Favorite Cash Flow Sections

A cash flow statement is a financial statement that presents total data.

Cash flow sections. If this situation is. Three are used to classify the types of cash inflows and outflows during the period and the fourth reconciles the total cash balance from the beginning to the end of the period. 1 The main components of the cash flow statement.

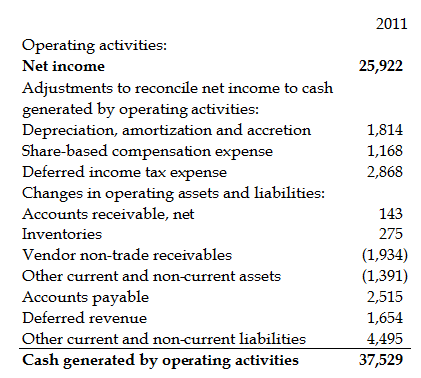

In financial accounting a cash flow statement also known as statement of cash flows or funds flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities. Cash Flow from Investing Activities This section covers investments your company has madeby purchasing equipment real estate land or easily liquidated financial products referred to as cash equivalents When you spend cash on an investment that cash gets converted to. When a statement of cash flows is prepared these three types of cash flows are reported under separate sections operating activities section investing activities section and financing activities section.

The main categories found in a cash flow statement are 1 operating activities 2 investing activities and 3 financing activities of a company and are organized respectively. This section answers the question how much cash did we generate from the daily activities of our core business. This includes cash receipts cash received from your customers cash paid to suppliers and employees and for general operating expenses interest received or.

The other two sections are cash flow from operations and cash flow from investing activities. The purpose of a cash flow statement is to provide a detailed picture of what happened to a businesss cash during a specified period known as the accounting period. Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time.

Operating activities involve the cash effects of transactions that enter into the determination of net income such as cash receipts from sales of goods and services and cash payments to suppliers and employees. The direct method shows the major classes of gross cash receipts and gross cash payments. Operating investing and financing activities.

In this discussion when cash is used it refers to cash and cash equivalents. The operating section of the statement of cash flows can be shown through either the direct method or the indirect method. It demonstrates an organizations ability to operate in the short and long term based on how much cash is flowing into and out of the business.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)