Neat Proof And Loss Statement

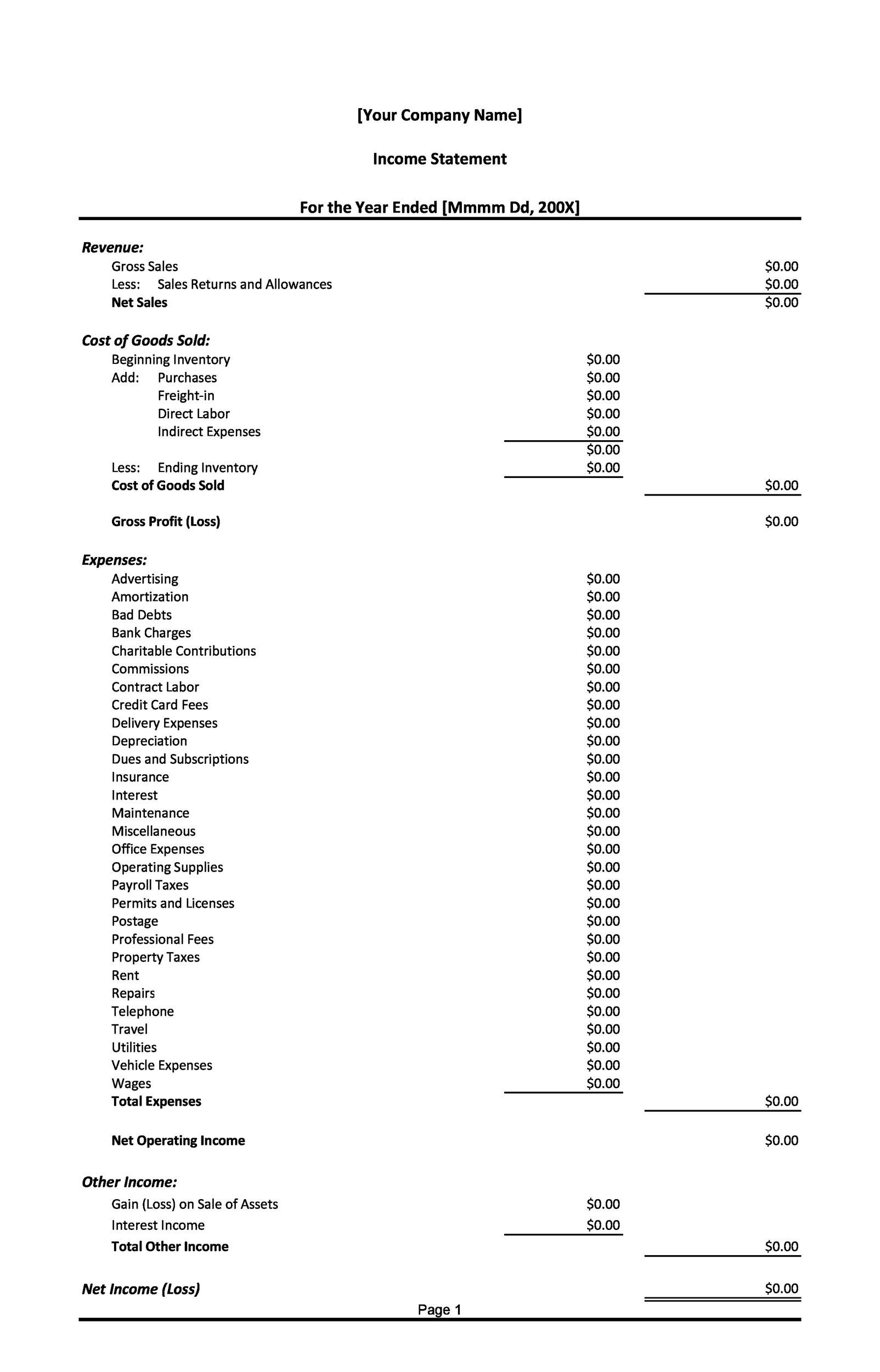

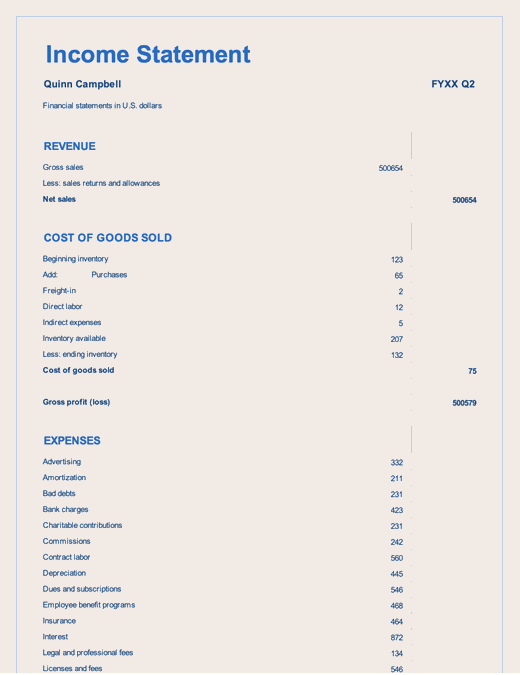

The most important financial statement any business needs is a profit and loss statement called a PL.

Proof and loss statement. The PL statement shows a companys ability to generate sales manage expenses and create profits. A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. Name of your insurance company 7.

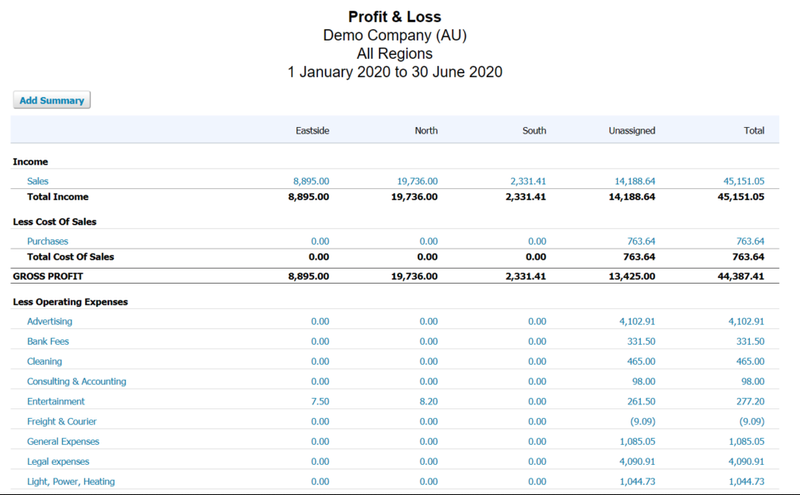

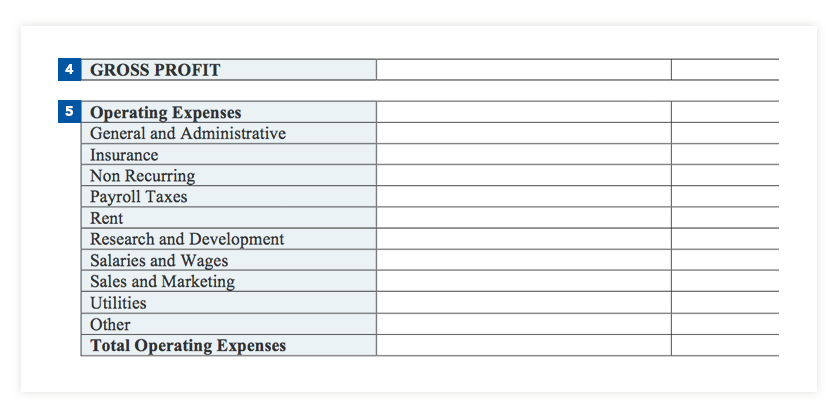

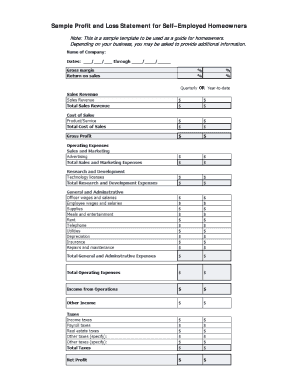

What is the Profit and Loss Statement PL. Use this professionally designed profit and loss template to create a comprehensive profit and loss statement for your company that calculates the percentage change from the prior period and budget. What is a Profit and Loss Statement.

Download and complete the Profit and Loss Statement form. A profit and loss PL statement summarizes the revenues. You should also use this form if your level of business activity or income from self-employment has changed.

Sometimes its called an income statement. This form helps to substantiate the value of the insureds loss to the insurance company. This statement shows the revenues and expenses of the business and resulting profit or loss over.

It provides the insurance company with detailed information regarding the formal claim of damages. Within this specified period of time usually a quarter a profit and loss statement lists all of the accounts receivable and accounts payable of a business. Fire wind water damage etc 9.

Proit and Loss Statement All borrowers who are self-employed or independent contractors should complete this form if they do not already have their own proit and loss statement. It provides the insurer with specific information about an incident its cause resulting damage and financial impact. A Proof of Loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim.