Simple Minority Interest Cash Flow Statement

Minority interests are irrelevant to the cash flow statement.

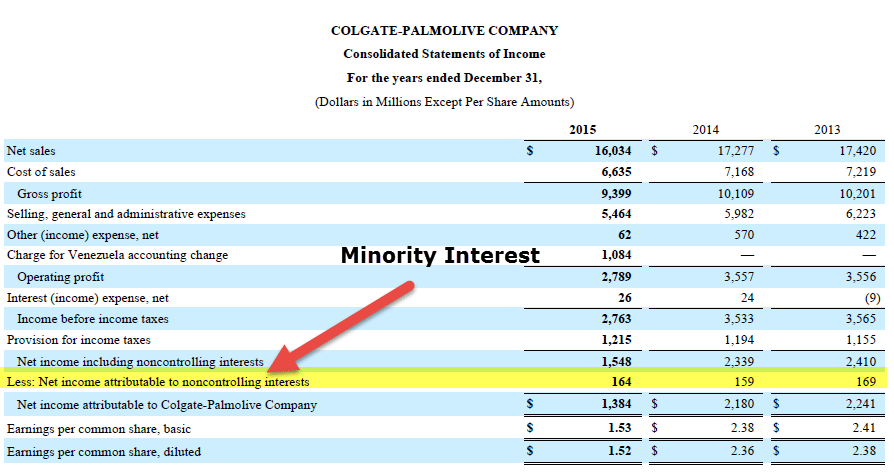

Minority interest cash flow statement. Shareholders holding less than 50 of the total outstanding number of shares are known as minority shareholders. Which is not owned by the XYZ Corp. The XYZ Corp on its balance sheet would have 10 million liability in minority interest account thus representing the 10 of ABC Inc.

It is also known as Non-controlling interest. When the Subsidiary Company is partly owned the method of consolidation is to include. If the FCF you use contains the cash flows that the minority interest would have claim to eg.

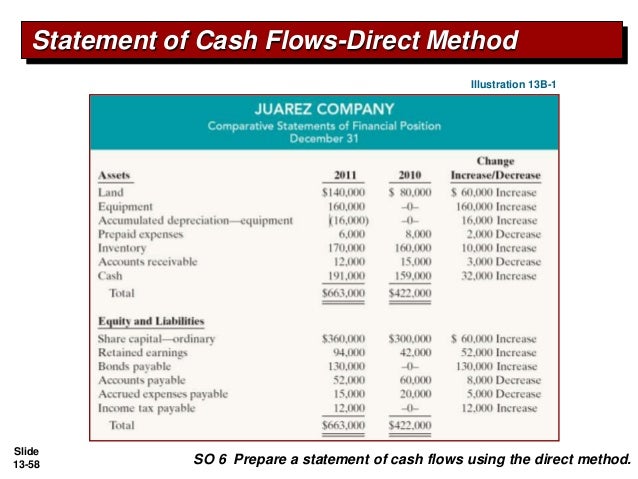

FCFF then you need to deduct the value of minority interest as one of the steps when going from the PV of FCF to equity value. A NEED FOR UPDATED TERMINOLOGY. 84 Statement of Cash Flows Presentation 107 85 Statement of Stockholders Equity Presentation 108 851 Interim Equity Reconciliations for SEC Registrants 110 851A Redeemable Noncontrolling Interests Impact on Disclosures and Reconciliations of Stockholders Equity 113.

A non-controlling interest is also specifically used in relation to subsidiary companies with equity interests owned by outside investors rather than the parent company. This means that if you are calculating a cash flow from the P L or you are reconciling the cash flow statement with the other accounting statements you need to remember to add minority. The minority interest which is related to PL should be added if it is a share in profit to net income before minority in the statement of cash flows as a non cash item.

The result will be more informative financial statements that reflect how the existence of and changes in noncontrolling interests NCI can affect cash flow potential for the consolidated entity and its shareholders. Suppose a Holding Company purchases only 75 of the shares in Subsidiary Company and remaining 25 shares are with the outsiders. The cash flow statement will be prepared by the parent after acquisition of the subsidiary.

The subsidiary purchases its own shares from minority interest holders. As I said earlier the cash flow statement will report under Investing activities the amount of cash. Cash flows from interest received and paid and dividends received shall each be disclosed separately and classified consistently period to period.