Matchless Negative Net Income On Balance Sheet

If there is still a discrepancy on the Net Income between the Balance Sheet and P L reports.

Negative net income on balance sheet. When you access the two reports Balance Sheet and Profit Loss make sure the following filters are the same. On January 1st of the next year last years Net Income is posted to Retained Earnings Owners Equity. Display columns by Year.

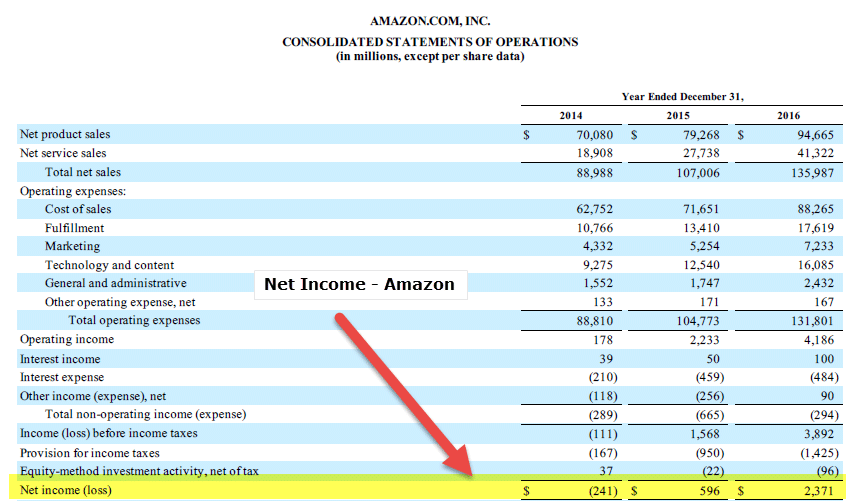

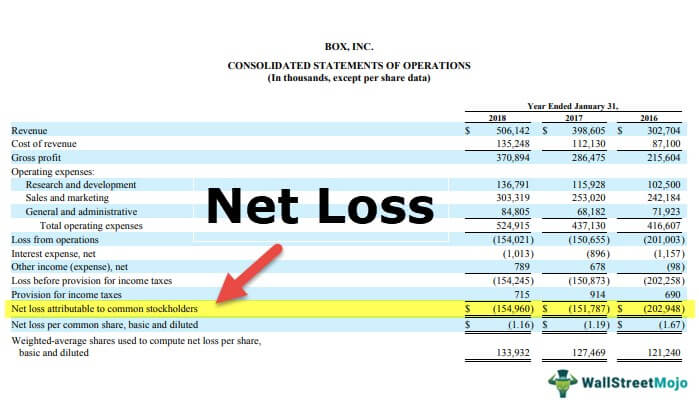

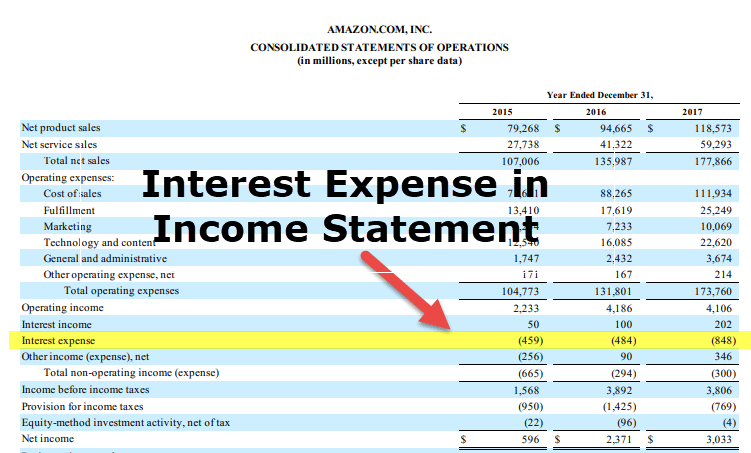

Report Basis Accrual or Cash. People often use the word income interchangeably with salary or wages However a business uses the word income to represent the companys profit or loss over a period of time. Net income is the profit a company has earned or the income thats remaining after all expenses have been deducted.

To start with go to the bottom of the companys balance sheet and look for a line called Total Equity. Open the Balance Sheet and Profit Loss reports with the following settings. As long as a company has cash available it may be able to continue operations.

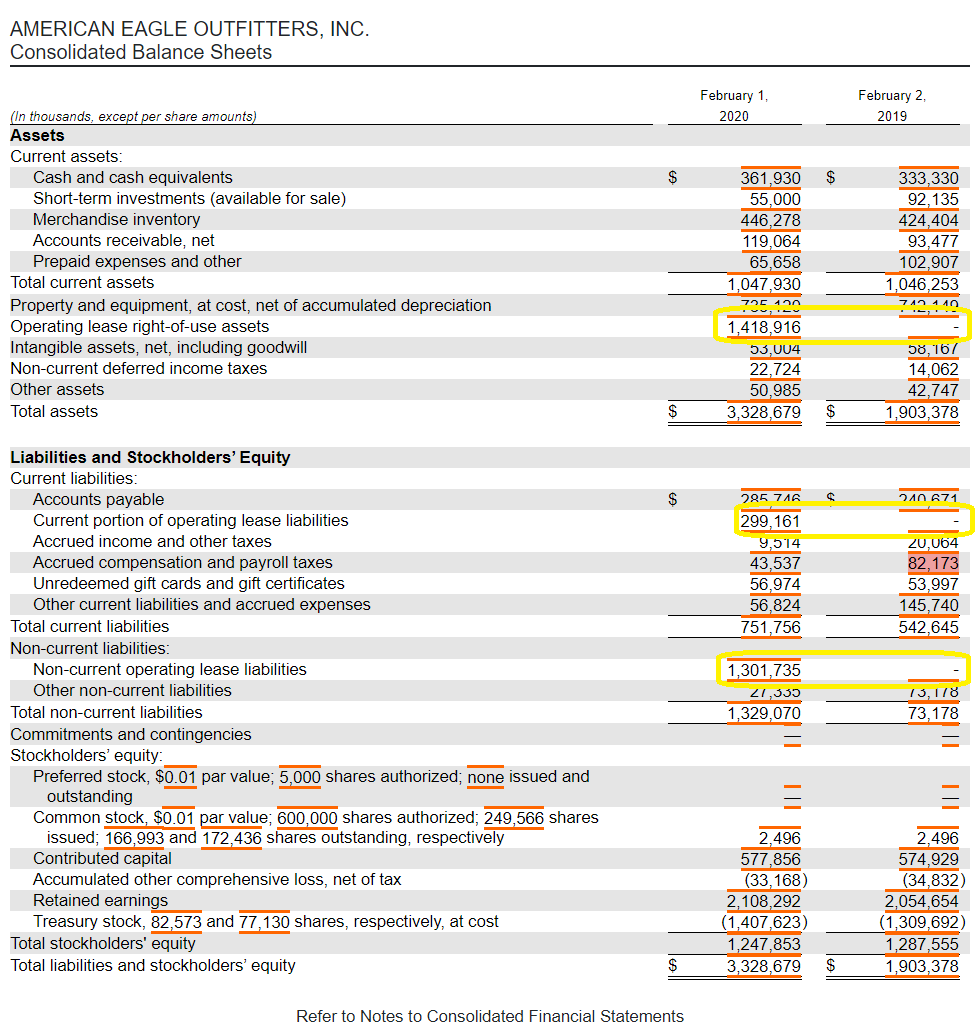

A negative number credit balance in the assets section of a balance sheet is unusual and should be questioned and explained. If the same thing happens we can drill-down the transactions associated to the Net Income. Retained earnings can be negative if the company experienced a loss.

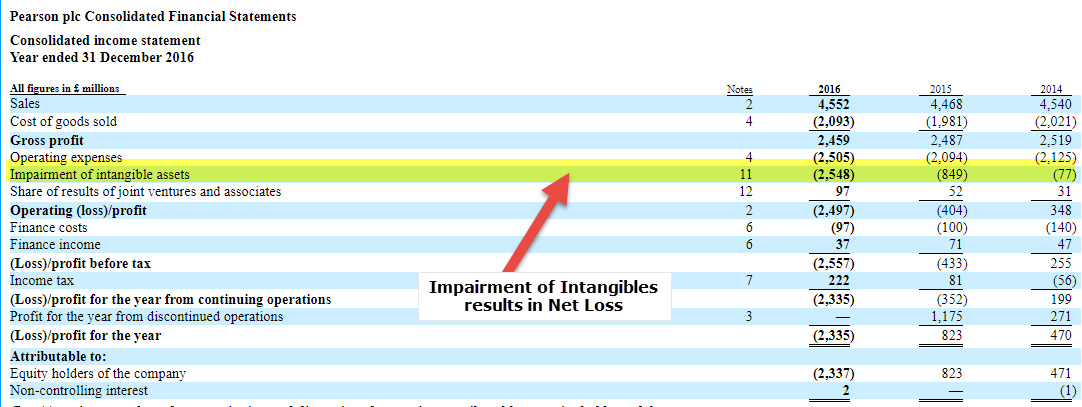

Net income is commonly referred to as the bottom line since it sits at the. Retained earnings are the balance sheet items that record under equity sections. If net income is negative the company has lost money for the period.

Dollar equivalent of 100500 and the ending balance in Retained Earnings on the balance sheet is 181800 net income must be 282300. Reconciling the amount of income reported in the statement of retained earnings and in the income statement requires a remeasurement loss of 47000 in calculating income. Click the amount for Net Income.