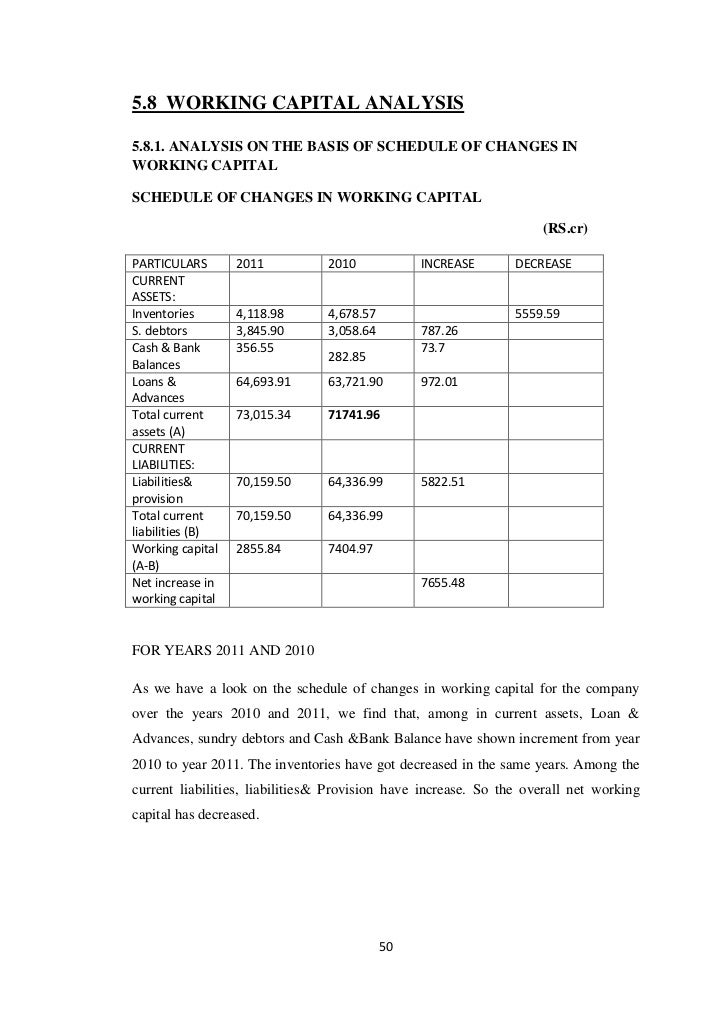

Under this technique information for a number of years is taken up and one year-usually the first year-is taken as the base year. Oil And Natural Gas Corporation Balance Sheets - Get the latest Financial Reports Balance Sheets of Oil And Natural Gas Corporation on The Economic Times. ONGC reports Q4 profit at Rs 6734 crore realisation increases 184.

Deriving the FCFF and FCFE. Are used and from them ratios are calculated so according to which we can easily compare the performance. The following step by step procedure is followed.