Unique Partnership Firm Financial Statement In Excel

The following trial balance was extracted from A B Co.

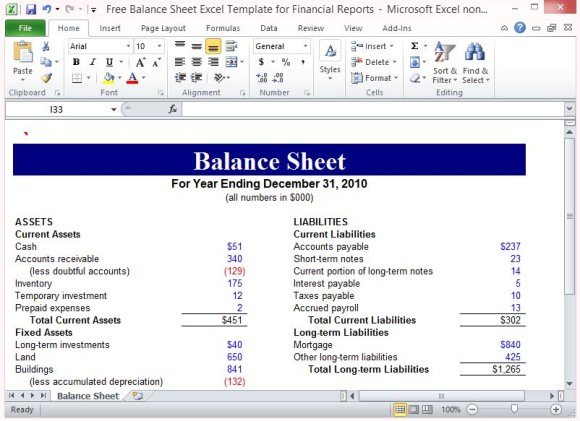

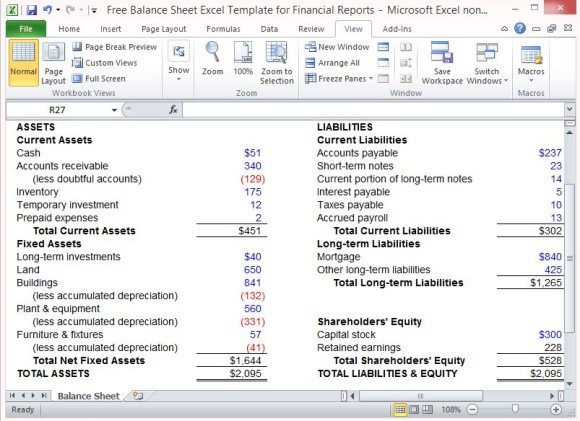

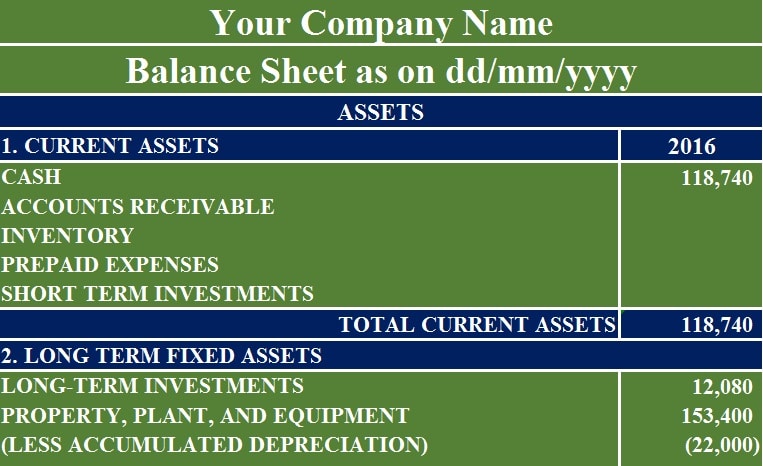

Partnership firm financial statement in excel. A balance sheet is used to gain insight into the financial. Statement of changes in partners capital Year ended December 31 20XX General partner Limited partners Total Partners capital beginning of year 75884000 682957000 758841000 Capital contributions 250000 24750000 25000000. Ad Save Time Editing PDF Documents Online.

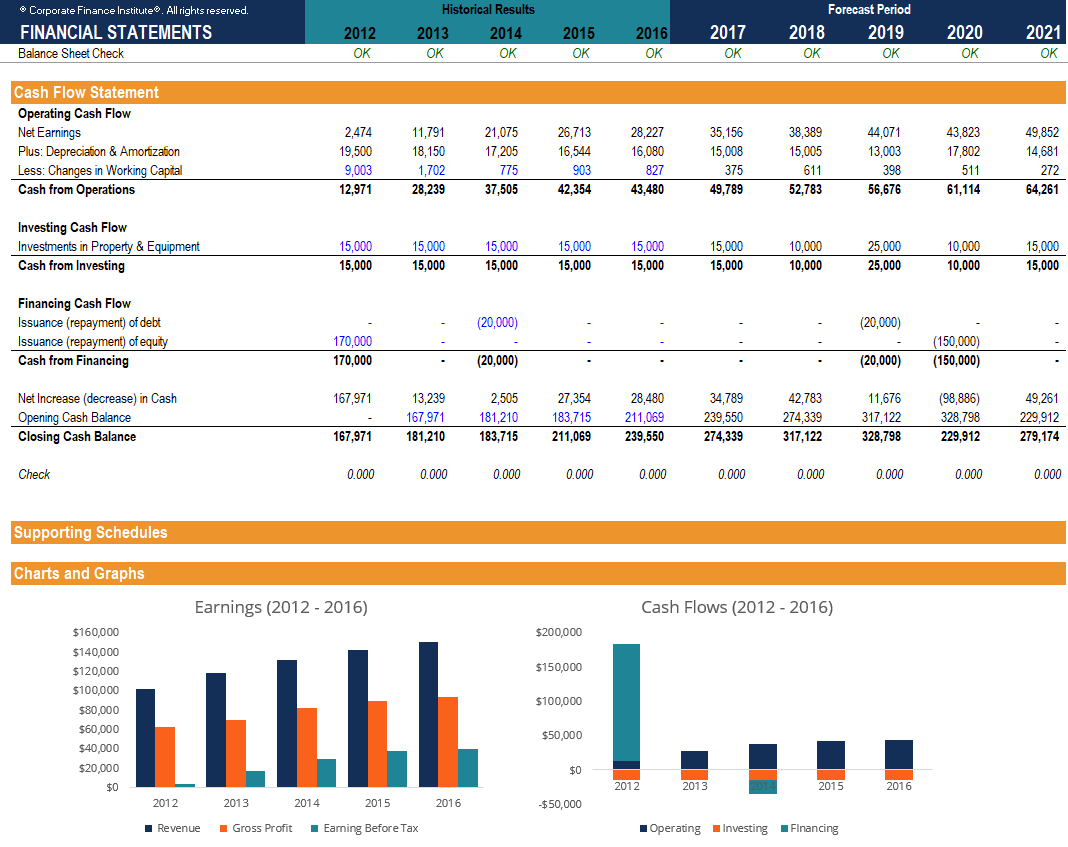

A B company. Download free financial model templates - CFIs spreadsheet library includes a 3 statement financial model template DCF model debt schedule depreciation schedule capital expenditures interest budgets expenses forecasting charts graphs timetables valuation comparable company analysis more Excel templates. Trial balance as on June 30 2002.

This Excel spreadsheet downloads bulk financial information for multiple companies into an Excel spreadsheet. See accompanying notes to financial statements. Click here to Download All Financial Statement Excel Templates for Rs 199.

Start 30 days Free Trial. Prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Partnership will continue in business. Click the link to visit the page to find the detail description about each template and understand how each template has been prepared.

Although there are some important differences both entities use three major financial statements the balance sheet the income statement or profit and loss statement and the cash flow statement. This template can be helpful to Accounts Assistants Accountants and Auditors etc. Retrieve EPS estimates EBIDTA dividend yields PE ratios and more.

The financial statements of the Trading Company including the Condensed Schedule of Investments are contained elsewhere in this reportand should be read together with the Partnerships financial statements. You can use your own accounts structure and just link your accounts to our reporting classes to. Excel Google Sheets Open Office Calc.