Awesome Compilation Report Without Disclosures

An accountant can issue a compilation report even though independence is lacking.

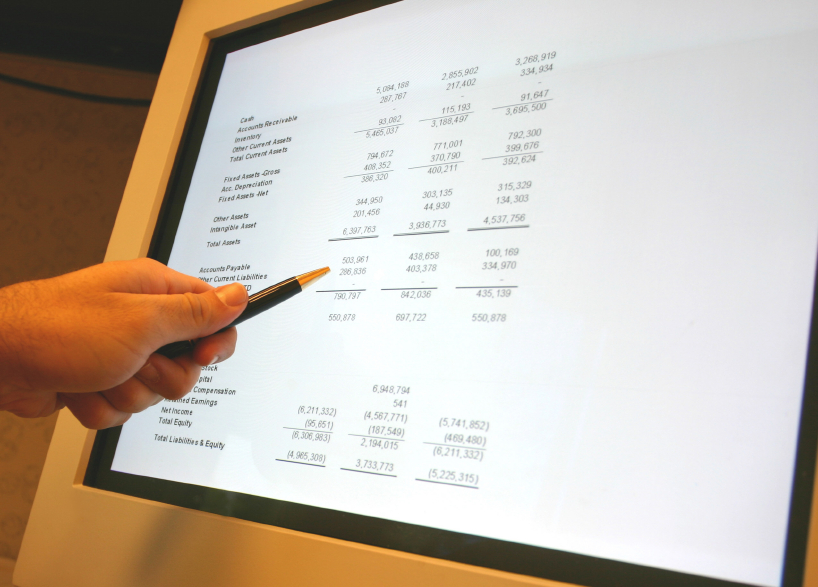

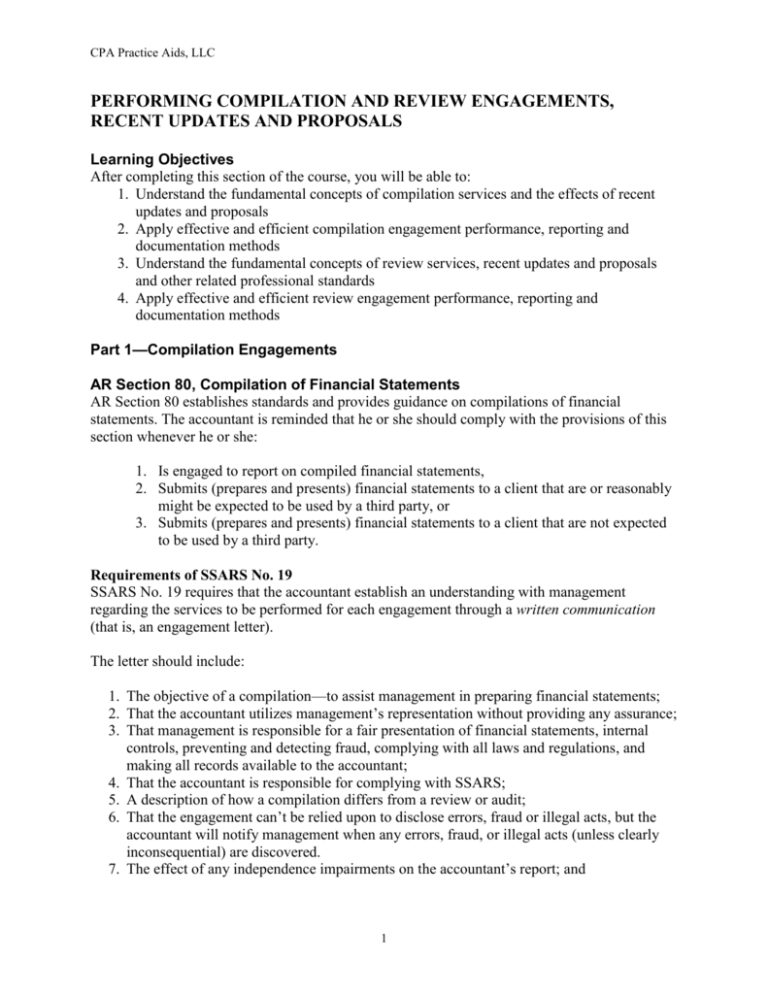

Compilation report without disclosures. The Statements on Standards for Accounting and Review Services SSARSs are clear for engagements that substantially omit all disclosures. The detail and location of such disclosure should depend on the extent to which the entity is affected. Omission of this information is not permissible under the other levels of service.

I have prepared a modified report for departure from GAAP. Management has elected to omit substantially all of the disclosures required by accounting principles generally accepted in the United States of America. Second modification of the standard report for a sole practitioner.

Compilation that omits substantially all disclosures. And a practitioner is not permitted to issue a compilation report if in the practitioners professional judgment the financial statements would be misleading to users of such financial statements. Compilation without independence D.

Below are illustrative accountants compilation and review reports on financial statements prepared in accordance with IFRS for Small and Medium-sized Entities. The accountant is not precluded from supporting the compilation report byother means in addition to the compilation documentation. The compilation report may be a full disclosure report with complete footnote explanations of certain amounts and policies contained in the financial statements.

However AR-C 80AA21 indicates that disclosure of the uncertainty is not required if the financial statements omit substantially all disclosures. First the illustrative standard report. Here is the report I will be using after the first of the year for my non-profit clients if any choose to omit all disclosures.

Or these otherwise required disclosures may be omitted. Omission of substantially all disclosures Compilation reports will change for organizations with fiscal years ending after December 15 2010. Objective of a compilation is to assist management in presenting financial information in the form of financial statements without undertaking to obtain or provide any assurance that there are no material modifications that should be made to the financial statements.