Spectacular Corrected Trial Balance Example

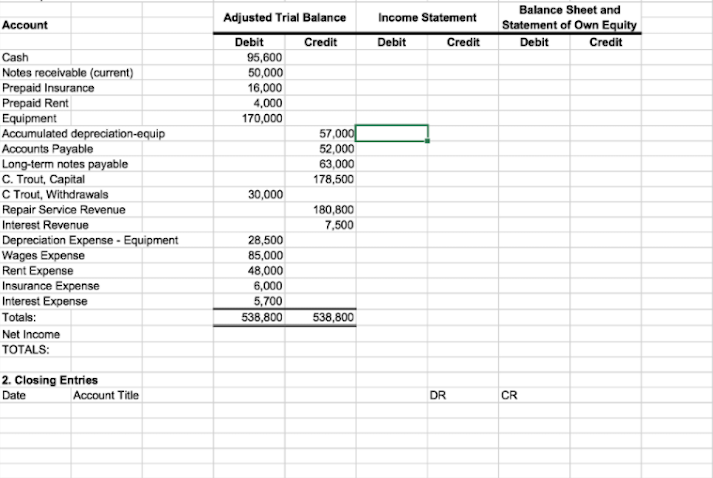

After incorporating the adjustments above the adjusted trial balance would look like this.

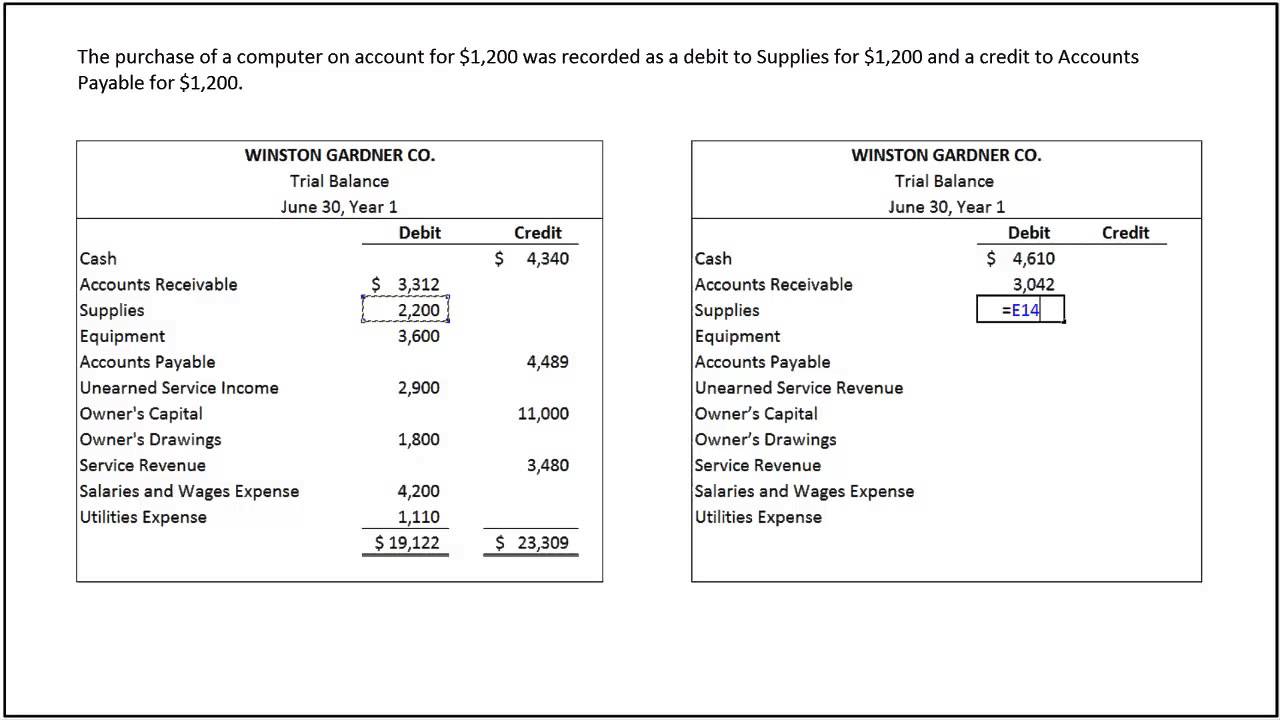

Corrected trial balance example. To simplify the procedure we shall use the second method in our example. Trial Balance of Mrs. The new balances of the individual t-accounts are then taken and listed in an adjusted trial balance.

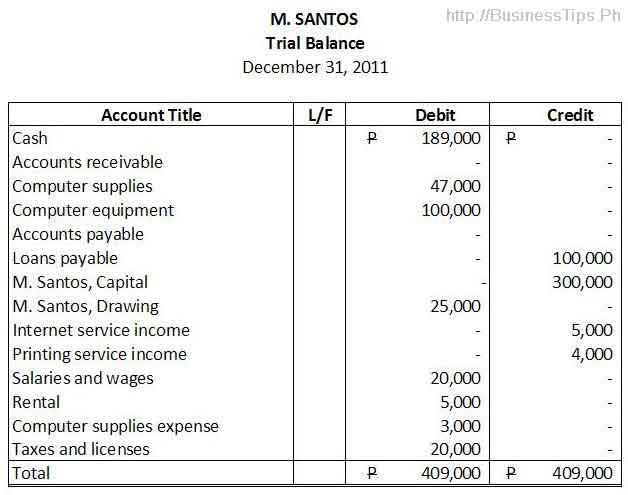

The financial statement is prepared as follows. Prepare trial balance by using totals method for the given data. Just like in the unadjusted trial.

What is adjusted trial balance. To exemplify the procedure of preparing an adjusted trial balance we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. There are two ways to prepare an adjusted trial balance.

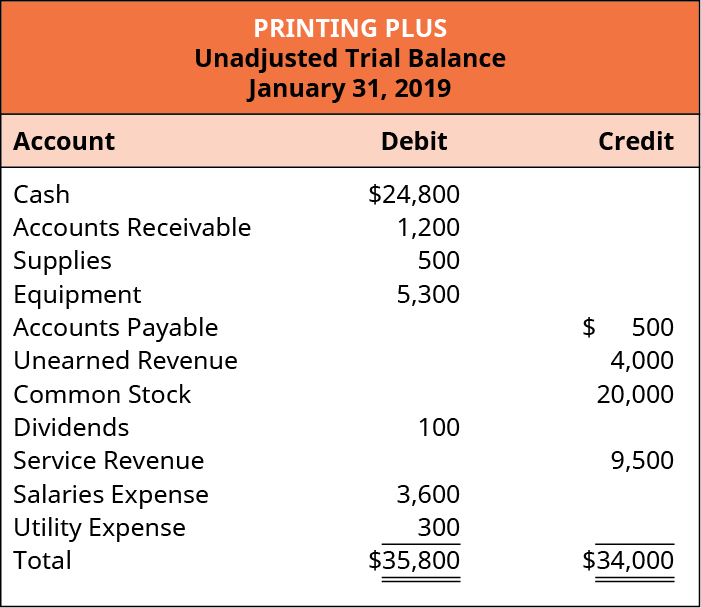

Example of a Trial Balance The following trial balance example combines the debit and credit totals into the second column so that the summary balance for the total is and should be zero. Trial Balance is the report of accounting in which ending balances of different general ledger of the company are available. Unadjusted trial balance list down all the closing balances before the adjustment and adjusted trial balance list down all closing accounts after adjusting.

For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. As of January 31 2020. The first method is to recreate the t-accounts but this time to include the adjusting entries.

Ad Easily Create Your Trial Balance Just Fill-in the Blanks Print. Prepare trial balance using total and balance method for the given data. Adjusted Trial Balance Example To understand this better let us see the examples Suppose a printing company name ACE Prints run a small business of printing their trial balance as on 31 st March2018 is below- We get clear information from trial balance about debit entries and credit entries.