Fine Beautiful Note Payable Cash Flow

Cash payments to employees for services including benefits Note.

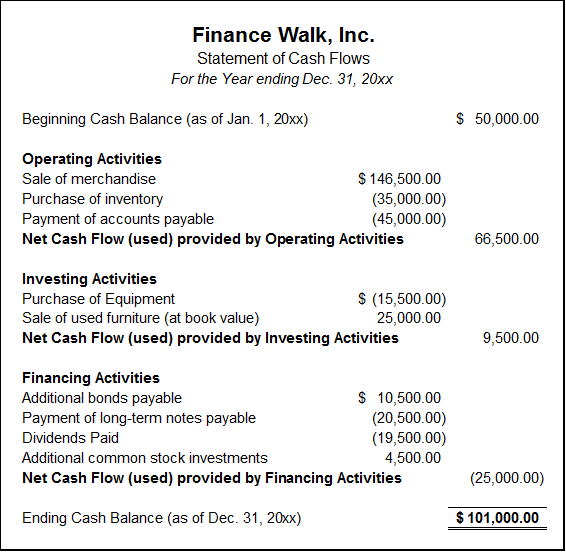

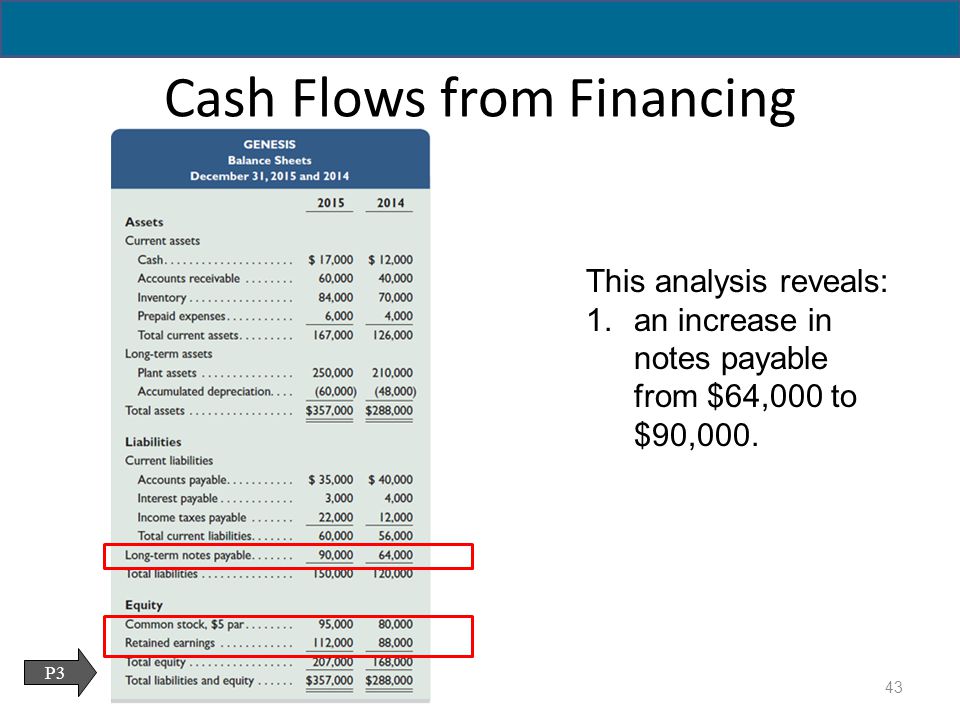

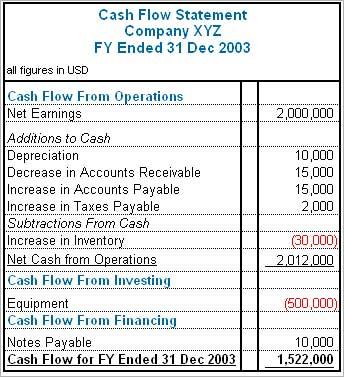

Note payable cash flow. Cash payments to suppliers of goods and services. Cash flow from financing activities are activities that result in changes in the size and composition of the equity capital or borrowings of the entity. A business reports this amount as a cash inflow in the financing activities section of the cash flow statement.

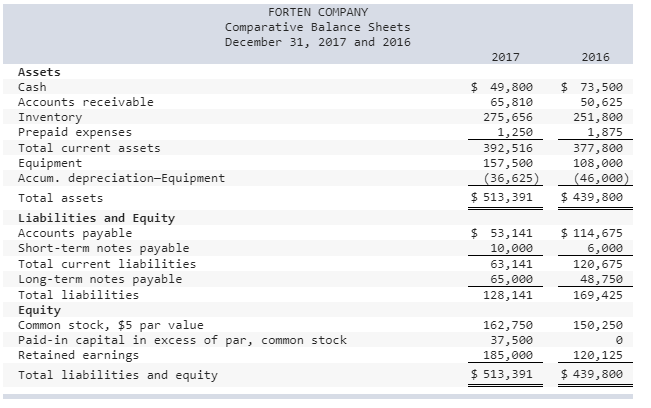

The statement of cash flows explains the changes in the balance sheet during an accounting period from the perspective of how these changes affect cash. Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable cash proceeds from issuance of capital stock cash payments for dividend distributions principal repayment or redemption. Separate accounts payable and payroll payable when determining the cash payments.

Interest payments on a note payable do not change the notes payable account but. On the other hand interest paid shows up in cash flow to creditors but not repayments of note principal which show up in the change in NWC. A A decrease in cash flows from investing activities.

In both contexts NWC is essentially treated as an asset which means that notes payable have been netted out treated as a contra-asset. A business reduces its notes payable account when it makes a payment toward a notes. Determine Net Cash Flows from Operating Activities.

When a business takes on a new loan or note it increases the notes payable account on the balance sheet. The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. The interest rate and frequency of payments are parts of the note agreement.

Cash is debited and Notes Payable is credited for 5000. How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method. Interest Payments on a Note Payable.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)