Heartwarming Are Drawings Included In The Income Statement

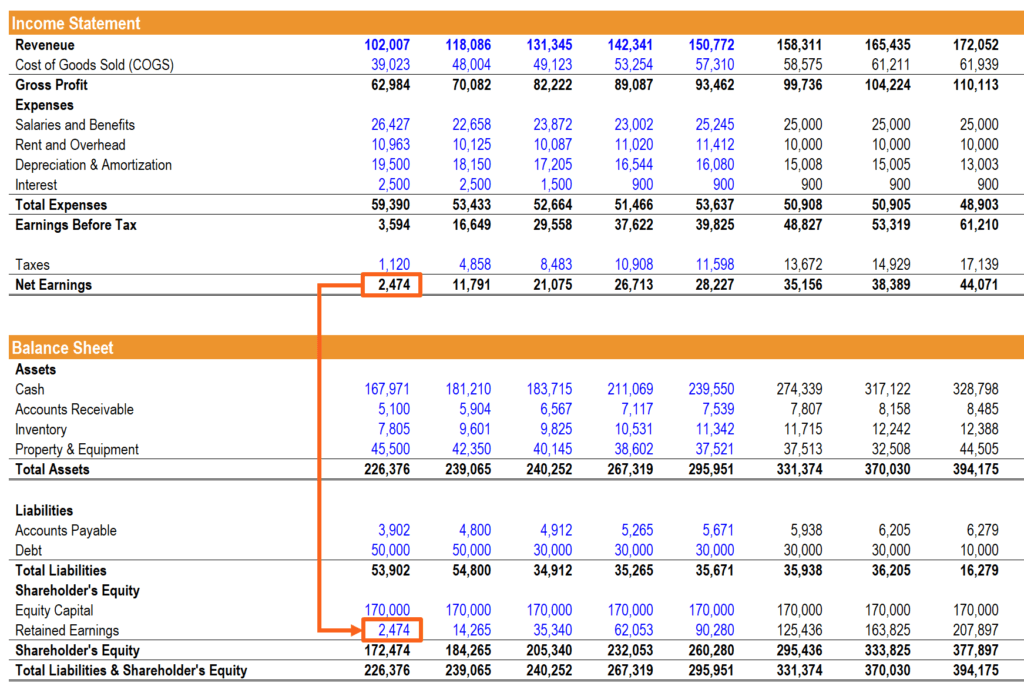

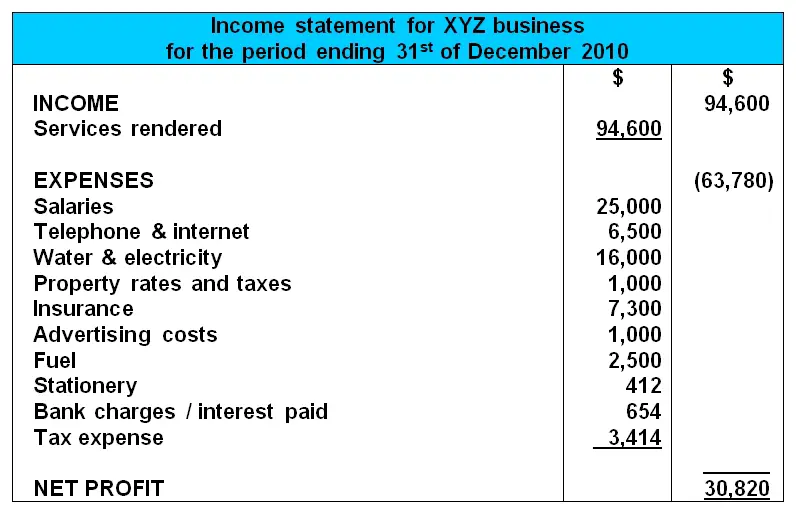

EBT is found stands for Earnings Before Tax also known as pre-tax income and is found by subtracting interest expense from Operating Income.

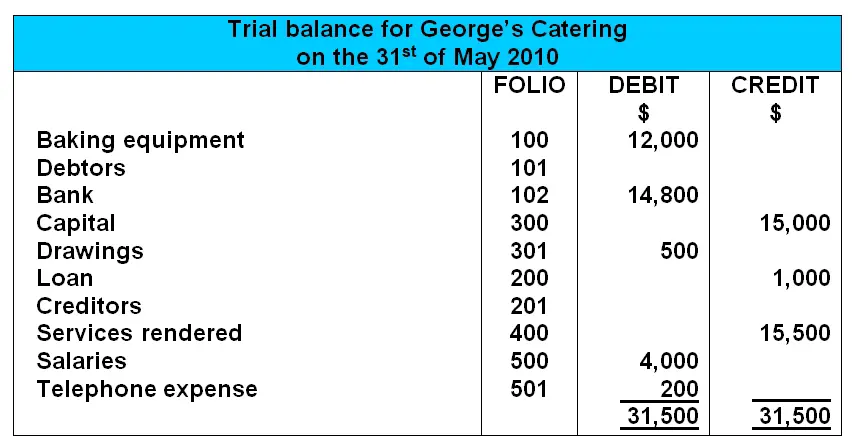

Are drawings included in the income statement. If the enterprise is a corporation the owners gross compensation should be debited to. They are in effect drawing funds from the business hence the name. In balance sheet drawings are subtracted from capital at the end of accounting period.

An example of a transaction demonstrating drawings would be an owner taking equipment of the company for herhis own use. This means that income and expenses are recorded in the income statement as they are earnedincurred regardless of whether cash has been receivedpaid. The drawings account is a temporary account and is cleared at the end of each year either by a debit against the capital account repayment by the owner or against the salary of the owner depending on the circumstances.

The owner has effectively withdrawn part of their equity as cash. As drawings have effectively already been taxed by not including them as an expense in the Profit and Loss AC they are not then taxed as a separate source of personal income. They belong only in the division of profit statement section.

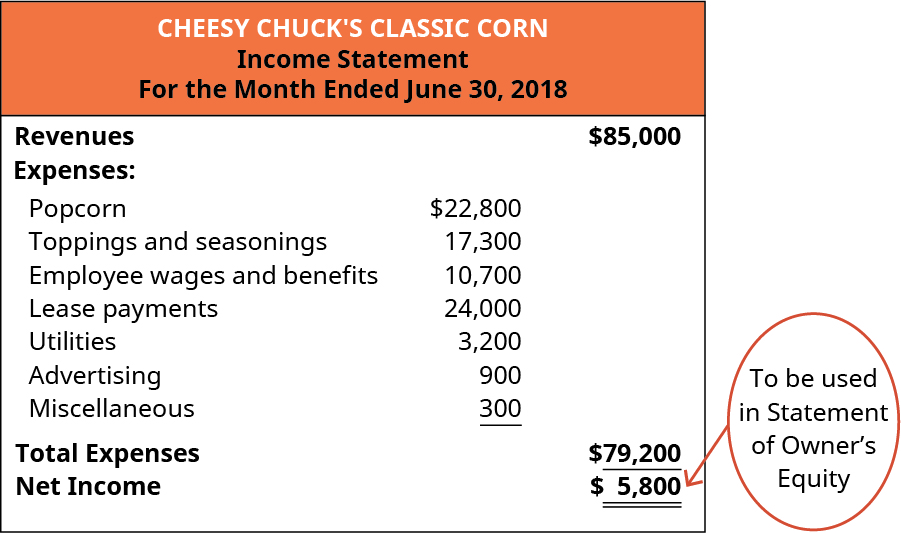

A chart of accounts is a list of the ledger accounts and their account numbers in ledger order. The drawing account is an accounting record used in a business organized as a sole proprietorship or a partnership in which is recorded all distributions made to the owners of the business. The income statement is prepared following the accruals concept.

The owners drawings of cash will also affect the financing activities section of the statement of cash flows. Drawings are not included on the income statement because they are not always directly related to earning revenue or to supporting revenue-making activities. It is compiled from a number of other budgets the accuracy of which may vary based on the realism of the inputs to the budget model.

Should an owners compensation be recorded as an expense or in the Drawing account. Since the drawing account is not an expense it does not show up on the income statement of the business. Drawings are included in the income statement.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)