Simple Profit And Loss Adjustment Account In Partnership Format

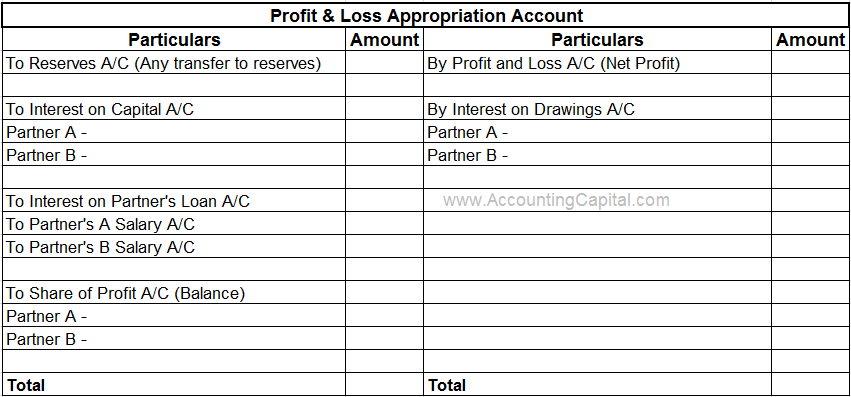

To be made through the Profit and Loss Appropriation Account.

Profit and loss adjustment account in partnership format. Special accounts for partnerships. A partnership appropriation account is an intermediary account between the profit and loss account of the partnership and the individual capital accounts of each partner. Distribution of Profit and Losses in Partnership Examples 2.

Profits or losses will be shared equally e. The purpose of the partnership appropriation account is to allow adjustments to be made to the net income from the profit and loss account before distribution of any residual net income is made to the partner capital accounts. To Interest on Partners Capitals To Reserve Ac.

To Salaries to Partners. It starts with the net profitnet loss as per Profit and Loss Account. When such salary is actually paid to the partner it is debited to his current account and credited to firms cash account.

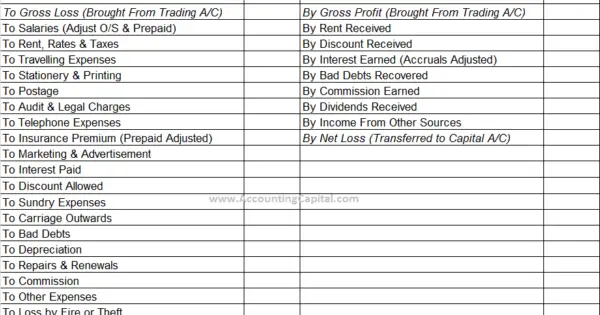

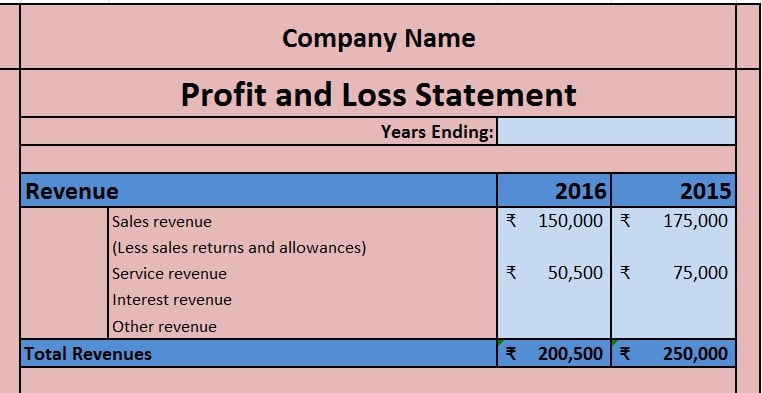

Profit and Loss Appropriation Account is merely an extension of the Profit and Loss Account of the firm. Indian Companies have to prepare the Profit Loss Account as per Schedule III of Companies Act 2013. That is why the Profit and Loss Appropriation Account is an important part of an organization.

In India there are basically two formats of PL statements. In a horizontal format the T shaped structure for preparing the PL account is used. In case of partnership accounting it is usual that adjustments relating to Interest on Capital Interest on Drawings Salary Commission Share of profits etc.

Are made through this account. Ad Find Loss Profit Statement. Bs future share in profits or losses 25 25 x 45 25 825 1825.