Formidable Bad Debts Treatment In Balance Sheet

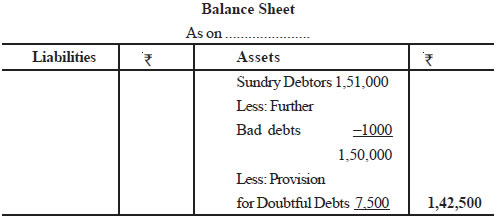

Accounts Receivable is reported in Balance Sheet at its net realizable value.

Bad debts treatment in balance sheet. This results in reduction of provision and increase in income. This entry will directly affect both the income statement and balance sheet. It means under this method bad debt expense does not necessarily serve as a direct loss that goes against revenues.

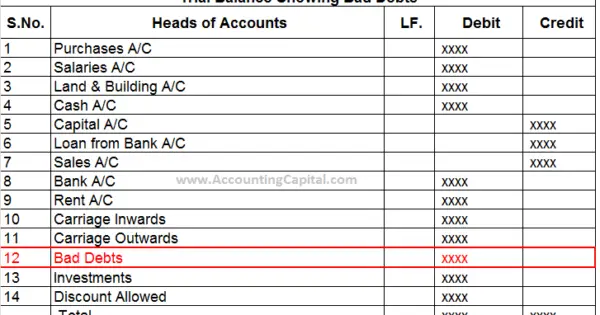

This method is based. Bad debt can be reported on the financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Reporting Bad Debts.

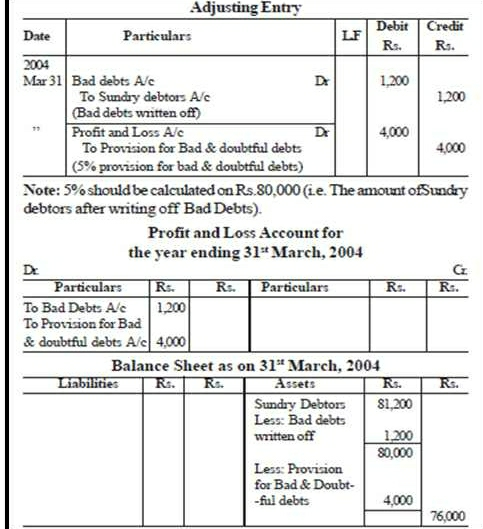

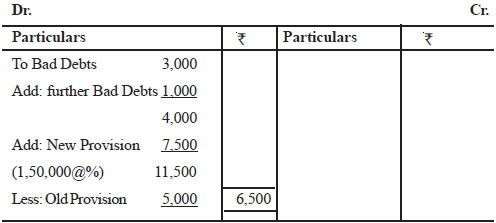

The entry will DB. Accordingly they enter a bad debt expense of 3000 on the companys monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet. Thus the total debit to profit and loss account of Year 2015 would be 6820 ie.

If net assets equity then if asset is lower due to bad debt then equity must reduce to balance the balance sheet. Subsequently when the debtor defaults only the balance sheet accounts have an impact as the bad debt expense was already recorded in the income statement at the time of creation of allowance for doubtful debts. A bad debt amount of 500 will be recognized as expenses in the income statement and the account receivable will be reduced by 500.

Accounts receivable aging method. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. You have to reduce the amount of debtors by the amount of bad debts.

Debit Provision and credit income. My understanding is that bad debt is charged as an expense in the income statement and also remove the amount of bad debt from the asset side of the balance sheet. Provision for Bad Debts The debit account is charged against current years profit and the credit head is shown as a deduction from debtors in the balance sheet.