Beautiful Liquidation Basis Of Accounting Ifrs

IFRS and US GAAP.

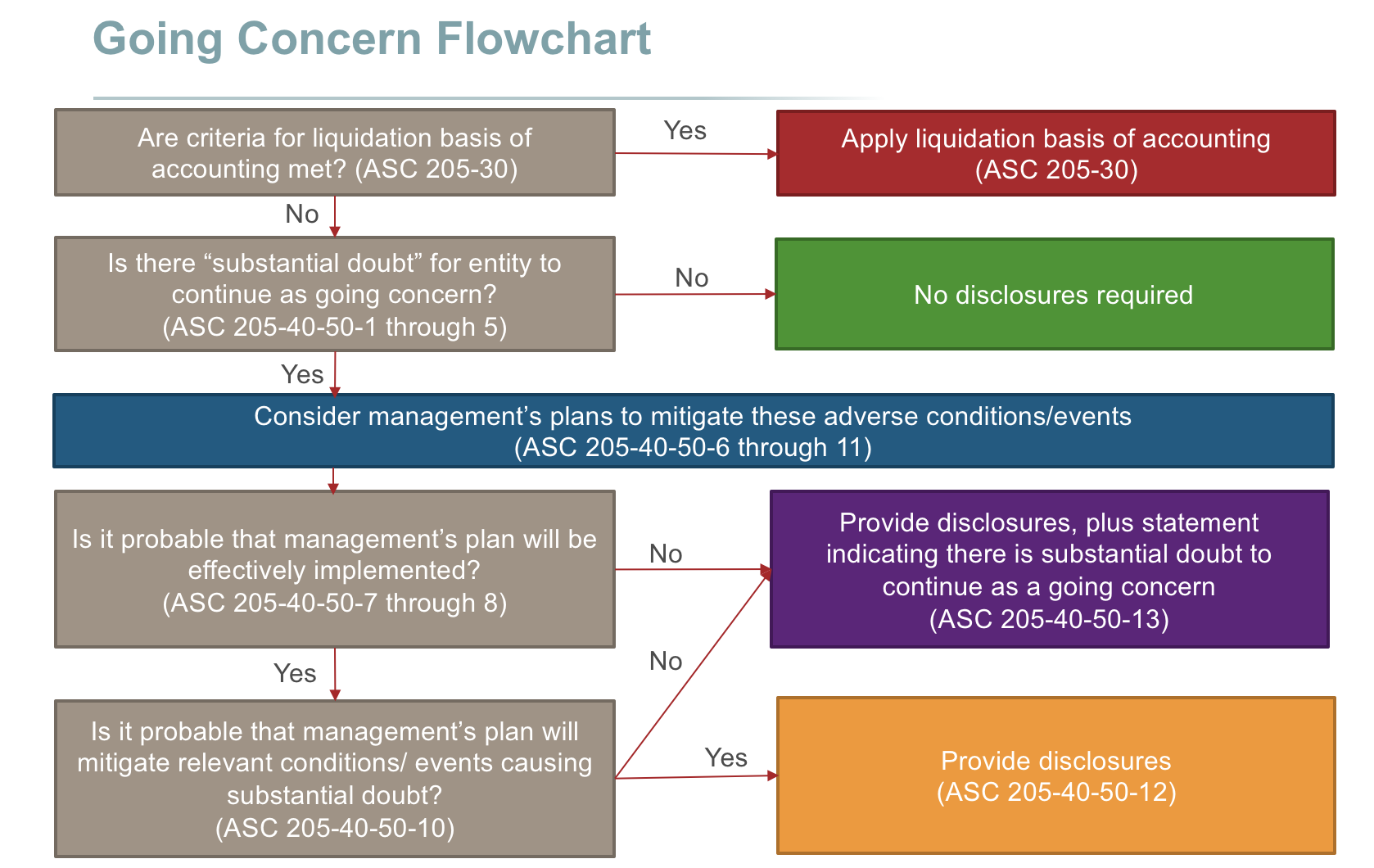

Liquidation basis of accounting ifrs. An entitys financial statements prepared under the liquidation basis of accounting should contain information about its resources and obligations upon liquidation. The terms break-up basis and liquidation basis are not defined terms that are used in IFRS but are ones that are used informally. Basis of preparation used.

The creditors generally have the first right to the assets of a company in liquidation or. Liquidation basis accounting is concerned with preparing the financial statements of a business in a different way if its liquidation is considered to be imminent. Liquidation basis of accounting when liquidation is imminent.

The key objective for management is to communicate to the individual investor what the overall impact of liquidation will be. IFRS 5 applies to accounting for an investment in a subsidiary for which control is intended to be temporary because the subsidiary was acquired and is held exclusively with a view to its subsequent disposal in the near future. Imminent refers to either of the following two conditions.

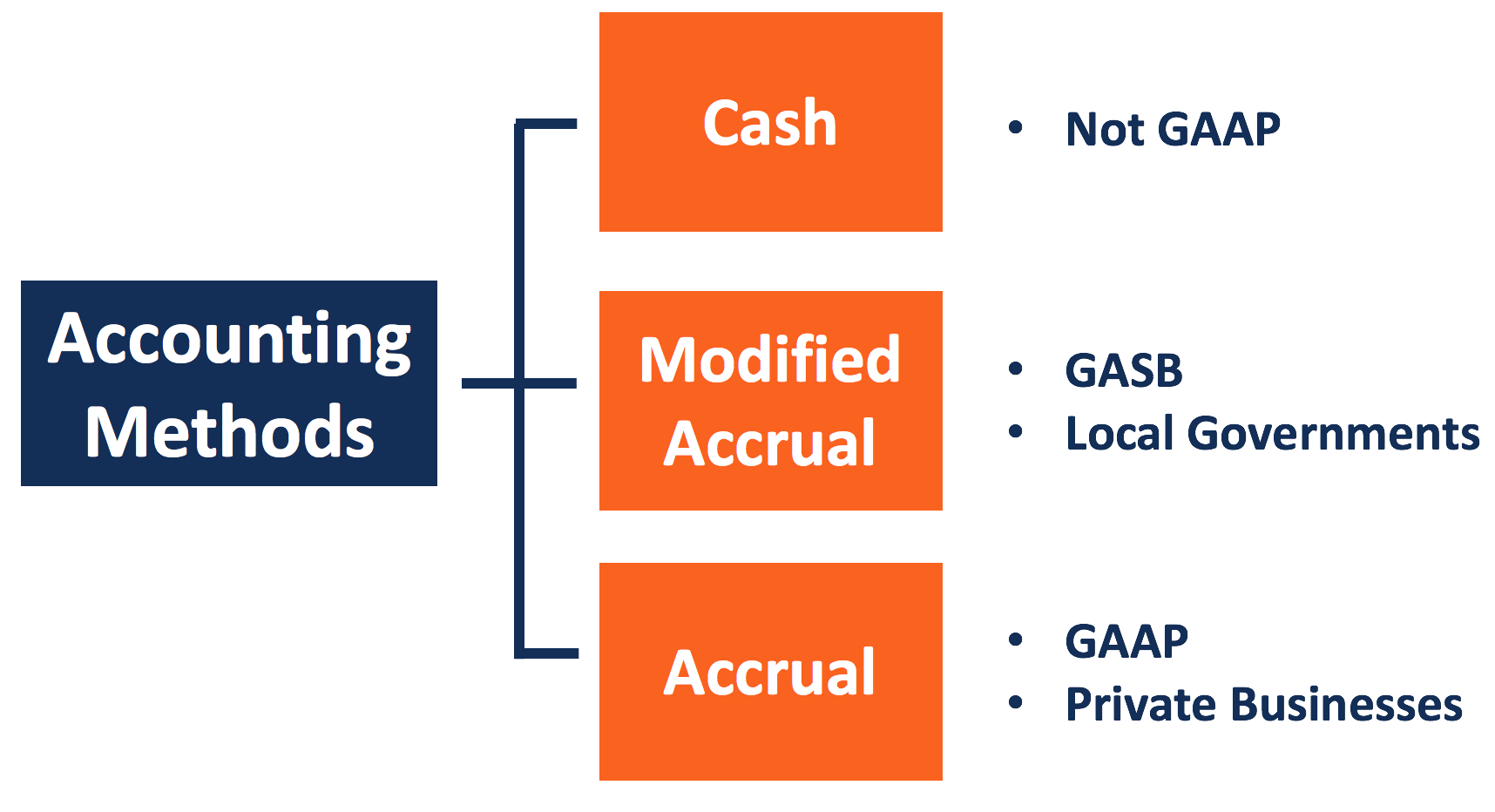

Accounting and reporting guides. When a company determines it is no longer a going concern it does not prepare financial statements on a going concern basis. What is the Liquidation Basis of Accounting.

Break-up basis is used in some countries to signify that an entity is at a stage where its assets are being realised or are about to. Carve-out financial statements. Break-up basis of accounting.

You can for example use so-called break-up basis of accounting. Here you need to asses. It is not defined in IFRS thats true but it is defined in the legislation of some jurisdictions.

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)